Wisdom Capital | Algo Trading

Wisdom Capital Broker Information

Image via X.com

Wisdom Capital Account Opening Link

Wisdom Capital XTS API Portal

https://trade.wisdomcapital.in/dashboard#!/login

Wisdom Capital XTS Trading Terminal

https://trade.wisdomcapital.in/

Wisdom Capital Brokerage & Charges

https://wisdomcapital.in/brokerage-plan/

WWisdom Capital Customer Support

01206633215

Wisdom Capital API Charges

Free

The Daily Trades Analysis Browser Extension. Now analyse your trades with ease.

This extension is FREE for everyone.

Chrome Extension Link - Click Here

Firefox Extension Link - Click Here

What You’ll Need For Wisdom Algo Trading

AlgoTest Account

You need to have an AlgoTest account. If you don’t have an AlgoTest account, you can create it by clicking on this link.

Wisdom Capital Account

You need to have an active Demat account in Wisdom Capital. If you don’t have an account, create an account in Wisdom Capital. Make sure to activate F&O on your account.

Wisdom Capital XTS API

You need to have XTS API activated on your demat account.

XTS API Activation

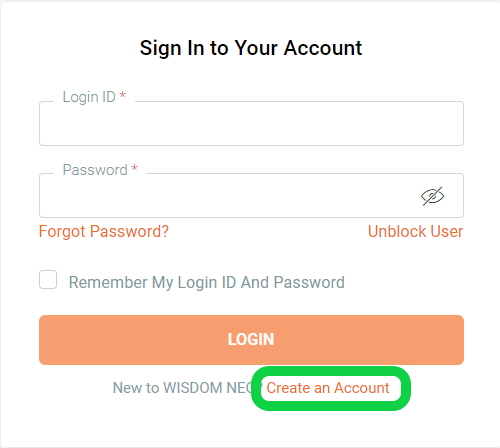

- First we will create an account on Wisdom Capital XTS API Portal. For that Go to https://trade.wisdomcapital.in/dashboard#!/login and click on create an account as shown in the image below.

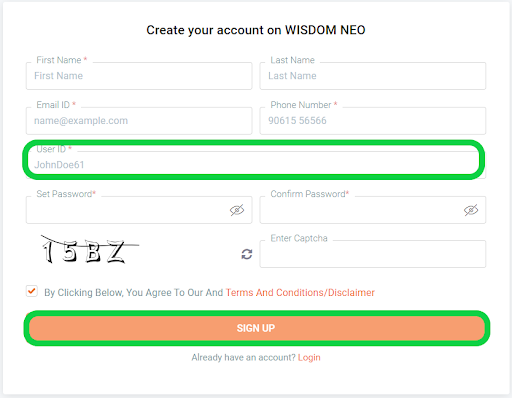

- Fill all the required details. Make sure to enter User ID same as you enter in Wisdom Capital Trading Terminal.

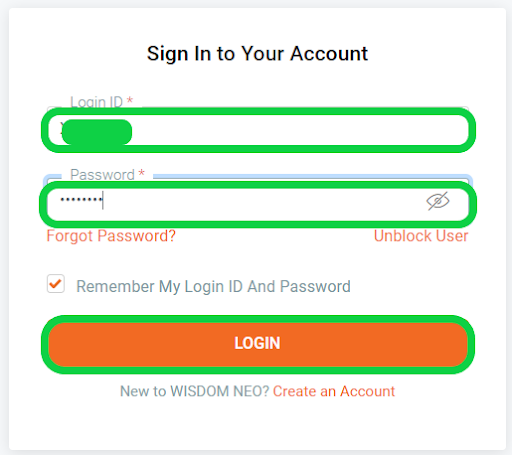

- We have successfully created our account on Wisdom Capital XTS API Portal account. Now login to this account on XTS API Portal by clicking on the login button.

-

Now we need to create 2 API Apps on API Portal.

- Interactive Order API

- Market Data API

-

Now click on My app, then create a new application. It will ask for validation. Enter the ID Password that you use for Trading Terminal. After validation is completed, click on create new application.

