The Short Straddle

The Short Straddle is a neutral options strategy designed to profit from minimal price movement in the underlying asset. It involves selling both a call option and a put option at the same strike price and expiration date. The goal is to collect premiums and profit if the asset remains near the strike price. However, the risk becomes unlimited if the asset makes a significant move in either direction.

How It Works

-

Sell a Call Option:

- Collect a premium but risk unlimited loss if the price rises sharply.

-

Sell a Put Option:

- Collect another premium but risk significant loss if the price drops sharply.

-

Net Credit:

- The total premium received represents the maximum profit if the asset stays close to the strike price.

Short Straddle on AlgoTest

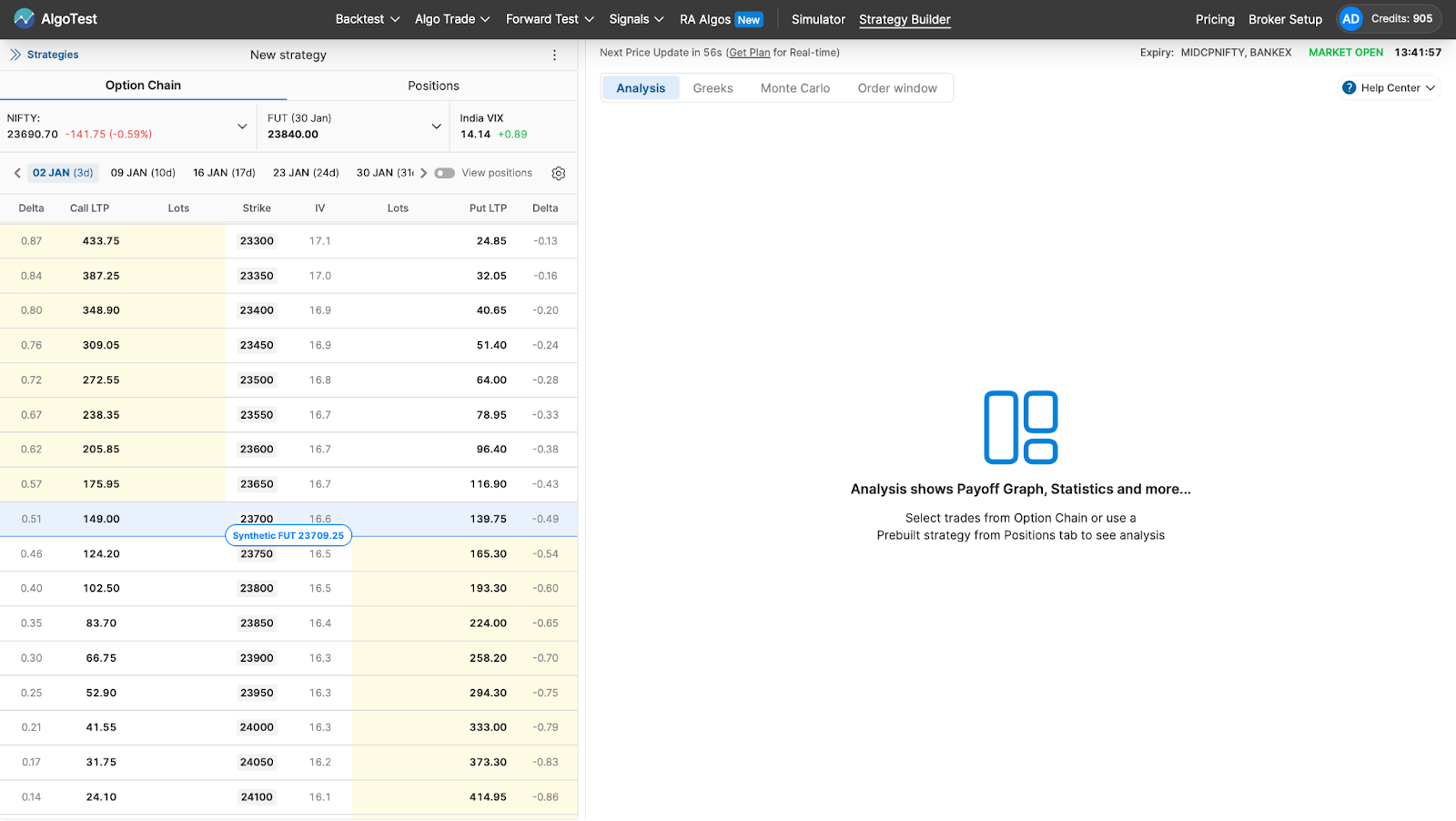

Go to AlgoTest’s Strategy Builder to get started. You will see an interface as shown in the image below.

