RA (Research Analyst) ALGOS

We are glad to announce our new product RA Algos.

Now you can trade using the strategies developed by SEBI registered Research Analysts which will be automated for you on the AlgoTest platform.

The power of algo trading combined with Research Analyst strategies is a game changer and we are happy to bring it to you.

What is RA Algo?

RA Algos provides access to trades from Algos created by SEBI-registered research analysts. You can backtest these algos and can also include slippages, brokerage, taxes and charges, forward test them, or deploy them directly in your broker account.

Who is a Research Analyst?

In the trading space in India, a Research Analyst is a SEBI (Securities and Exchange Board of India) registered professional who analyses financial markets, securities, and economic data to provide insights, forecasts, and investment recommendations to traders and investors. Their primary role is to help clients or firms make informed decisions about buying, holding, or selling securities like stocks, bonds, commodities, and currencies.

SEBI Regulations:

In India, SEBI has mandated that Research Analysts need to be registered to protect investors from misleading or biassed advice. They must follow strict compliance procedures and maintain a high level of transparency in their analysis. Some of the SEBI guidelines include:

-

Providing detailed disclosures in reports.

-

Avoiding personal trading on the stocks they analyse.

-

Ensuring that recommendations are backed by thorough research.

AlgoTest's RA Algos is compliant with SEBI's regulations and we provide access to all relevant information necessary to make informed decisions.

Trading is subject to market risks and AlgoTest isn't responsible for any losses incurred from using RA Algos. Please make sure you understand the risks involved before committing to any trades.

:For any queries reach out to us!

How to use the platform efficiently?

Choose the Algo from the list of SEBI RA Algo and save it.

Backtest:

Analyze backtested results by including brokerage, slippages, Taxes and charges.

Forward Test:

Test the Algo without using real capital.

- Activate the Algo between 8:15 AM and 9:15 AM. (Timing is crucial; late activation may alter Algo logic.)

- Activate the Algo only on the specified days mentioned in the Algo card.

Algo Trade:

Automate real trades in your broker account.

- Log in with your broker and activate the algo between 8:15 AM and 9:15 AM. (Timing is crucial; late activation may alter algo logic.)

- Activate the algo only on the specified days mentioned in the Algo card.

Make sure to follow these things:

- Check their backtest result after brokerage, taxes, and slippages and do a forward test for at least a week and if it makes sense to you then only go ahead with it.

- Check Algo Max DD and Max losing streaks so you can be prepared for that and don’t stop if Algo goes in the DD initially.

- Activate the Algo before the market opens, and only activate it on the decided days so it can follow the same logic.

- There can be days when your Algo will not take any trades because there is an entry condition set by RA in your Algo and it is pretty much possible that the condition will not match the whole day.

Activation Flow

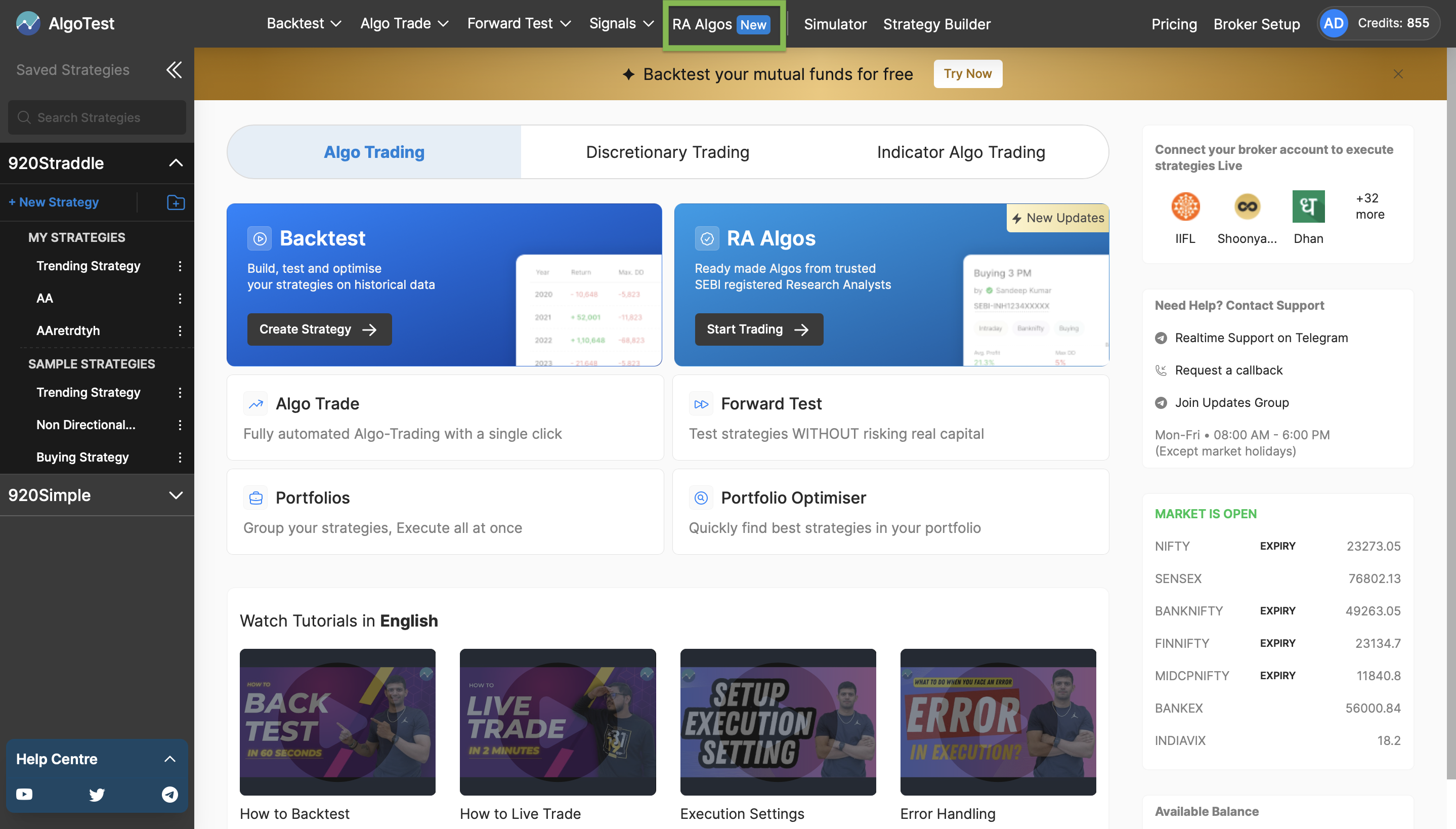

Once you log in to your AlgoTest account, you’ll see the below dashboard. Click on the RA Algos to start the activation process.