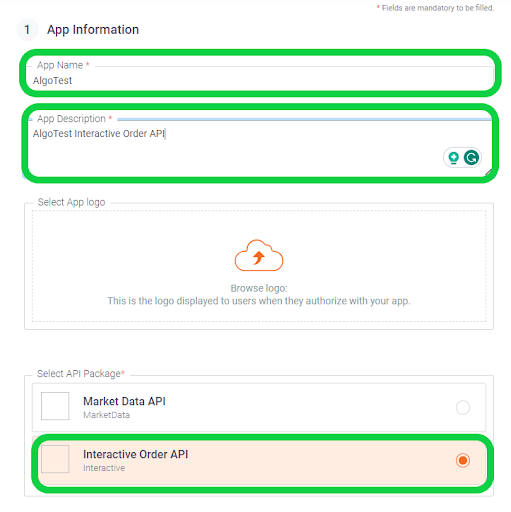

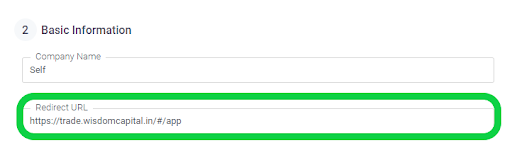

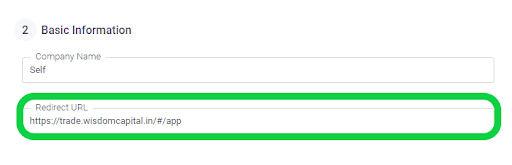

- First we are creating an Interactive Order API. So enter a random name in App name, a random description in API Description box and select Interactive Order API and Enter https://trade.wisdomcapital.in/#/app in Redirect URL. Click on the Create New Application button.

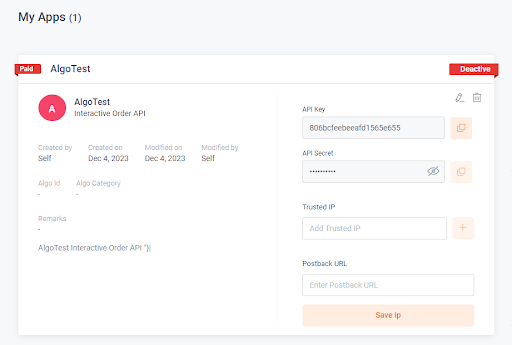

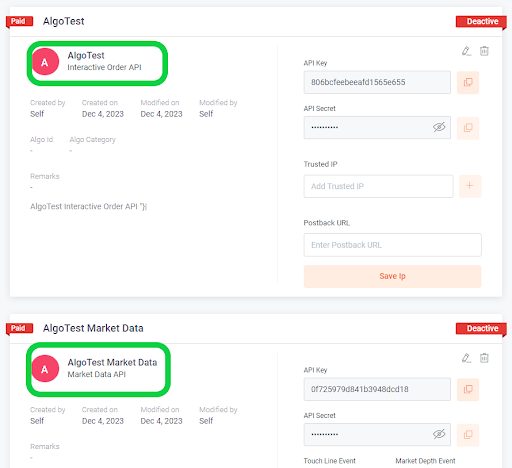

- Now you will see an Interactive Order API is created as shown below.

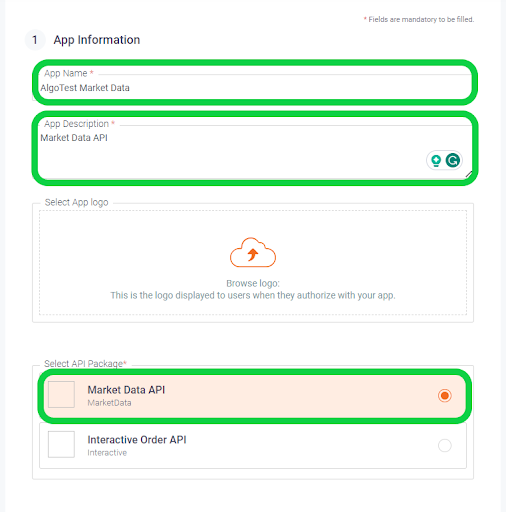

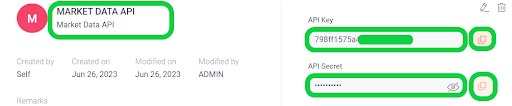

- Now we have to create a Market Data API. To create a Market Data API, click on My App and then click on create new application.

