The Long Straddle

The Long Straddle is a market-neutral options strategy used when a trader expects significant price movement in either direction but is unsure about the direction itself. It involves buying both a call option and a put option on the same underlying asset, with identical strike prices and expiration dates. The strategy profits from large price swings in either direction, while the maximum loss is limited to the total premium paid if the asset remains range-bound.

How It Works

-

Buy a Call Option:

- Provides the right to buy the asset if the price rises.

-

Buy a Put Option:

- Provides the right to sell the asset if the price falls.

-

Net Cost:

- The strategy incurs a net debit, equal to the combined cost of both options.

Long Straddle on AlgoTest

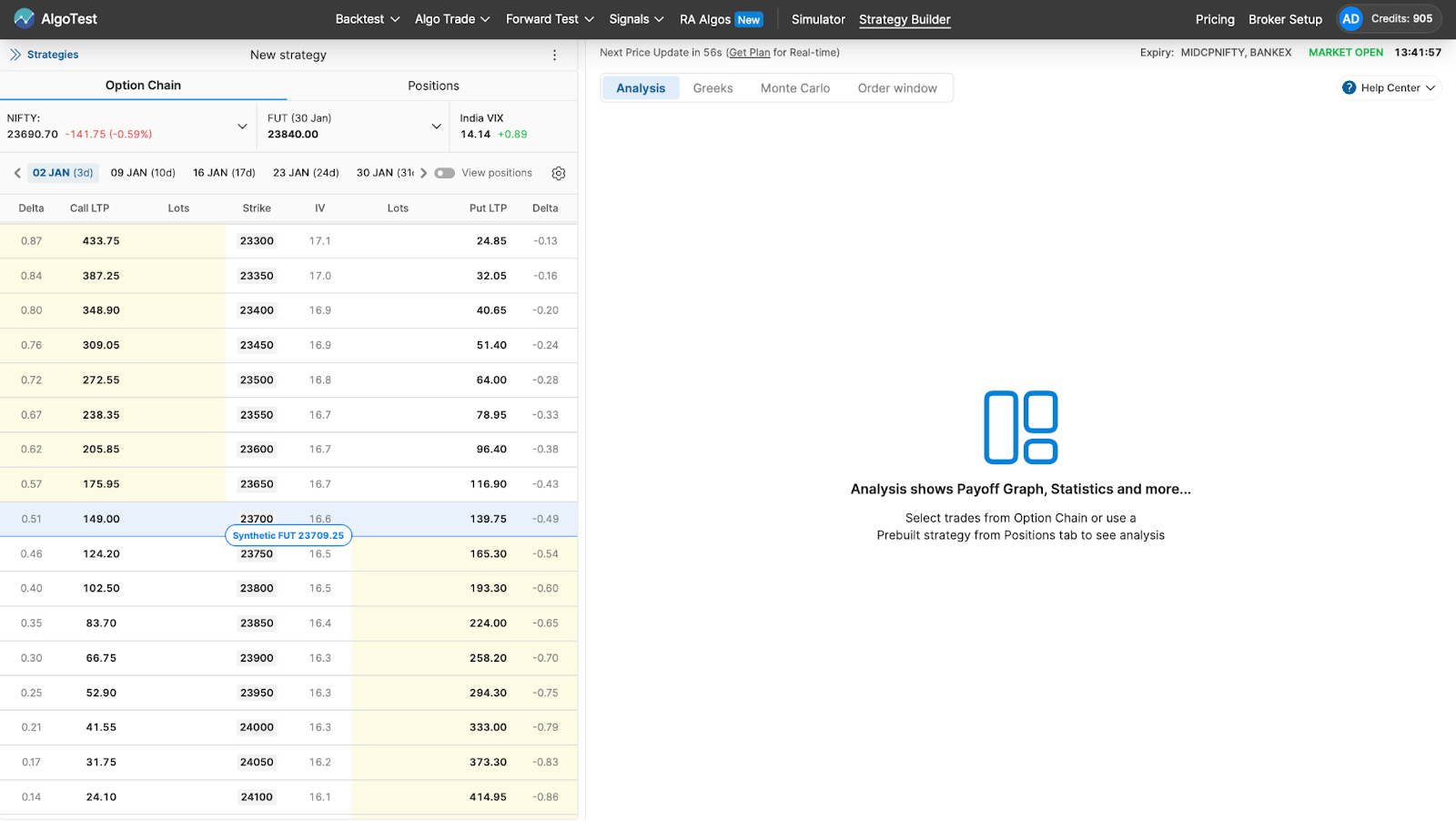

Go to AlgoTest’s Strategy Builder to get started. You will see an interface like the one shown above.