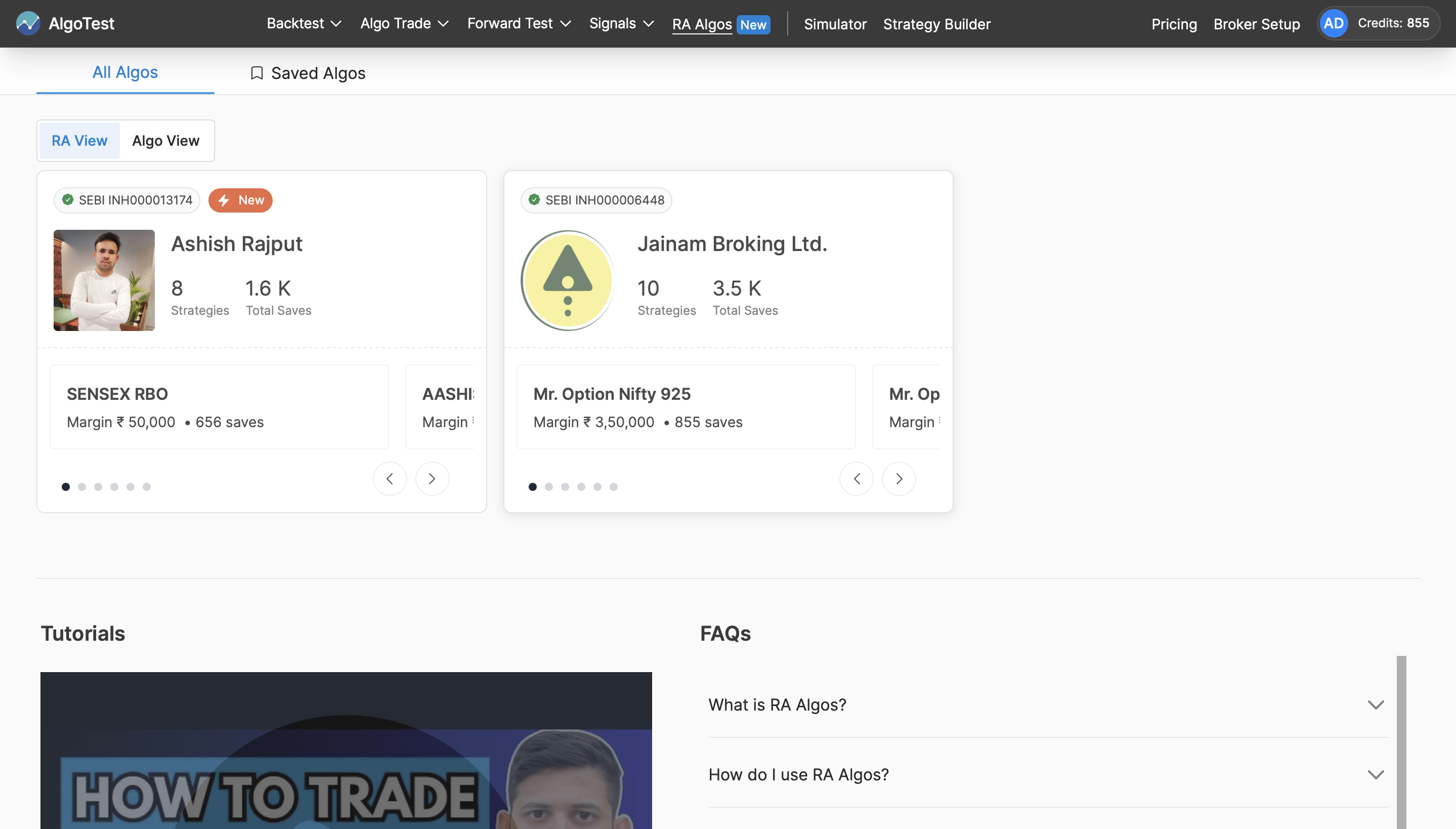

You’ll find RAs listed there as shown in the image below.

