Paytm Money | Algo Trading

Paytm Money Broker Information

Image via Wikimedia Commons

Paytm Account Opening Link

https://www.paytmmoney.com/open-demat-trading-account

Paytm Money Trading Terminal

Paytm Money API Portal

https://developer.paytmmoney.com/

Paytm Brokerage & Charges

https://www.paytmmoney.com/stocks/pricing

Paytm Customer Support

https://www.paytmmoney.com/contact-us

Paytm API Charges

Free

The Daily Trades Analysis Browser Extension. Now analyse your trades with ease.

This extension is FREE for everyone.

Chrome Extension Link - Click Here

Firefox Extension Link - Click Here

What You’ll Need For PayTM Algo Trading

AlgoTest Account

You need to have an AlgoTest account. If you don’t have an AlgoTest account, you can create it by clicking on this link.

Paytm Money Demat Account

You need to have an active Demat account in Jainam Duck. If you don’t have an account, Open a demat account in Paytm Money. Make sure to activate F&O on your account.

Connecting Paytm Money with AlgoTest

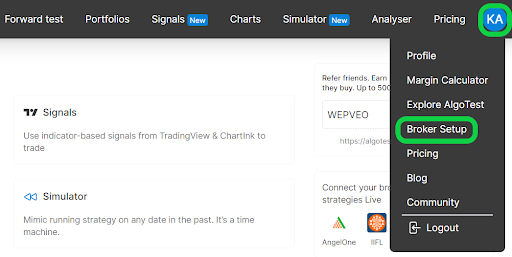

- Go to AlgoTest.in. Login your account. Click on the profile icon at the top right and select Broker Setup.

- Click on the setup icon located on the right side of the Paytm Money.

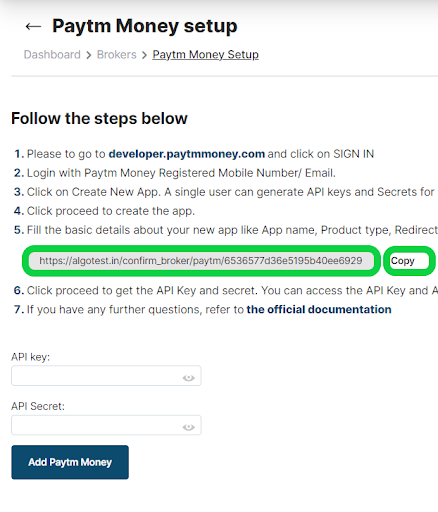

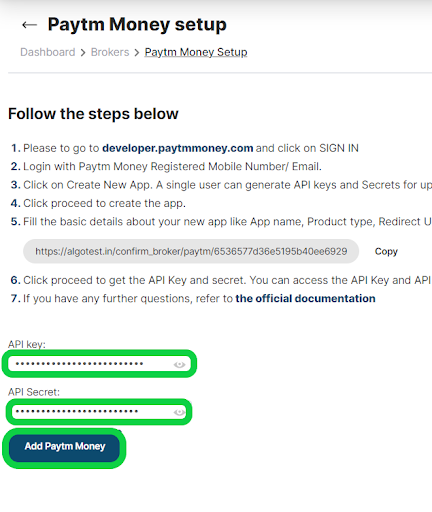

- Now we need Paytm Money API Key and API Portal to add Paytm Money in AlgoTest. For API Key we need to create an API App in Paytm Money API Portal. Copy the redirect URL as shown in the image below. We will use this while creating an API App in the Paytm Money API Portal.

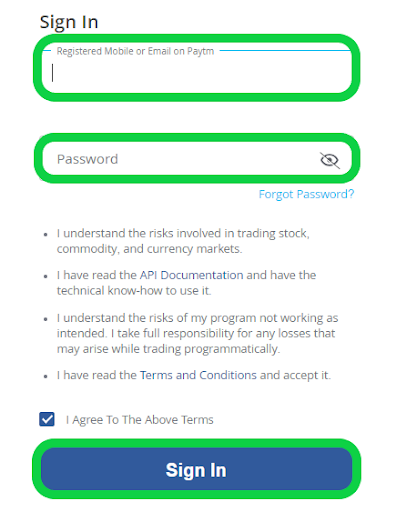

- Go to https://developer.paytmmoney.com/ and click on Sign In as shown in the image below.

- Enter your registered mobile number or email and password and click on sign in.

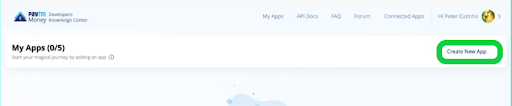

- Click on create new app. You can create up to 5 apps.

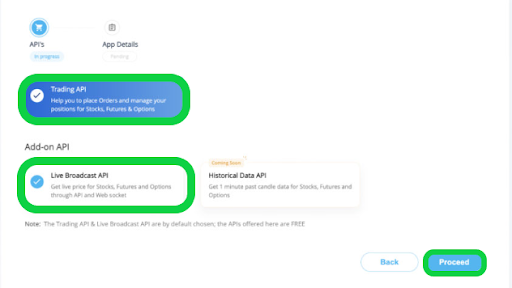

- Select Trading API and Market Data API and click on proceed.