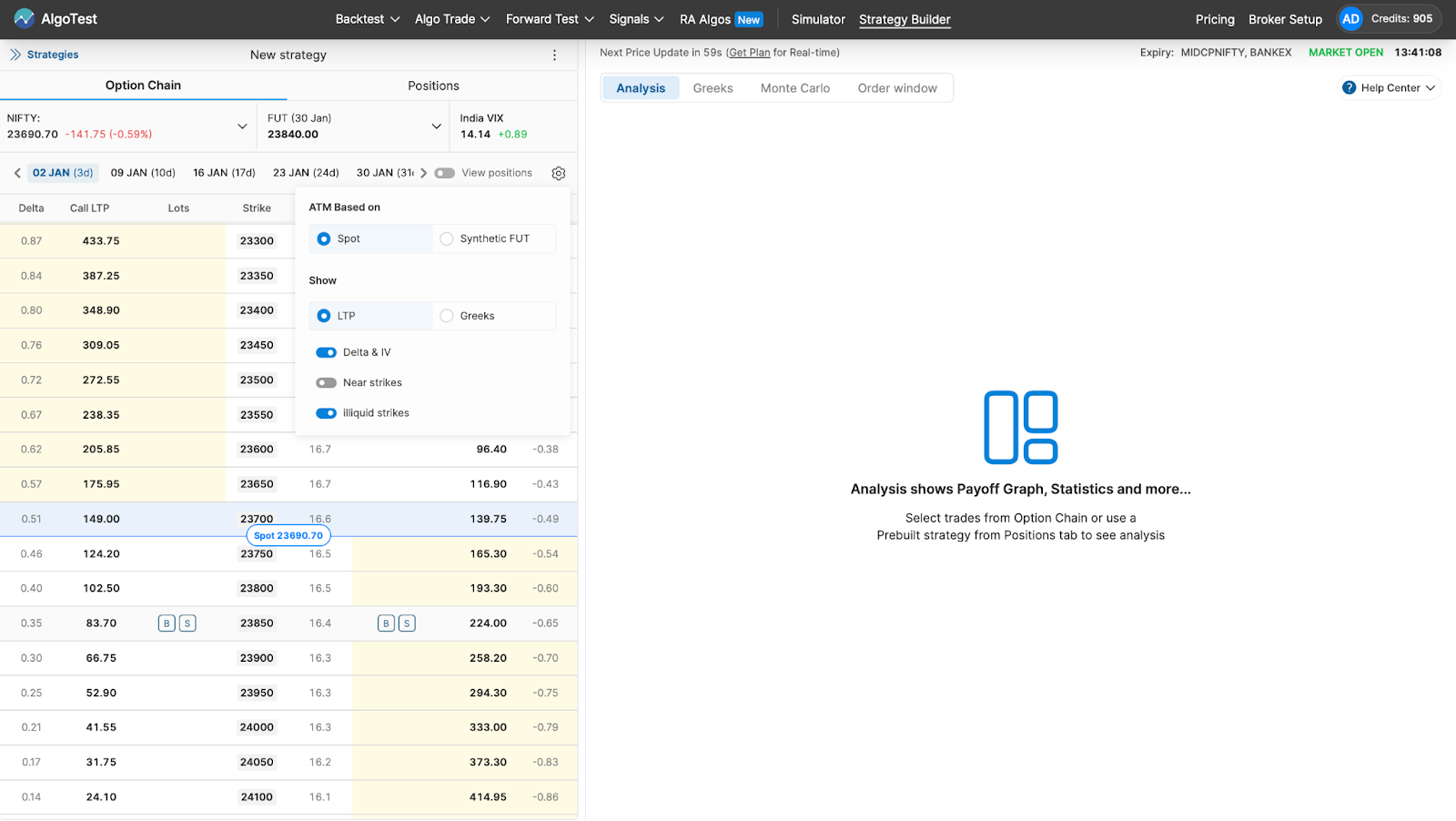

Go to Settings and select Spot to run the strategy.