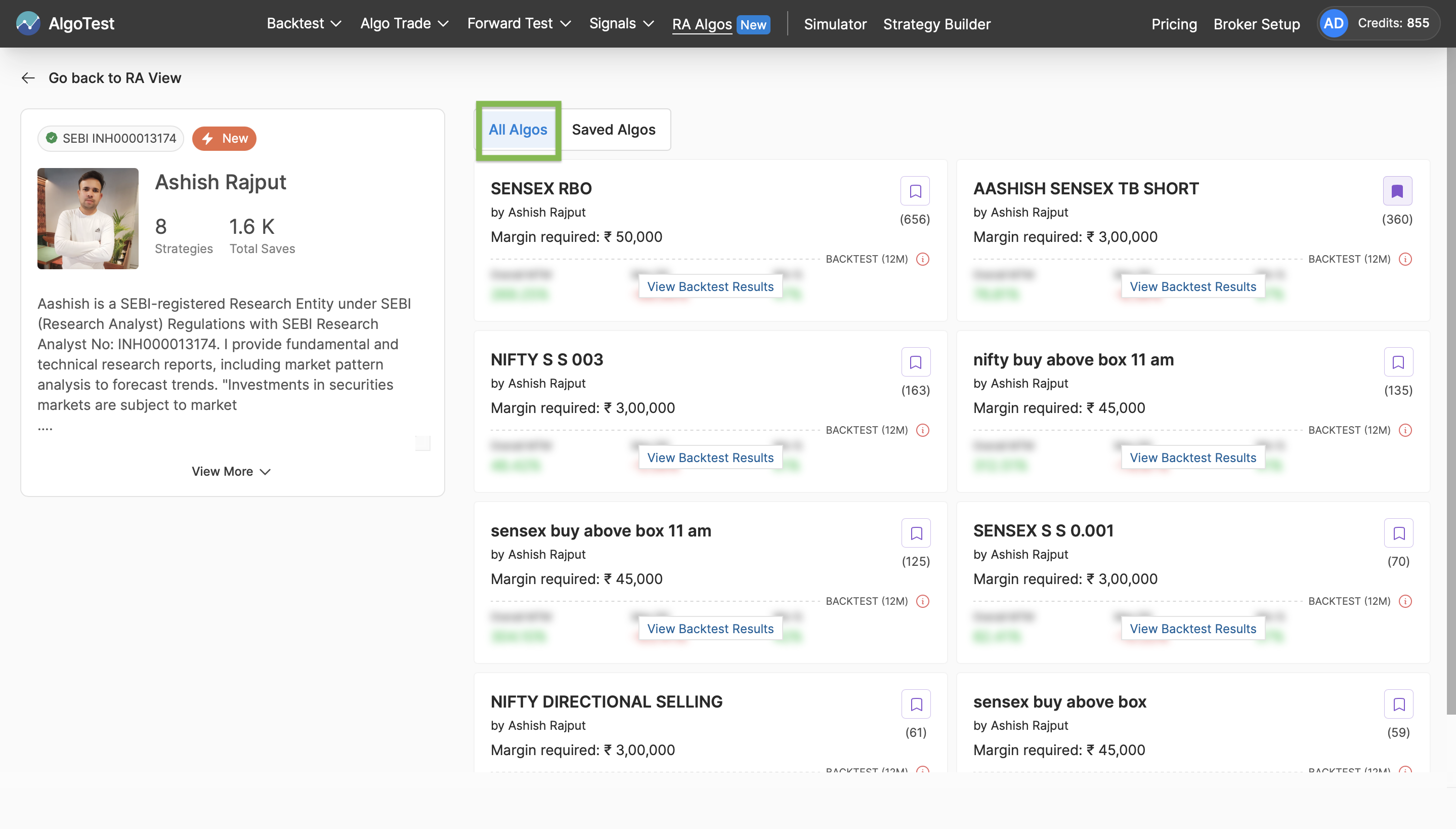

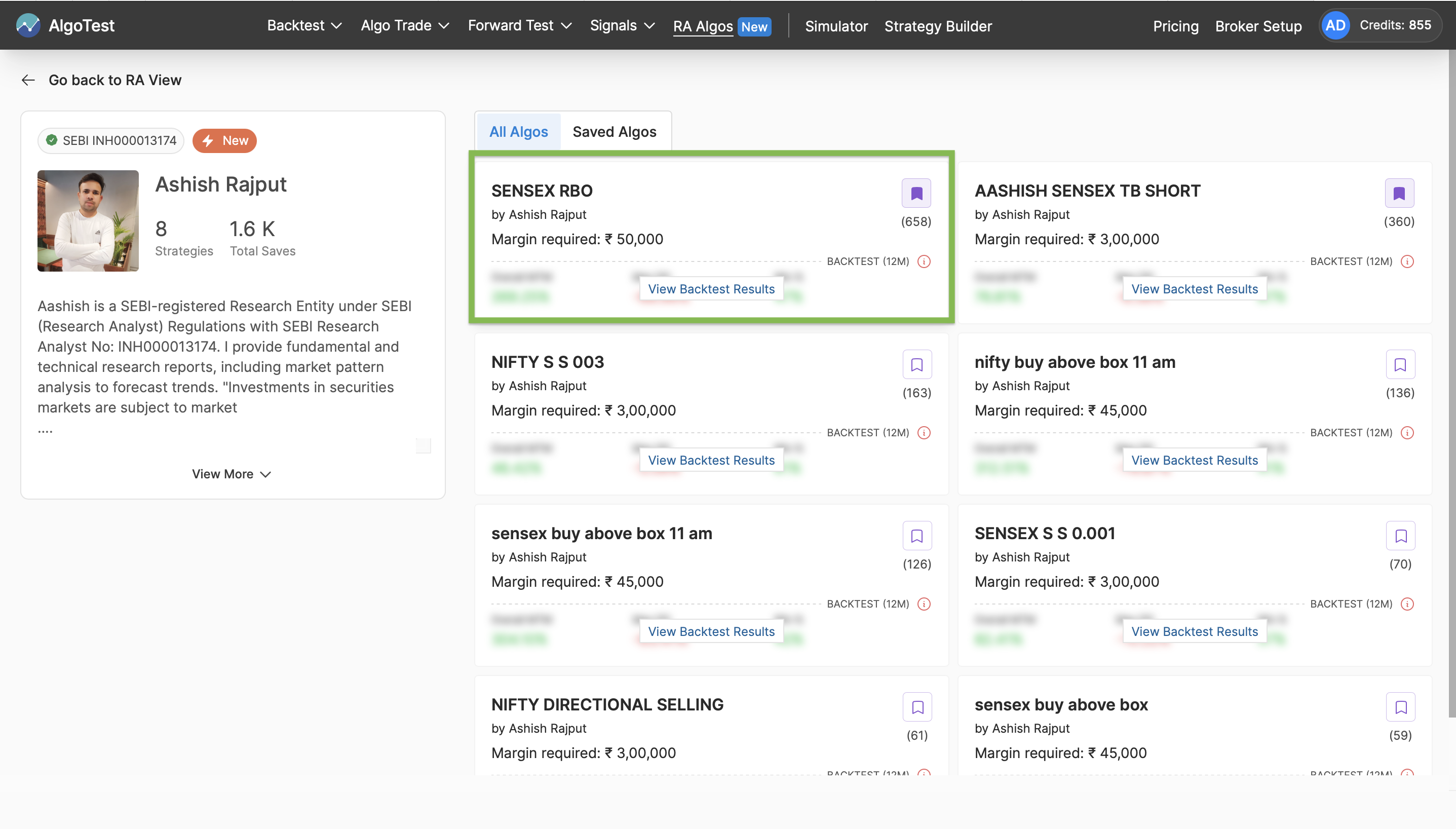

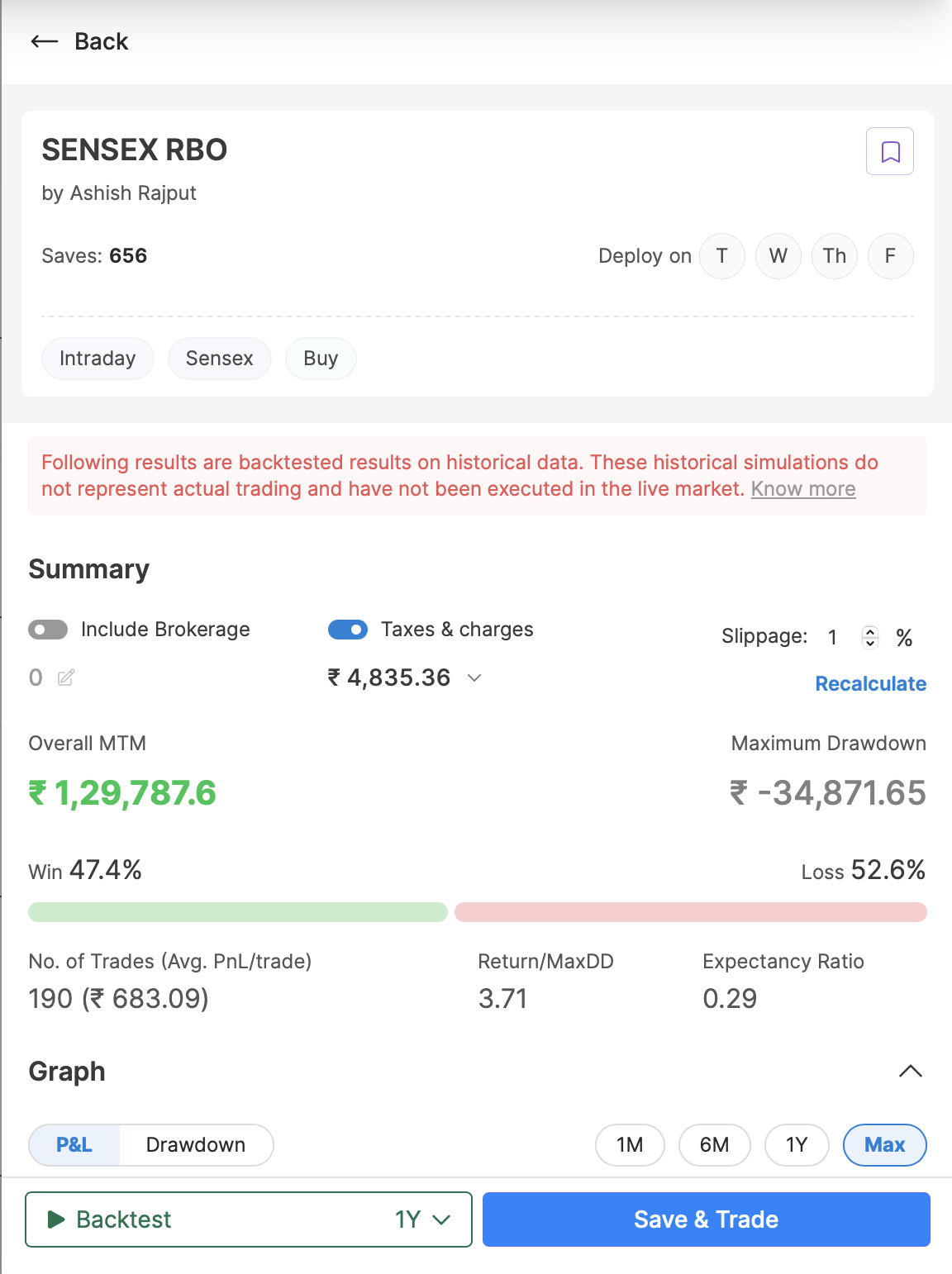

Let’s take a look at one algo given by RA Ashish Rajput. Click on the tab and you will find the dashboard shown in the image below.

There are two tabs. One shows all the algos given by the RA.