- Now enter a random name in App name, a random description in API Description box and select Market Data API. Enter https://trade.wisdomcapital.in/#/app in Redirect URL and click on the Create New Application button.

- Now you can see that there are 2 API apps created on API Dashboard. They are showing Deactive status. They will be active within 24 working hours. If they don’t become active in 24 hours you need to contact wisdom capital customer care at 01206633215 to make them active.

- Once the status shows active, we just have to copy API Key and API Secret from Interactive Order and Market Data and paste that into AlgoTest Broker Setup Page.

Connecting Wisdom Capital with AlgoTest

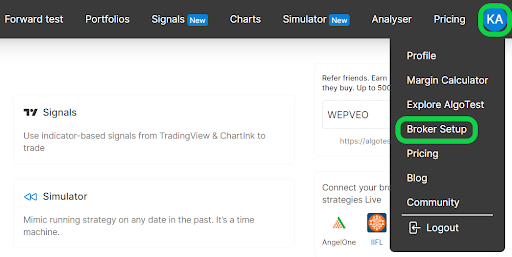

- To connect Wisdom Capital with AlgoTest, go to AlgoTest.in. Click on the profile icon at the top right and select Broker Setup.

- Click on the setup icon located on the right side of the Wisdom Capital.

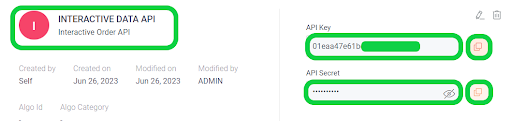

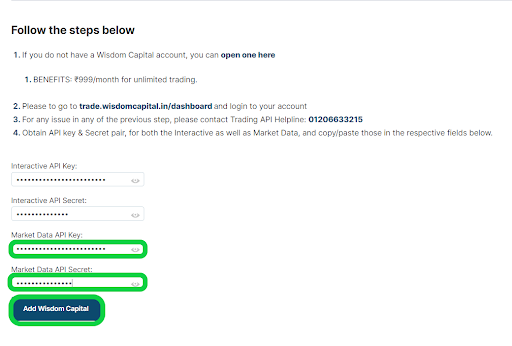

- Copy the API Key and API Secret from Interactive Data API from Blaze API Dashboard and paste it into AlgoTest as shown in the image.

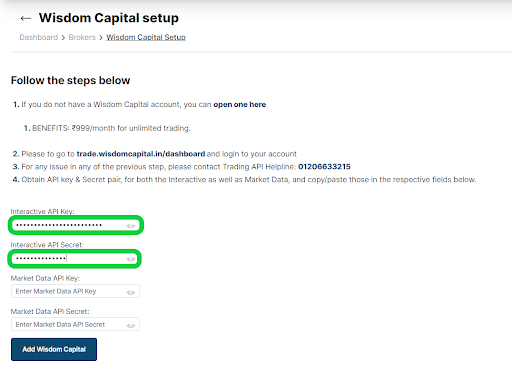

- Now copy the API Key and API Secret from Market Data API in XTS API Dashboard and paste it into algotest as shown in the image and click on Add AC Aggarwal.

-

We have successfully added Wisdom Capital to our AlgoTest Account. Now we just have to login to Wisdom Capital in AlgoTest. To log in, click on the Login button.

Note :- Broker Login timing is 08:30 AM to 3:28 PM

- Once you are logged in, the system will display a status message confirming your login status, as shown in the image below.