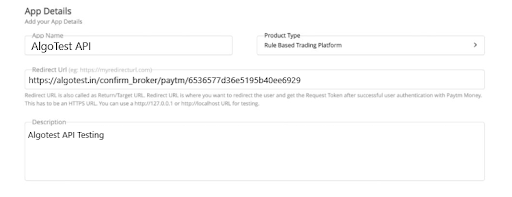

- Enter any random name in “App name”, paste the redirect URL that we copied from algotest broker setup page in “Redirect URL ”. Enter random description in “Description”

- Our API App has been created. You can see it in the API dashboard. Copy API Key and API Secret from here and paste that in the algotest broker setup page and click on Add Paytm Money.

-

We have successfully added Paytm Money broker to our AlgoTest Account. Now we just have to login to the Paytm Money account in AlgoTest. To log in, click on the Login button.

Note :- Broker Login timing is 08:30 AM to 3:28 PM

- Once you are logged in, the system will display a status message confirming your login status, as shown in the image below.

Paytm Money: An Overview

Paytm Money is a popular investment and trading platform in India, offering a wide range of financial services, including mutual funds, stock trading, NPS (National Pension System), and digital gold. It is a subsidiary of Paytm, one of India's leading digital payment platforms. Paytm Money is designed to provide users with a simple, transparent, and cost-effective way to invest and manage their wealth.

Key Features of Paytm Money

-

Safe and Secure: Paytm Money is known for its robust security measures, ensuring that all transactions and data are protected.

-

Comprehensive Investment Options: Users can invest in mutual funds, stocks, ETFs, and NPS directly from the app.

-

User-Friendly Interface: The app is designed to be user-friendly, making it easy for both new and experienced investors to navigate and manage their investments.

Paytm Money Pricing

Account Opening Charges

-

Trading Account Opening Fee: ₹0 (Free)

-

Demat Account Opening Fee: ₹0 (Free)

Annual Maintenance Charges (AMC)

- Demat Account AMC: ₹300 per annum

Brokerage Charges

-

Equity Delivery: ₹0 (Zero brokerage on delivery trades)

-

Equity Intraday: 0.05% of turnover or ₹10 per executed order (whichever is lower)

-

Futures & Options: ₹10 per executed order

-

Currency Futures: ₹10 per executed order

-

Commodity Trading: ₹10 per executed order

Other Charges

-

Call and Trade Charges: ₹50 per call

-

DP Charges: ₹12.5 per debit transaction

-

Pledge Creation: ₹30 per request

FAQs on Paytm Money

- Is the Paytm Money app safe?

Yes, the Paytm Money app is safe to use. It employs advanced security measures, including data encryption and secure servers, to protect user information and transactions.

- How does Paytm Money work?

Paytm Money allows users to invest in various financial products like mutual funds, stocks, and NPS. Users can open an account online, add funds, and start investing through the app.

- Can I withdraw money from Paytm Money?

Yes, you can withdraw money from Paytm Money. Funds can be transferred back to your linked bank account after selling your investments.

- Is Paytm Money chargeable?

Paytm Money offers zero brokerage on equity delivery trades, but charges a minimal fee for intraday and F&O trades. There are also charges for certain services like AMC for the Demat account.

- How can I refund my money from Paytm?

To request a refund from Paytm, you can contact Paytm customer care via the Paytm customer care number for refund money transfer or raise a dispute directly through the app.

- How can I directly talk to Paytm customer care?

You can directly talk to Paytm customer care by calling the Paytm money customer care number, which is available on their website or within the app.

- Is Paytm Money customer care 24x7?

Paytm Money customer care is not available 24x7, but they offer support during business hours. You can contact them via the app, phone, or email for assistance.

- Where can I complain about Paytm?

You can file a complaint about Paytm through their customer care, the Paytm app, or by contacting the Paytm customer care number for refund money or other issues.

- Is Paytm better than Generic Broker?

Paytm Money and Generic Broker cater to different types of investors. While Paytm Money is known for its simplicity and ease of use, Generic Broker is often preferred by experienced traders for its advanced tools and features.

- Is Paytm Money good for trading?

Paytm Money is good for beginners and casual traders looking for a straightforward and affordable trading platform. It provides access to various financial products with competitive pricing.

- Which platform is better than Generic Broker?

Platforms like Paytm Money and Groww offer simpler interfaces and lower fees for mutual fund investments, while Generic Broker is favored for its comprehensive trading tools and services.

- Can I switch from Paytm Money to Generic Broker?

Yes, you can switch from Paytm Money to Generic Broker by closing your Paytm Money account and opening a new account with Generic Broker. However, ensure you transfer your investments properly.

- Is Groww better or Paytm Money?

Both Groww and Paytm Money offer similar services, but Paytm Money has a broader range of investment options, including stock trading. The choice depends on your specific needs.

- Is Paytm Money app real or fake?

The Paytm Money app is a legitimate platform, regulated by SEBI and offering genuine financial services.

- Which is better, ET Money or Paytm Money?

Paytm Money is generally better for stock trading and a wider range of investments, while ET Money focuses on mutual funds and personal finance management.