Put Ratio Back Spread

The Put Ratio Back Spread is a strategic options play used when you expect significant downward movement in the underlying asset but want to limit potential losses if the asset price increases. This strategy involves selling a lower number of put options at a higher strike price and buying a greater number of put options at a lower strike price. The result is often a net credit or minimal cost and offers the potential for substantial profit if the asset declines sharply, while limiting losses on an upward price move.

How It Works

-

Sell Higher Strike Put:

- Collect a premium by selling fewer in-the-money or near-the-money put options.

-

Buy More Lower Strike Puts:

- Use the premium to buy a greater number of out-of-the-money put options.

- This position profits significantly if the asset price drops below the lower strike price.

-

Net Credit or Minimal Cost:

- The strategy often results in a net credit, but sometimes a small debit depending on the strike prices and premiums.

Put Ratio Back Spread on AlgoTest

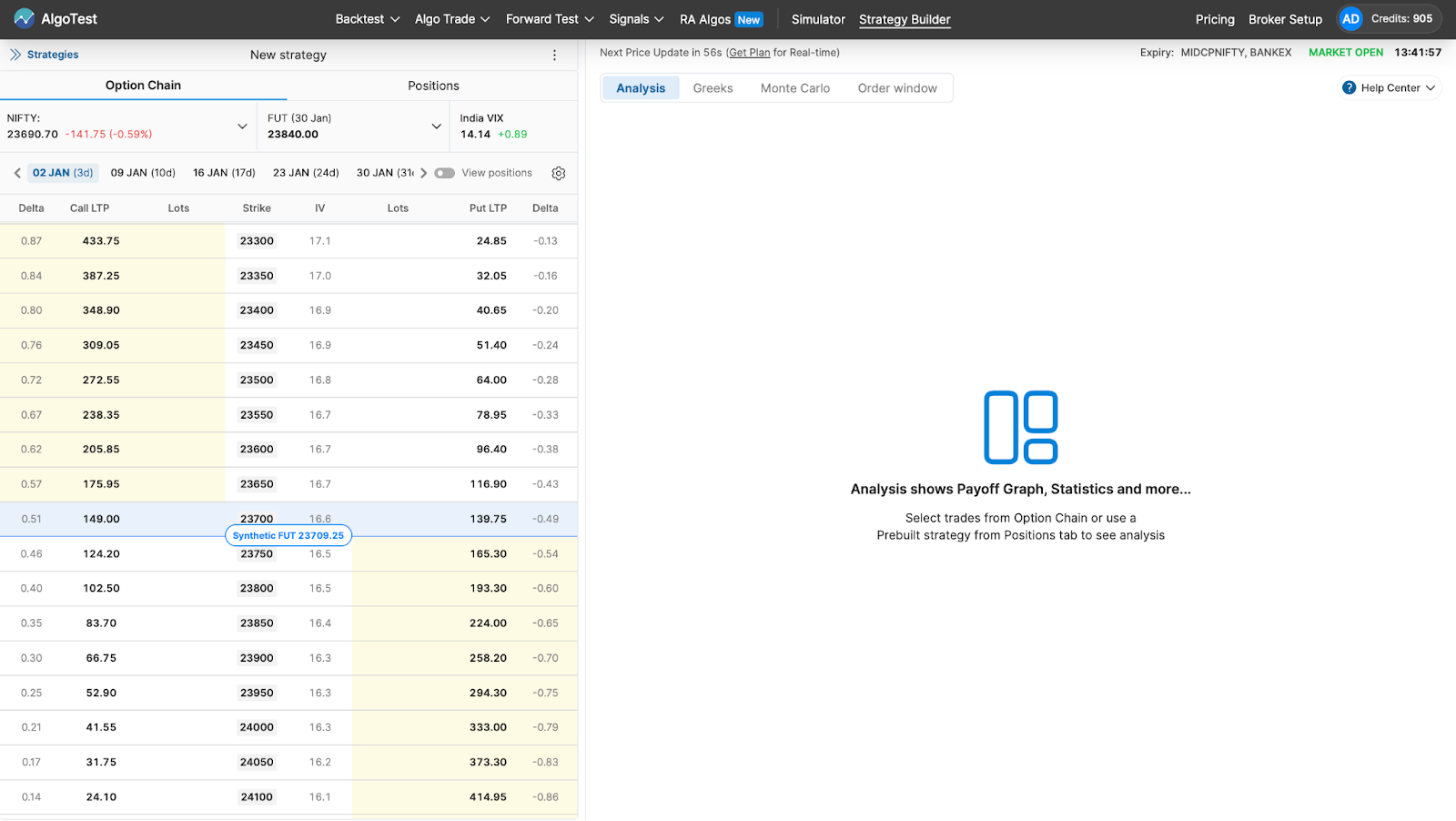

Go to AlgoTest’s Strategy Builder by clicking on this link. You will get an interface as shown in the image below.