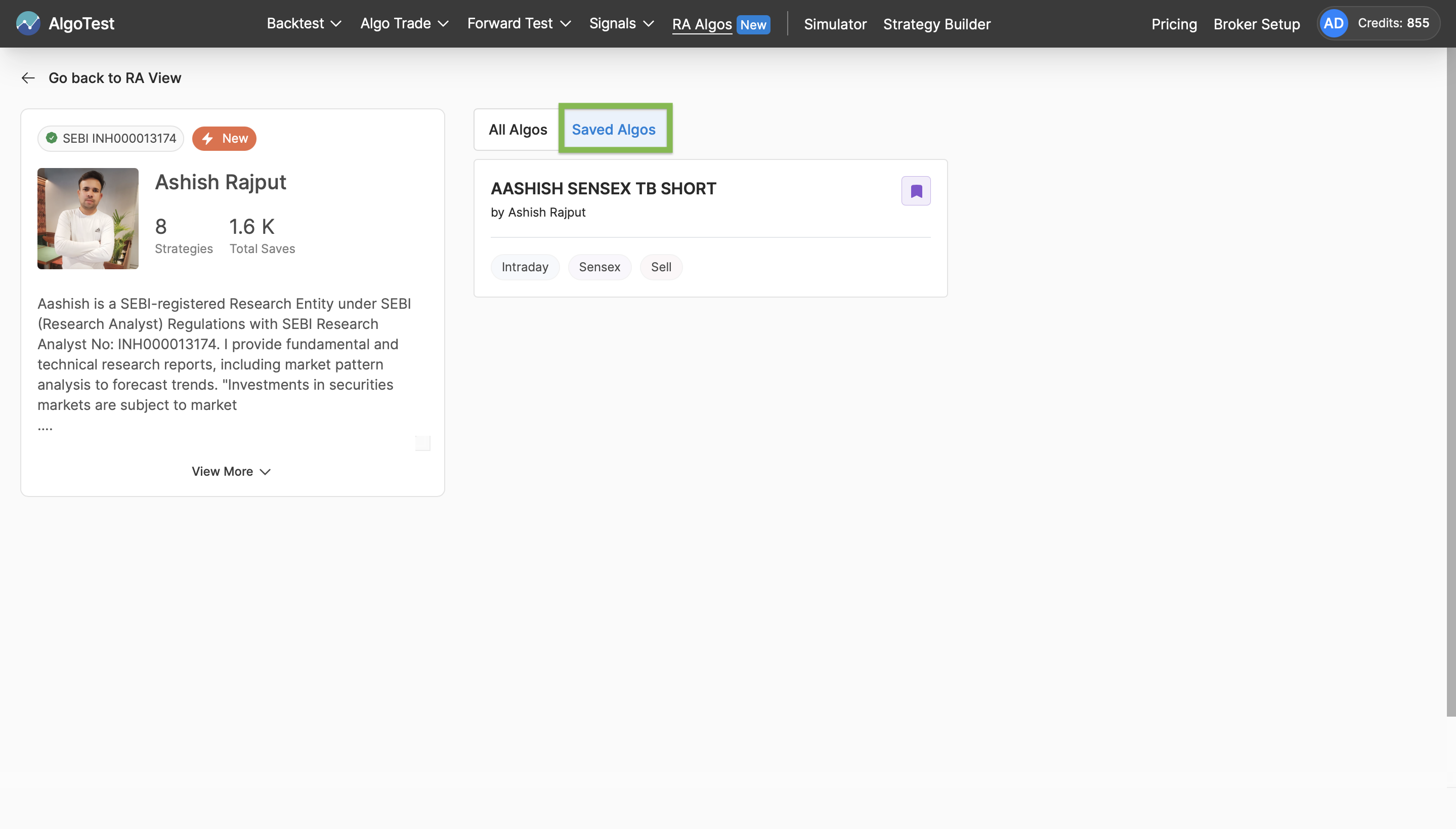

And the other tab shows the algos that you saved.

Let’s see how we can backtest the “Sensex RBO” algo.

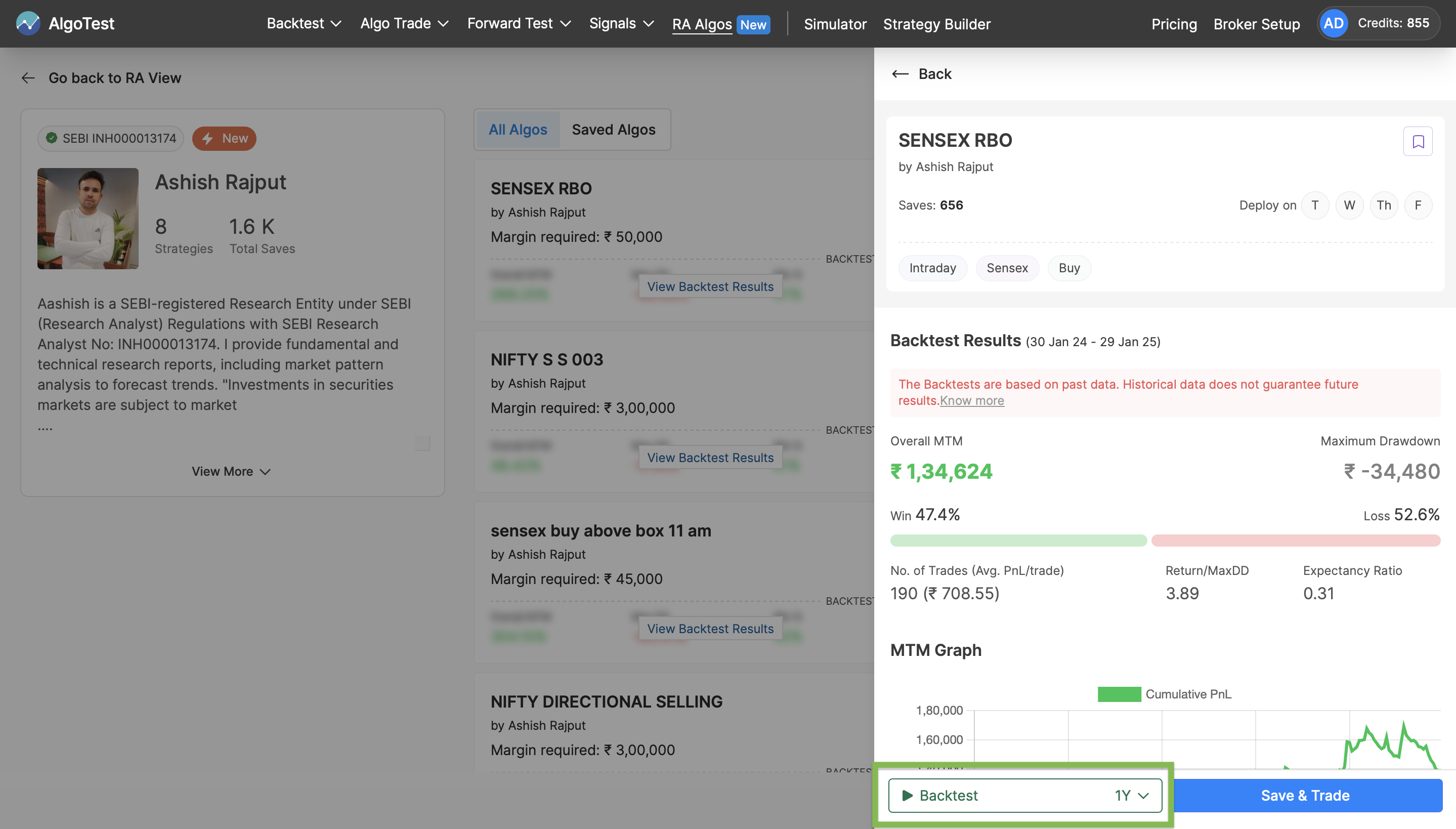

Once you click on the Algo, you’ll see the Algo card as shown below. Now to backtest the algo, click on the backtest.