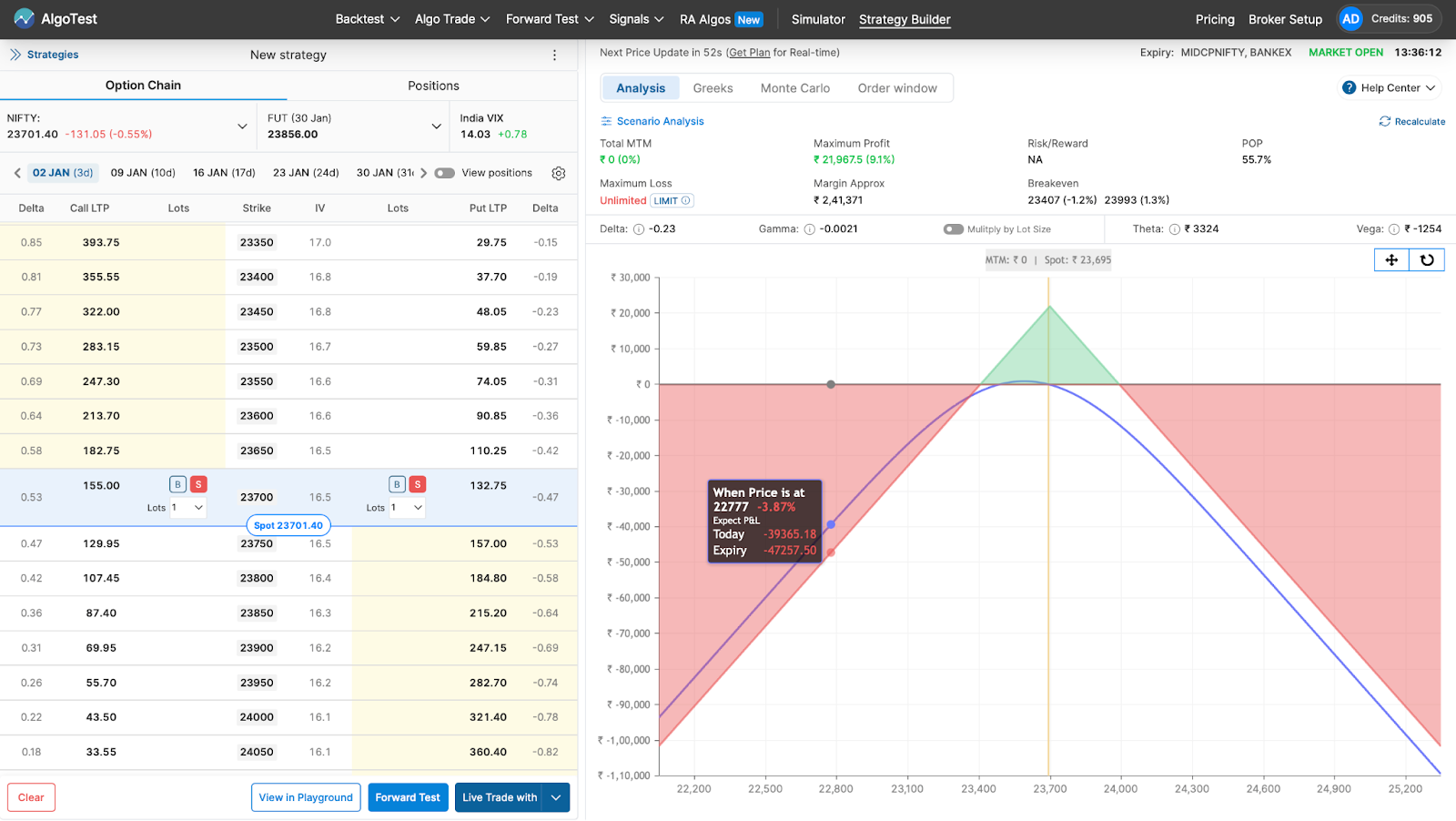

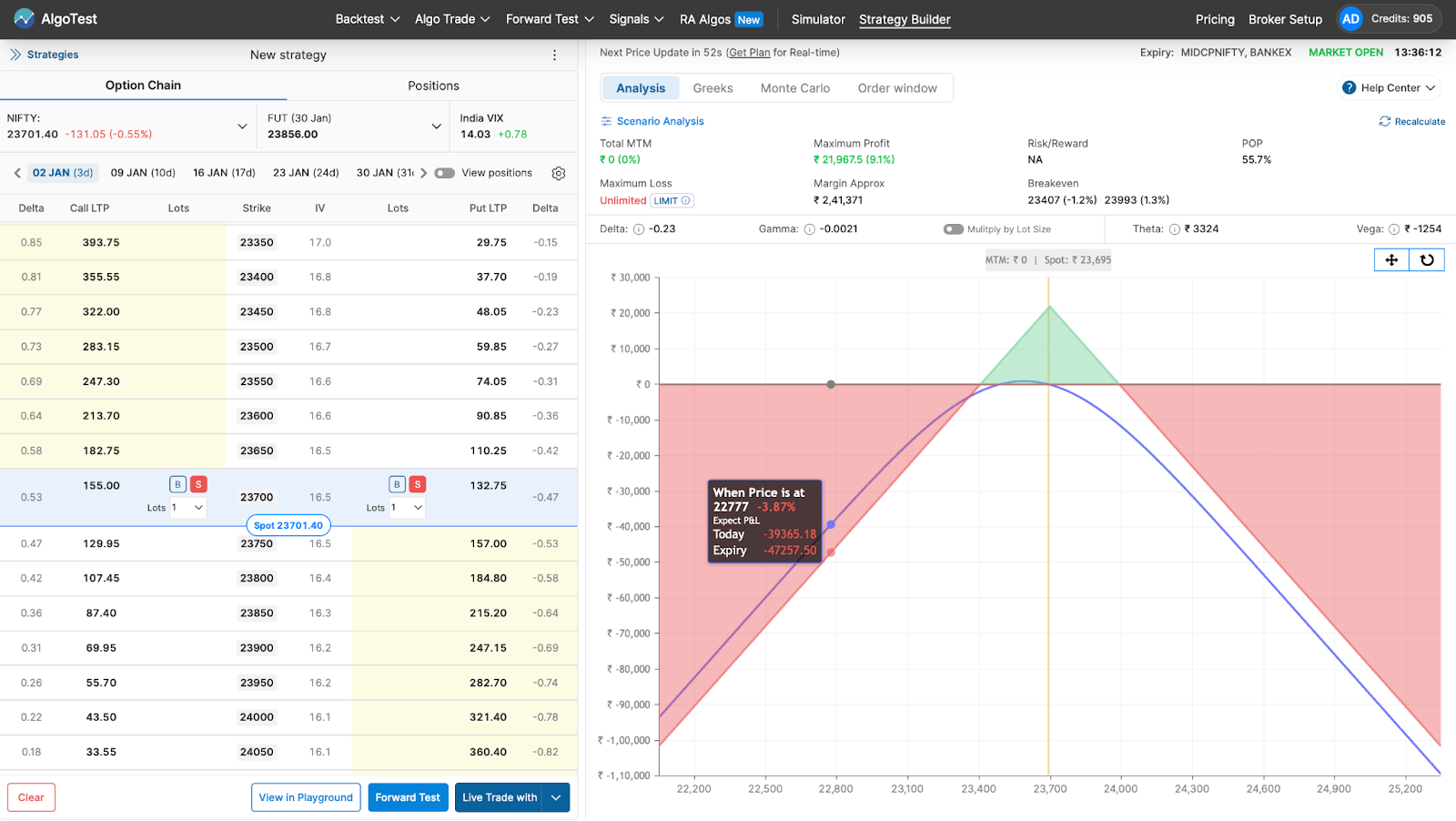

From the Option Chain, we just have to:

- Sell 1 lot of ATM call options

- Sell 1 lot of ATM put options

Click the Buy/Sell button as shown in the image below.

After that, you can deploy it on your broker in one click by clicking the Live Trade With button as shown in the image below. Alternatively, you can forward test (paper trade) it on AlgoTest if you don’t want to deploy it with real money.

Example

Suppose a stock is trading at ₹100:

- Sell a ₹100 strike call for ₹5.

- Sell a ₹100 strike put for ₹5.

Total Premium Collected:

- ₹5 (call) + ₹5 (put) = ₹10.

Profit Scenarios:

- If the stock price remains near ₹100 at expiration, you keep the ₹10 premium as profit.

Loss Scenarios:

- If the stock price moves significantly above or below ₹100, losses can become substantial because there is no cap on risk.

When to Use It

-

Market Outlook:

- Best suited for periods of low volatility where you expect the asset price to remain stable.

-

Range-Bound Conditions:

- Effective when the asset is trading within a narrow range.

Advantages and Disadvantages

Advantages

-

Income Generation:

- Collect premiums from selling both options.

-

High Profit Potential:

- Maximum profit is achieved when the asset stays close to the strike price.

Disadvantages

-

Unlimited Risk:

- Large price movements in either direction can result in significant losses.

-

Capital-Intensive:

- High margin requirements, making the strategy capital-intensive.

Practical Application for AlgoTest Users

AlgoTest simplifies executing and managing the Short Straddle strategy:

- Automation: Automate the execution of the strategy and monitor positions in real-time.

- Risk Management: Set up alerts to quickly adjust positions if volatility spikes unexpectedly.

- Backtesting: Analyze historical performance to understand how the strategy behaves under various market conditions.

With AlgoTest, traders can ensure better control, timely adjustments, and improved decision-making when deploying the Short Straddle.

Conclusion

The Short Straddle is a premium-collecting strategy that can be highly profitable in stable, low-volatility markets. However, the unlimited risk makes it essential for traders to remain vigilant and have a clear plan for managing losses if market volatility increases.

By leveraging AlgoTest to automate, monitor, and backtest the strategy, traders can manage risks more effectively and improve their overall trading efficiency.