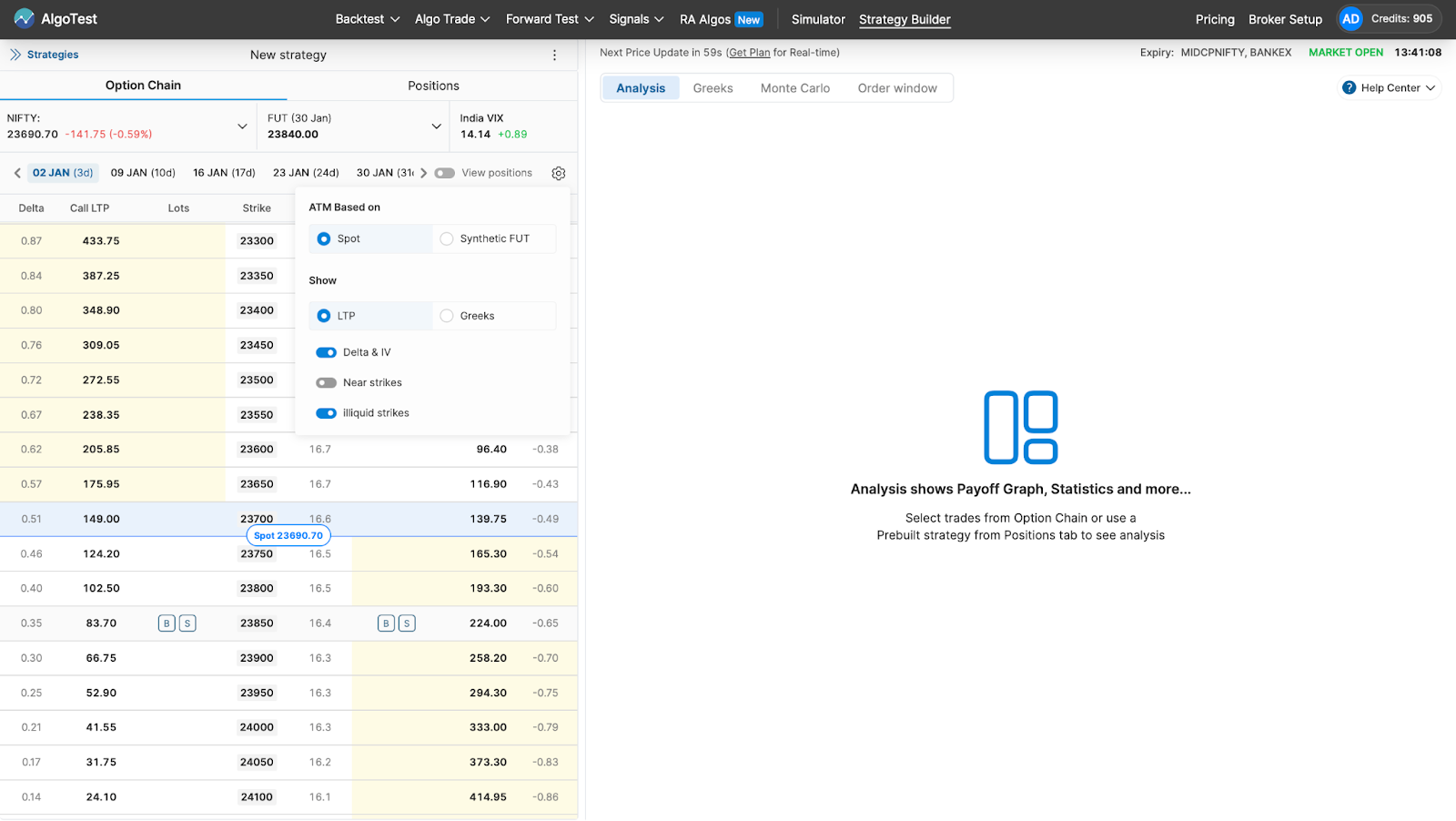

Go to Settings and select Spot to run the strategy.