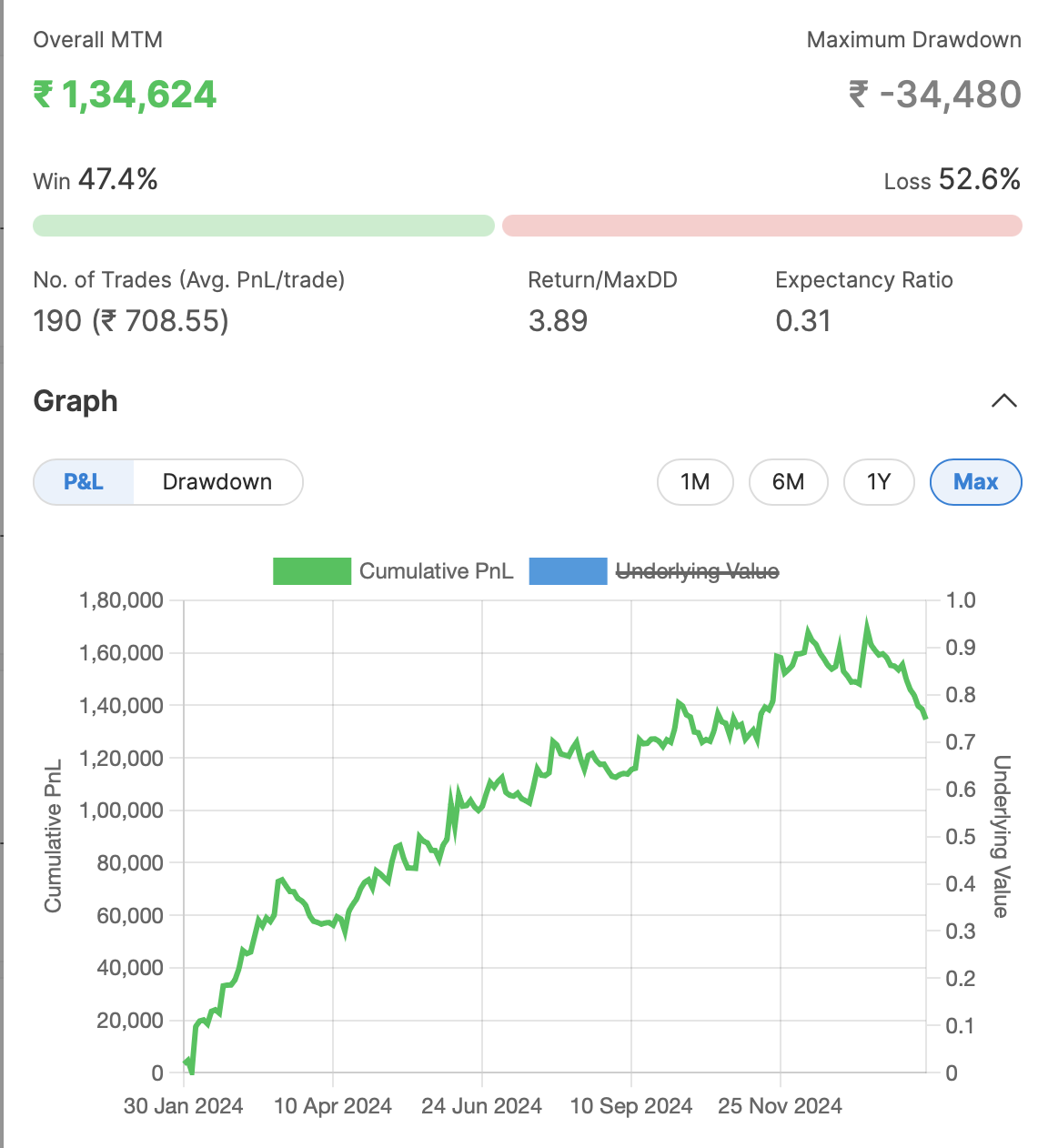

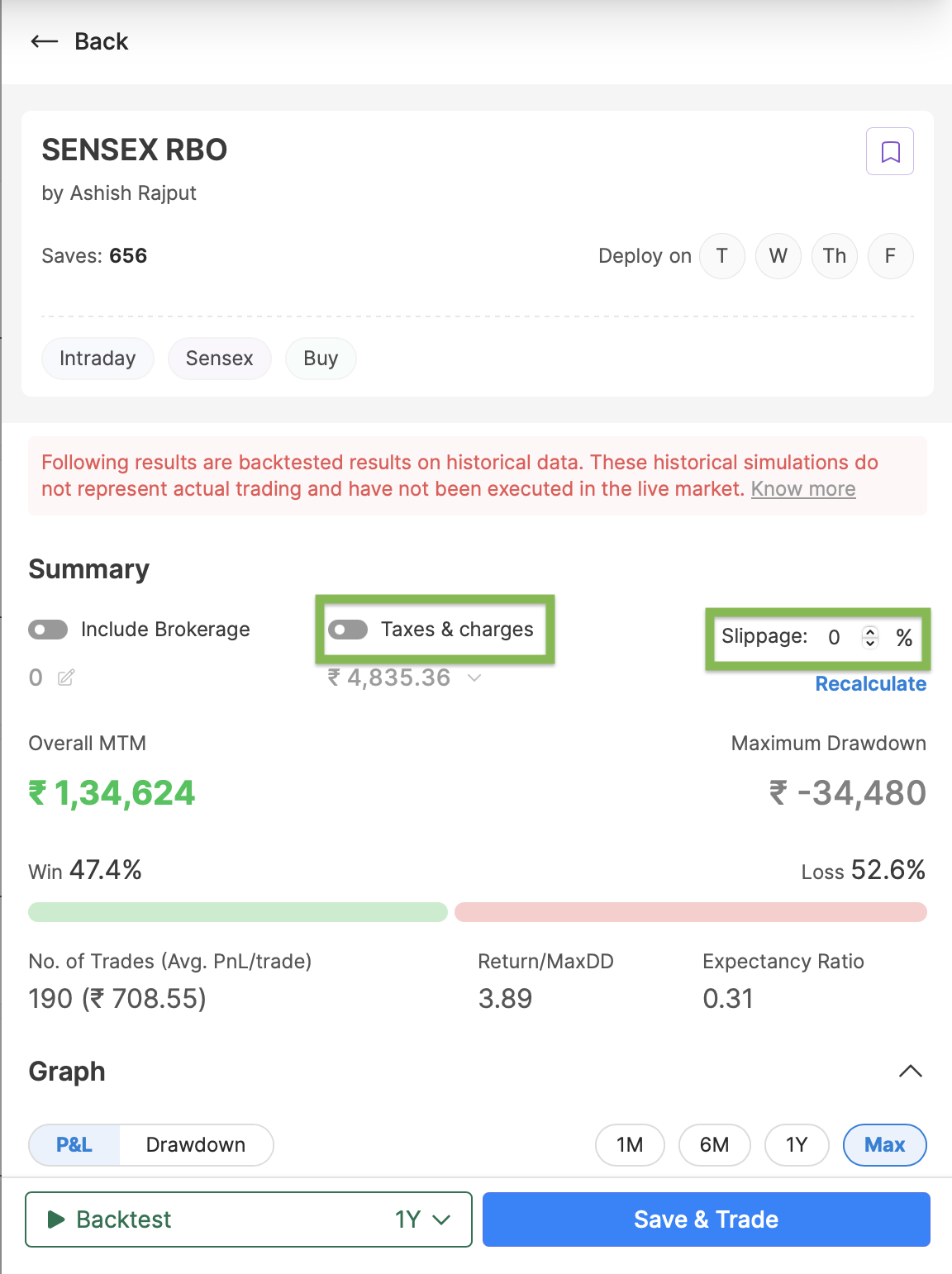

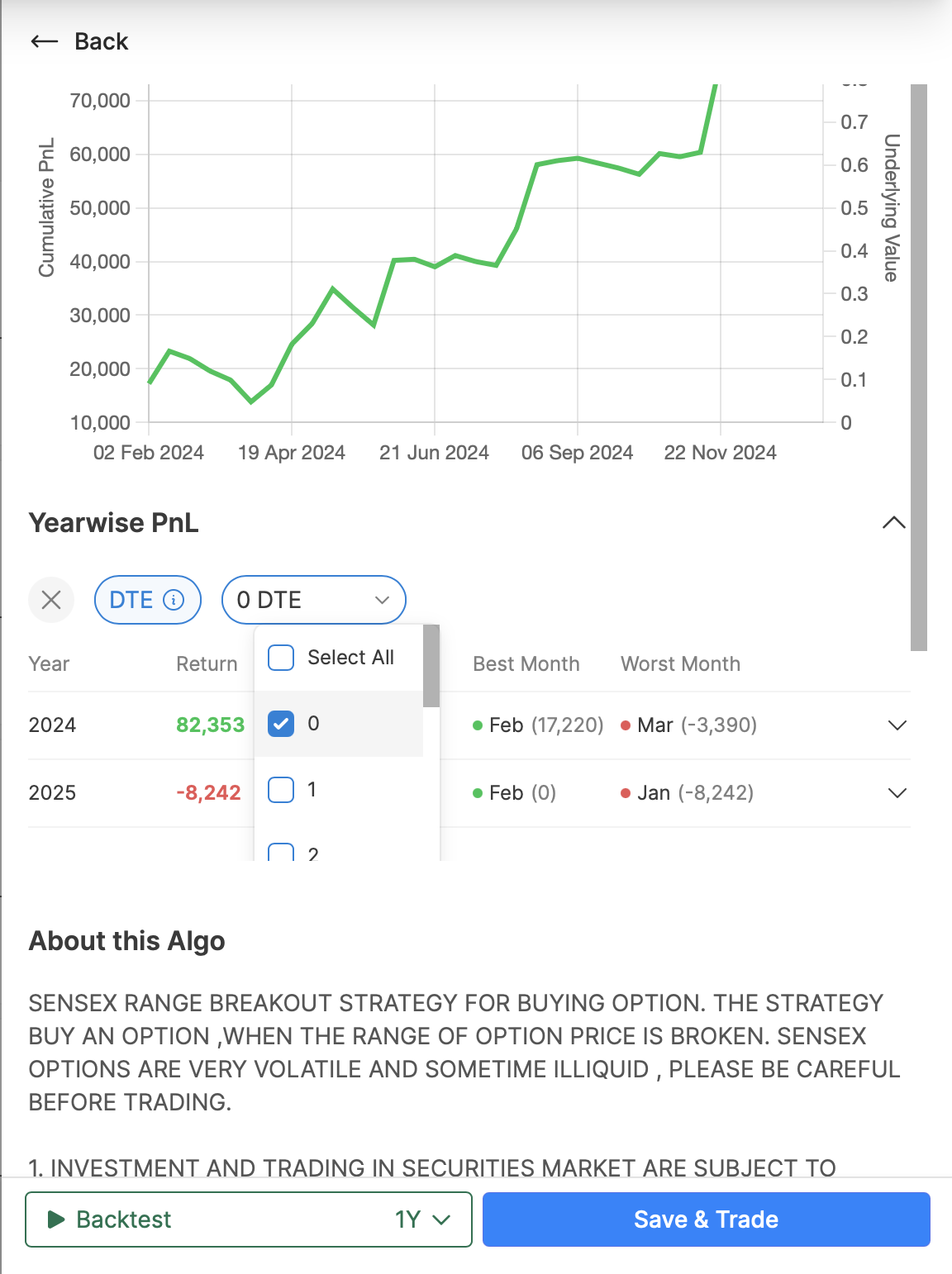

You’ll see the results as shown below.

Before you move forward, add taxes & charges and Slippage. To add taxes and charges, turn the toggle on, add 1% slippage for buying and 0.5% for selling strategy and click on recalculate.