Wisdom Capital: An Overview

Wisdom Capital is a well-known discount brokerage firm in India, offering a range of trading and investment services with competitive brokerage plans. The company is recognized for providing high leverage, low brokerage fees, and various trading platforms that cater to both beginners and seasoned traders. With a focus on affordability and customer satisfaction, Wisdom Capital has gained a reputation as a reliable broker in the Indian financial market.

Key Features of Wisdom Capital

-

High Leverage: Wisdom Capital is known for offering some of the highest leverage in the industry, particularly for intraday trading.

-

Competitive Brokerage Plans: The firm offers a variety of brokerage plans, including the Wisdom Capital Neo plan, which caters to different types of traders.

-

Advanced Trading Platforms: Wisdom Capital Pro and other platforms provided by the broker offer robust tools and real-time data for efficient trading.

Wisdom Capital Pricing

Account Opening Charges

-

Trading Account Opening Fee: ₹0 (Free)

-

Demat Account Opening Fee: ₹0 (Free)

Annual Maintenance Charges (AMC)

- Demat Account AMC: ₹999 per annum (for Premium Plan)

Brokerage Plans

-

Freedom Plan: Zero brokerage on equity delivery and ₹9 per order for intraday, F&O, and commodities.

-

Pro Plan: ₹15 per order for intraday, F&O, and commodities.

-

Ultimate Plan: ₹999 per month for unlimited trading.

Margin Requirements

-

Intraday Margin: Up to 40x leverage for intraday trading.

-

Delivery Margin: Up to 4x leverage for delivery trades.

FAQs on Wisdom Capital

- Is Wisdom Capital a good broker?

Wisdom Capital is considered a good broker, especially for traders looking for high leverage and low brokerage fees. The firm offers multiple trading platforms and flexible brokerage plans to suit different trading needs.

- Who is the owner of Wisdom Capital?

Wisdom Capital is owned by Deb Mukherjee, who is responsible for the strategic direction and operations of the company.

- What is Wisdom Capital?

Wisdom Capital is a discount brokerage firm offering trading services in equities, derivatives, commodities, and currencies with competitive pricing and high leverage.

- Which broker is the cheapest in India?

Wisdom Capital is among the cheapest brokers in India, offering zero brokerage on equity delivery trades and low fees for intraday and F&O trades.

- Who is the CEO of Wisdom Capital?

The CEO of Wisdom Capital is Deb Mukherjee, who leads the company's strategic initiatives and operations.

- What is the leverage of Wisdom Capital?

Wisdom Capital offers up to 40x leverage for intraday trading and up to 4x leverage for delivery trades, making it one of the highest leverage providers in the industry.

- How do I calculate brokerage fees in Wisdom Capital?

Brokerage fees can be calculated using the Wisdom Capital brokerage calculator available on their website. This tool allows clients to estimate the brokerage fees based on their trade value and the selected brokerage plan.

- What are the top 5 brokerage companies in India?

Some of the top brokerage companies in India include Generic Broker, Wisdom Capital, Upstox, Angel One, and ICICI Direct. Each offers different services and pricing models catering to various investor needs.

- What is the margin requirement for Wisdom Capital?

The margin requirement in Wisdom Capital varies depending on the segment. For intraday trading, the margin requirement can be as low as 2.5%, while for delivery trades, it is around 25%.

- What is Wisdom Capital Neo?

Wisdom Capital Neo is one of the brokerage plans offered by Wisdom Capital, providing traders with competitive pricing and access to various trading platforms and tools.

- How does Wisdom Capital compare with other brokers like Generic Broker and Finvasia?

Wisdom Capital is often compared to brokers like Generic Broker and Finvasia due to its high leverage and low brokerage fees. While Generic Broker is known for its comprehensive trading tools, Wisdom Capital stands out for its aggressive pricing and margin offerings.

- What is the Wisdom Capital trading platform?

Wisdom Capital offers several trading platforms, including Wisdom Capital Pro, which provides advanced trading tools, real-time data, and efficient order execution.