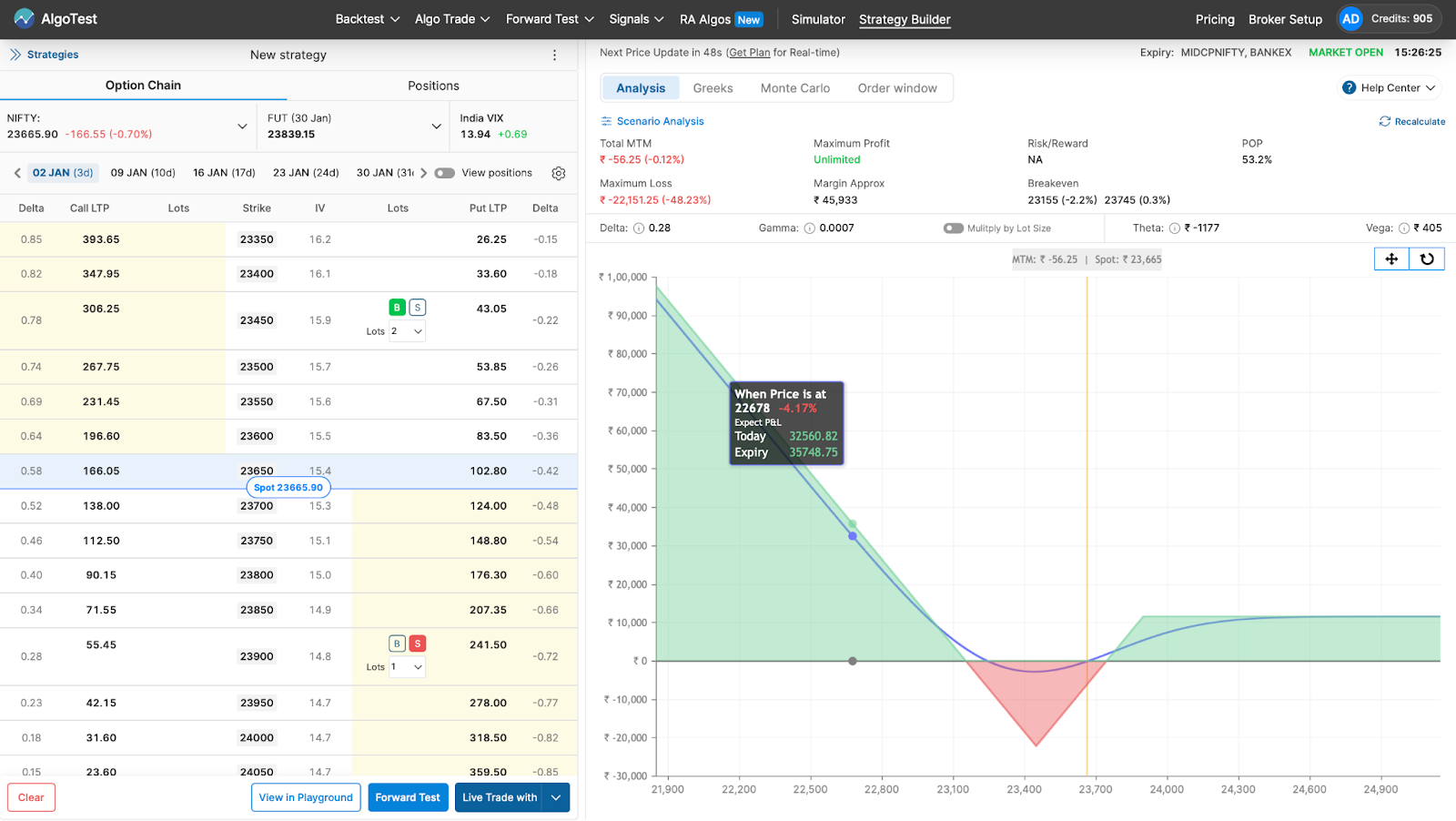

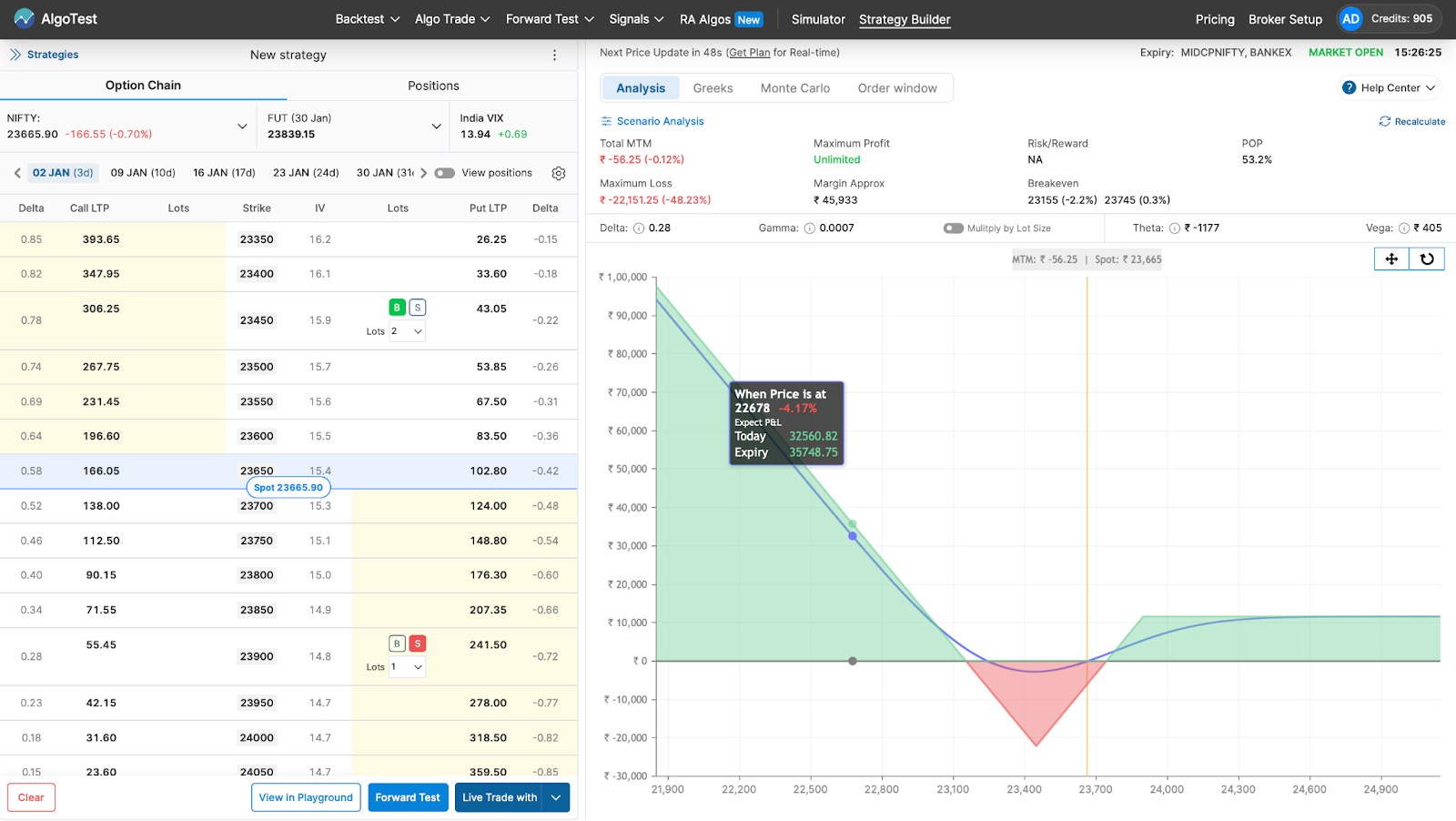

From the Option Chain, we have to:

- Buy two OTM Put options

- Sell one ITM Put option

Click the Buy/Sell button as shown in the image below.

After that, you can deploy it on your broker in one click by clicking the Live Trade With button as shown in the image below. Alternatively, you can forward test (paper trade) it on AlgoTest if you don’t want to deploy it with real money.

Example

Consider a stock trading at ₹100:

- Sell 1 Put Option with a ₹100 strike for ₹5.

- Buy 2 Put Options with a ₹90 strike for ₹2.5 each.

Net Cost:

- ₹5 (collected) - ₹5 (paid) = ₹0 (no cost).

Outcomes:

-

If the stock drops well below ₹90:

- The ₹90 puts gain significant value, leading to large profits.

-

If the stock remains above ₹100:

- All options expire worthless, and no profit or loss occurs.

-

If the stock drops only slightly:

- You incur a limited loss as the value of the sold put offsets part of the gain on the purchased puts.

When to Use It

-

Market Outlook:

- Ideal when you expect significant volatility and are highly bearish on the asset.

- Provides protection if the decline is moderate or the price increases.

-

Volatile Conditions:

- Best used before major announcements, earnings releases, or events that could trigger sharp price movements.

Advantages and Disadvantages

Advantages:

- Unlimited profit potential if the underlying asset declines sharply.

- Minimal or no cost to initiate the strategy, often generating a net credit.

- Limited loss if the price moves against you.

Disadvantages:

- Loses money if the asset price drops only slightly and stays between the strike prices.

- Requires a strong directional view; profits are limited if the asset remains range-bound.

Practical Application for AlgoTest Users

Using AlgoTest, traders can:

- Automate the Put Ratio Back Spread for efficient execution.

- Backtest the strategy to analyze historical performance and refine strike price parameters.

- Use real-time monitoring to make adjustments and respond swiftly to market changes.

AlgoTest’s platform simplifies managing this complex strategy, allowing traders to optimize risk and performance.

Conclusion

The Put Ratio Back Spread is an advanced options strategy suitable for traders expecting high volatility and a significant price drop. With the potential for large profits if the market declines sharply, it is a powerful tool for bearish scenarios. By leveraging AlgoTest, traders can automate, backtest, and optimize this strategy, gaining confidence in execution and improving risk management.