Now, you will see that these results are different from the previous ones.

Similarly, select the days the algo should be deployed from the DTE filter.

Now, save the algo.

After saving the algo, you’ll get two options, you can either forward test it or trade it with your broker.

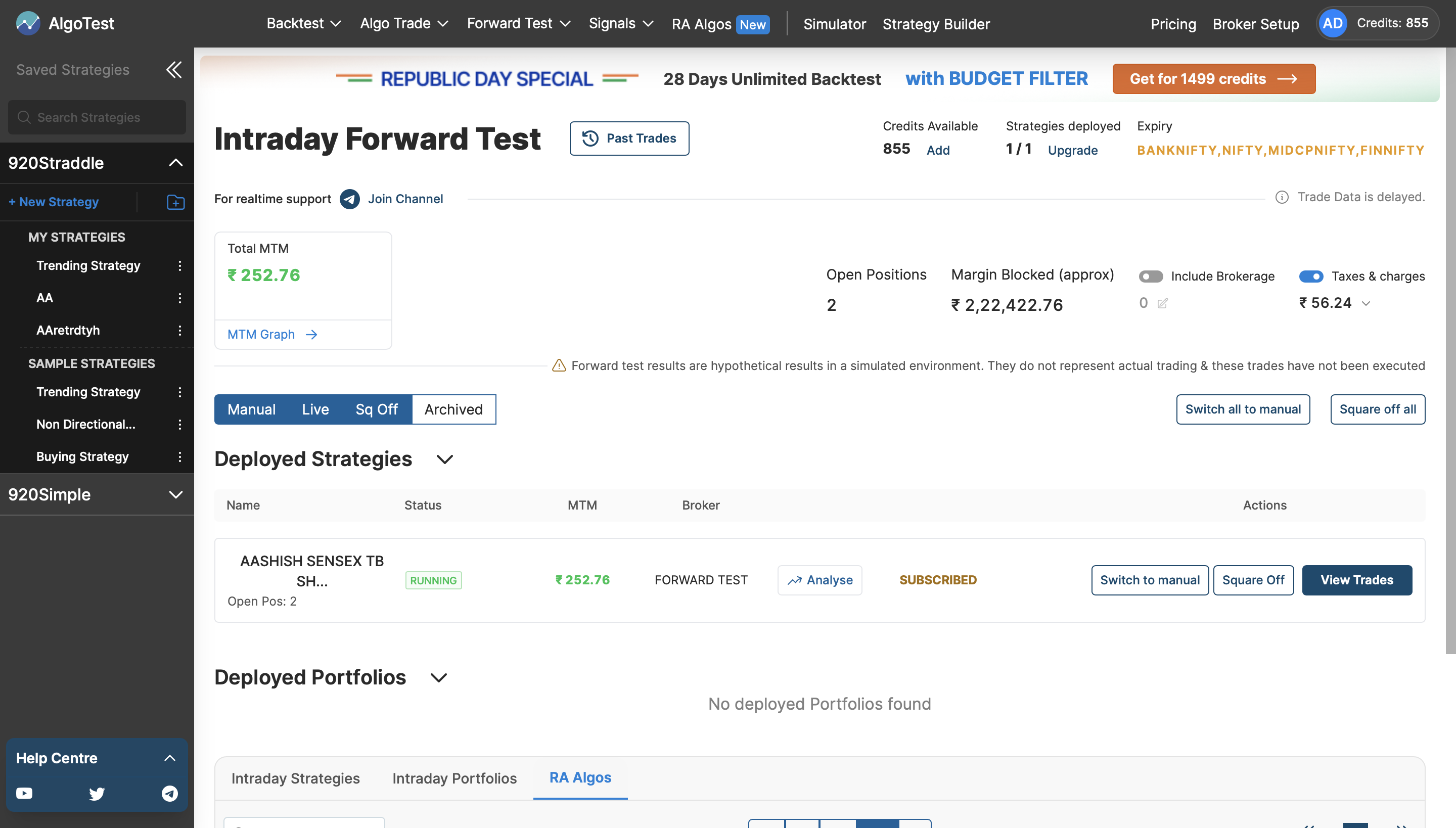

Once you click on the forward test, you’ll be redirected to the page shown below.

