Advanced Strategy Options

Advanced Strategy Options

Once you're comfortable with basic strategy creation, you can venture into the world of advanced options strategies. These strategies involve combining multiple option contracts to achieve specific goals, such as limiting risk, generating income, or profiting from a range-bound or directional market.

Here's an overview of some popular advanced strategies you can explore within AlgoTest's strategy builder:

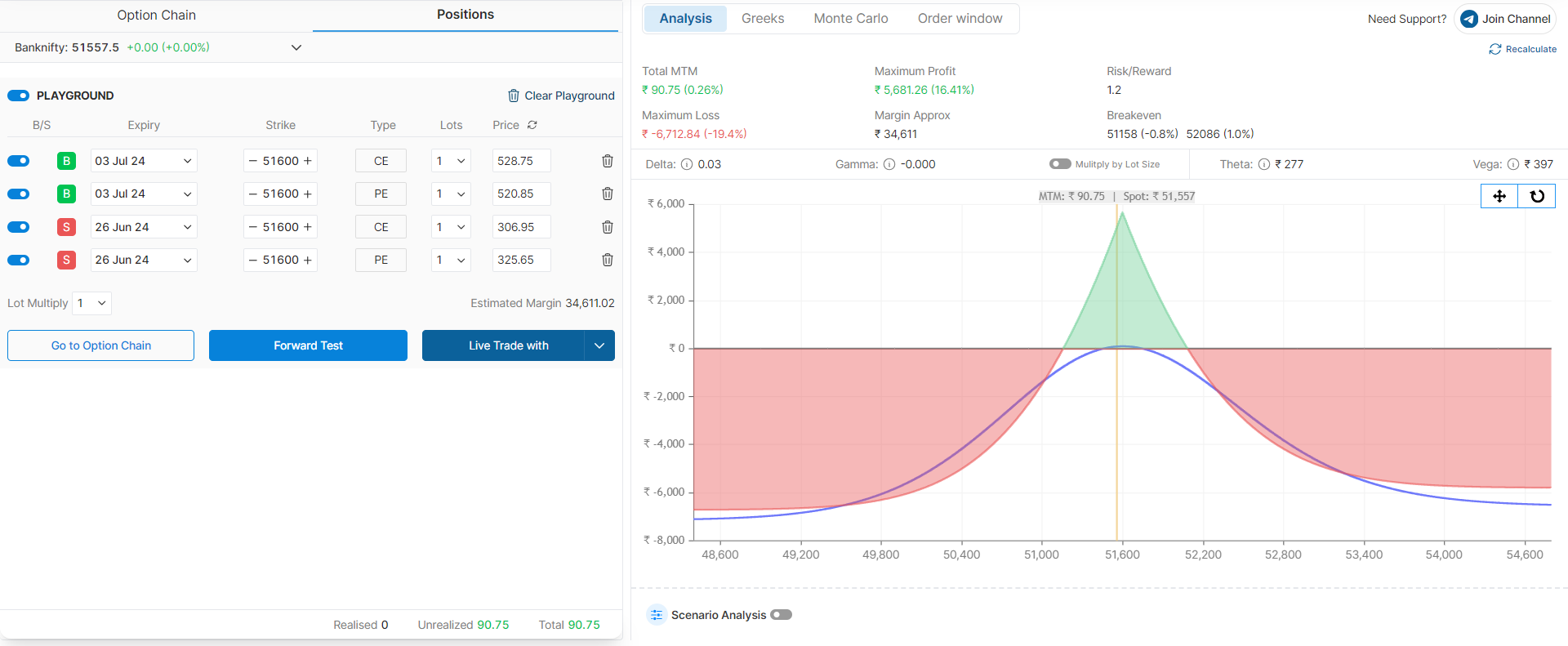

Calendar Spread

This strategy involves buying and selling options contracts with the same strike price but different expiration dates. It allows you to capitalize on time decay (Theta) and potentially profit even if the underlying asset price doesn't move significantly.

Bull Put Spread

A bull put spread involves buying a put option with a lower strike price and simultaneously selling a put option with a higher strike price, both having the same expiration date. Normally, it involves buying an out-of-the-money (OTM) put option and selling an in-the-money (ITM) put option.

The difference in strike depends on the aggressiveness of the trade you want to take. You can implement this strategy when you are moderately bullish on the instrument.

Bear Call Spread

A bear call spread involves buying a call option with a higher strike and selling a call option with a lower strike, both expiring on the same date. Normally, it involves buying an out-of-the-money (OTM) call option and selling an in-the-money (ITM) call option.

The difference in strike depends on the aggressiveness of the trade you want to take. You can implement this strategy when you are moderately bearish on the instrument.

Ratio Spread

A ratio spread is an advanced options strategy in which a trader holds a different number of long and short options. As the name suggests, the buy and sell options are held in a specific ratio, such as 2:1, where 2 quantities can be short options and 1 quantity can be a long option.

This strategy involves buying an at-the-money (ATM) call or put option and selling more than one quantity of the same option. It is typically implemented when the market is expected to remain relatively stable.

However, there are different variations of the ratio spread that can be used if you are slightly bullish or bearish in the market.

Diagonal Call/Put Strategy

This strategy is an advanced version of the Calendar Spread. It involves buying or selling options with different strike prices and expiration dates. It is created by selling or buying an in-the-money (ITM) call or put option for the current week and selling or buying an out-of-the-money (OTM) option for the same underlying asset for the following week.

This strategy is used when traders have neutral to bearish or bullish views.

Futures + Options Combined Strategy

AlgoTest's Strategy builder allows you to incorporate futures contracts into your options strategies.

Futures contracts represent an agreement to buy or sell an underlying asset at a specific price by a certain date. By including futures in your strategy, you can create more advanced structures that cater to diverse market outlooks.

For instance, you might combine an ATM long call option (bullish) with a short future contract (completely bearish) of the same underlying to create a strategy that profits if the underlying asset price decreases but limits your potential losses if it skyrockets.

Experimenting with different futures combinations within the strategy builder allows you to explore a wider range of options strategies and tailor them to your specific market views.