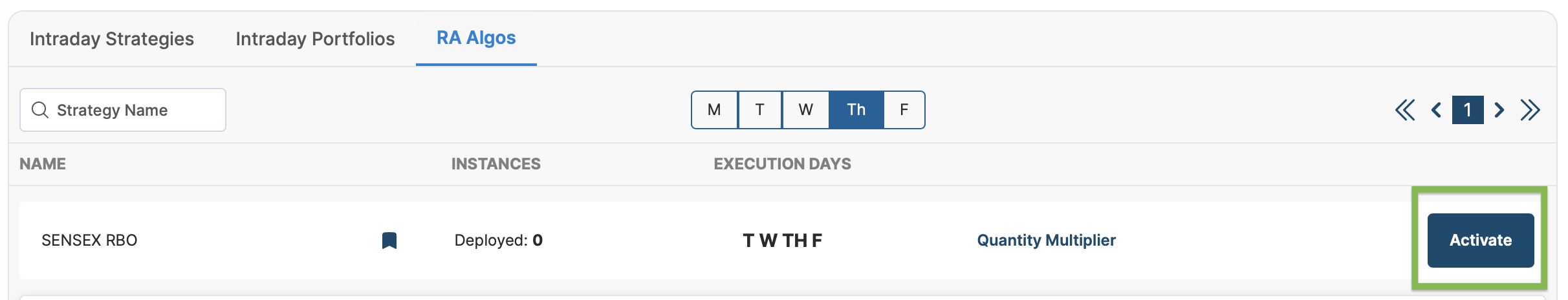

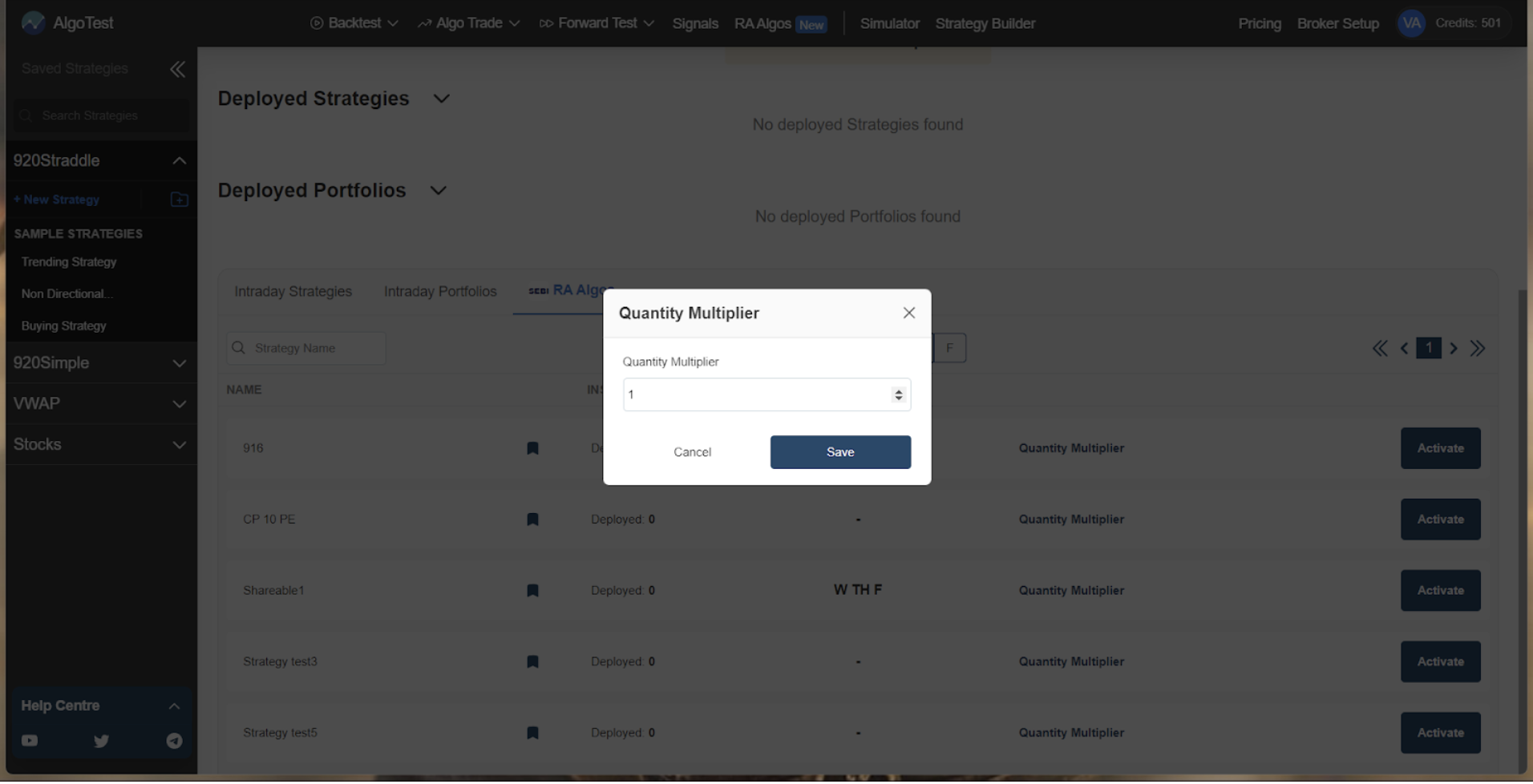

Before forward testing the algo, decide the number of lots you need to trade in by clicking on the quantity multiplier and then clicking on the activate button.

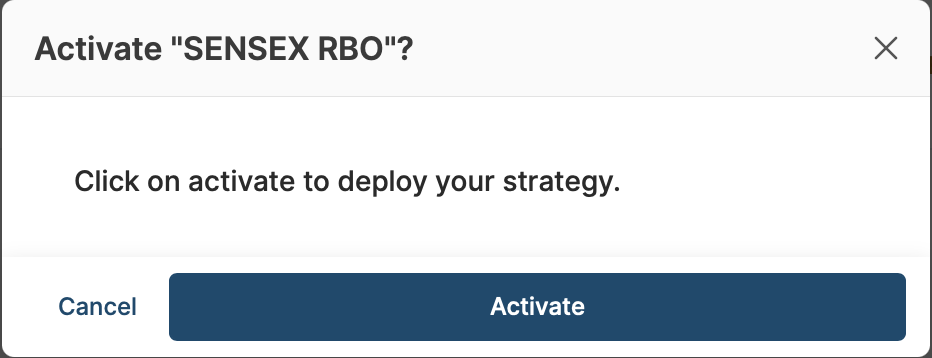

Click on the activation button again to deploy your Algo.

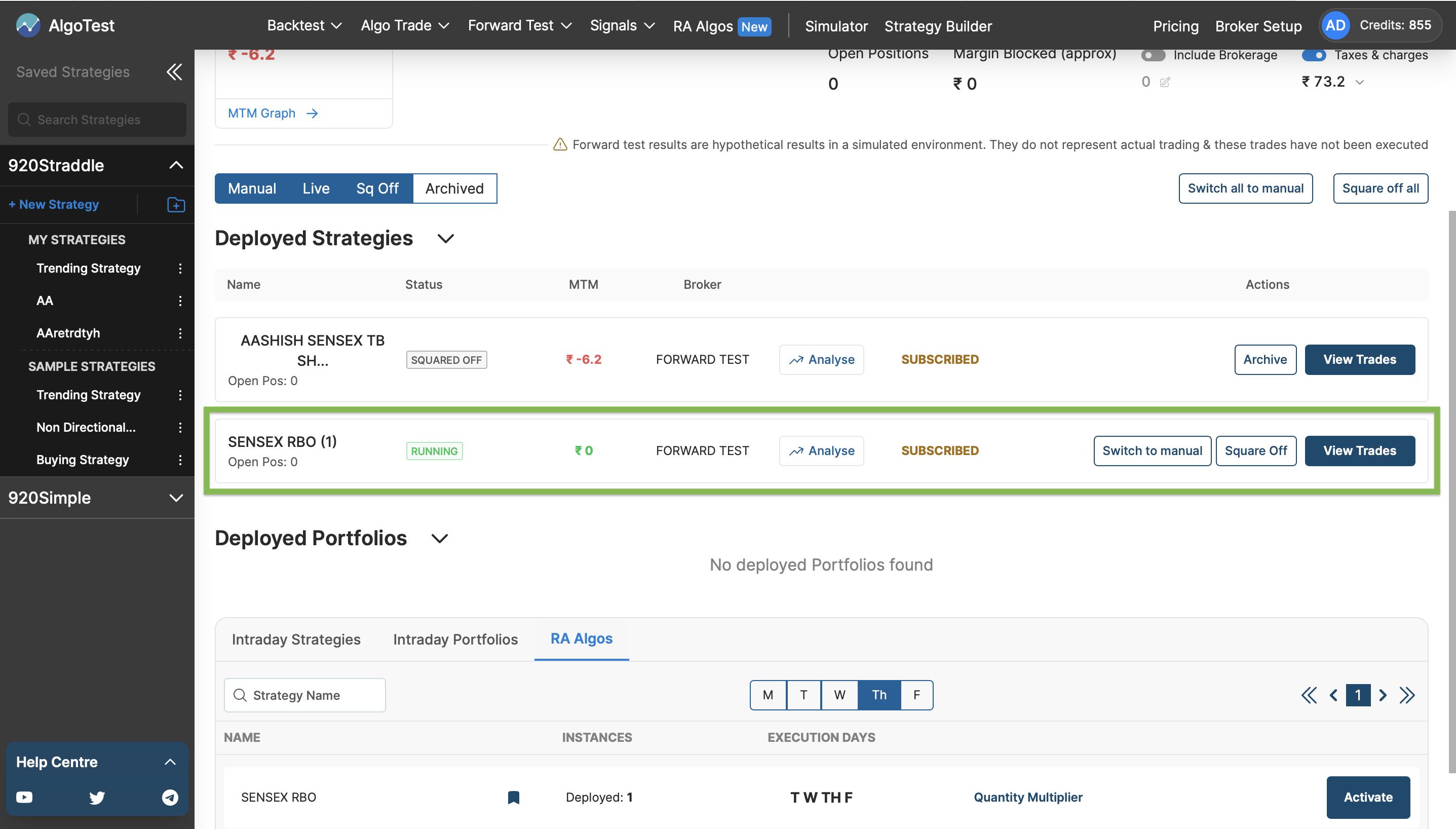

You’ll find the deployed Algos as shown below.

You can see the trades by clicking on View Trades.

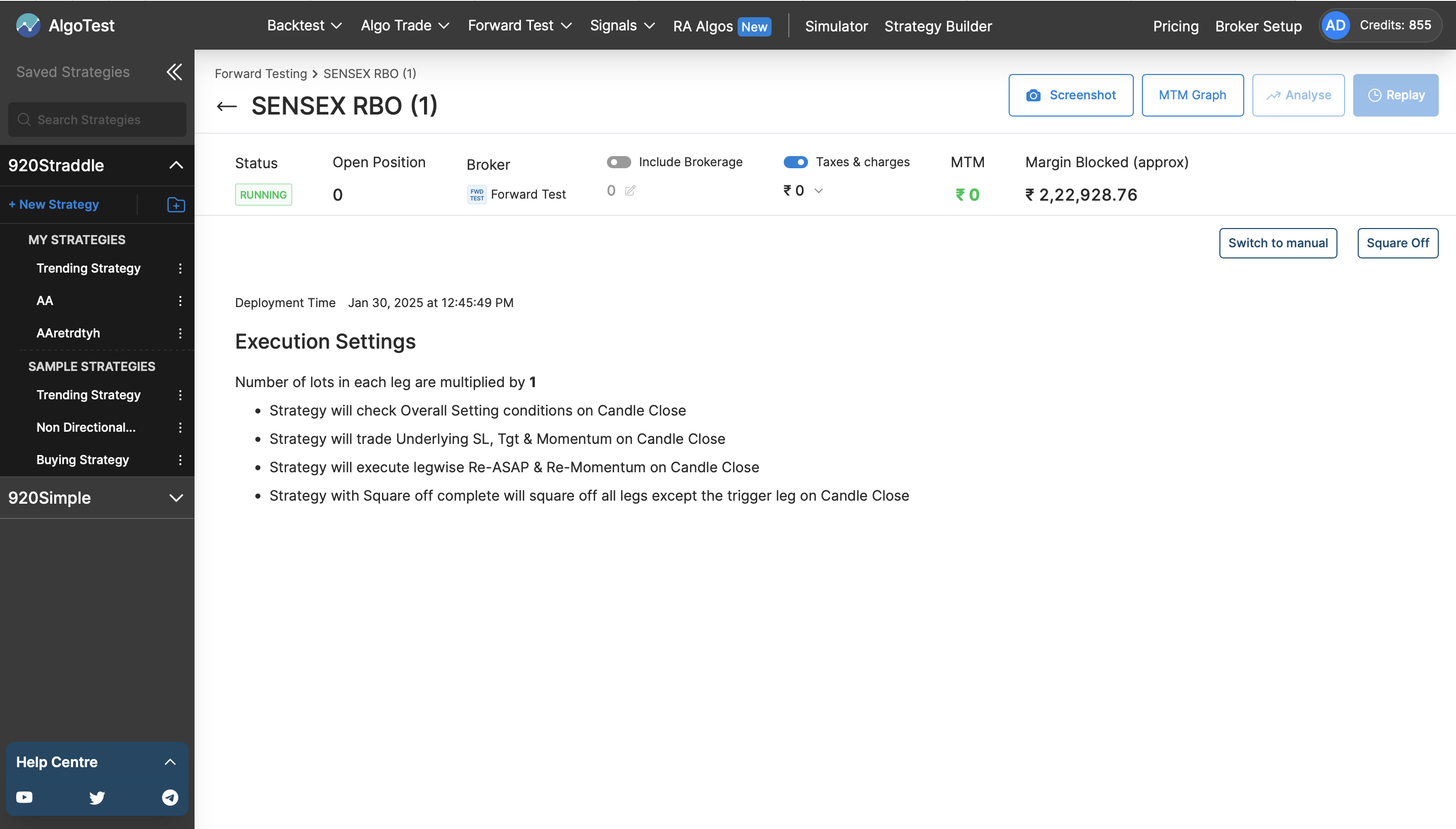

You’ll find the trade details as shown below.

Similarly, you can click on Algo Trade if you want to take the Algo live.

Live Trade

In this section you will have the option to multiply the quantity of the RA algo.

Click on the quantity multiplier and change it to your desired quantity.

It is better to activate the strategy before market hours. If not the logic of your strategy will be affected.

After entering the desired quantity click on the activate button.

Then you will have to select the broker of your choice to activate the RA algos and click on the activate button.

After activating the algo you will see your strategy in the deployed strategies section on your Algo Trading dashboard.

These were the steps that you need to follow in order to subscribe and run a RA algo in your Algotest account. In case you need further assistance feel free to reach out to us on our telegram channel.