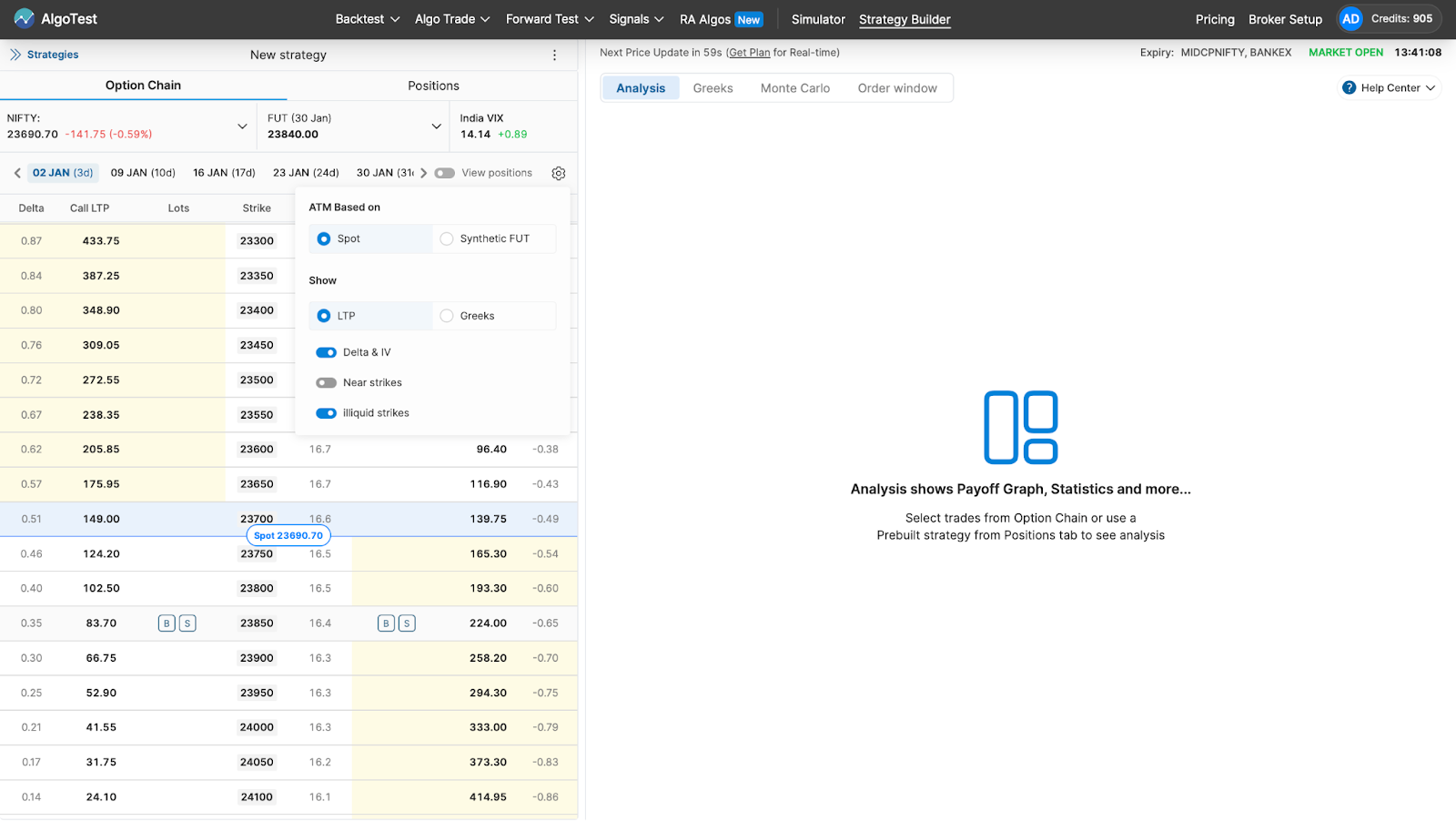

Go to Settings and select Spot to run the strategy.

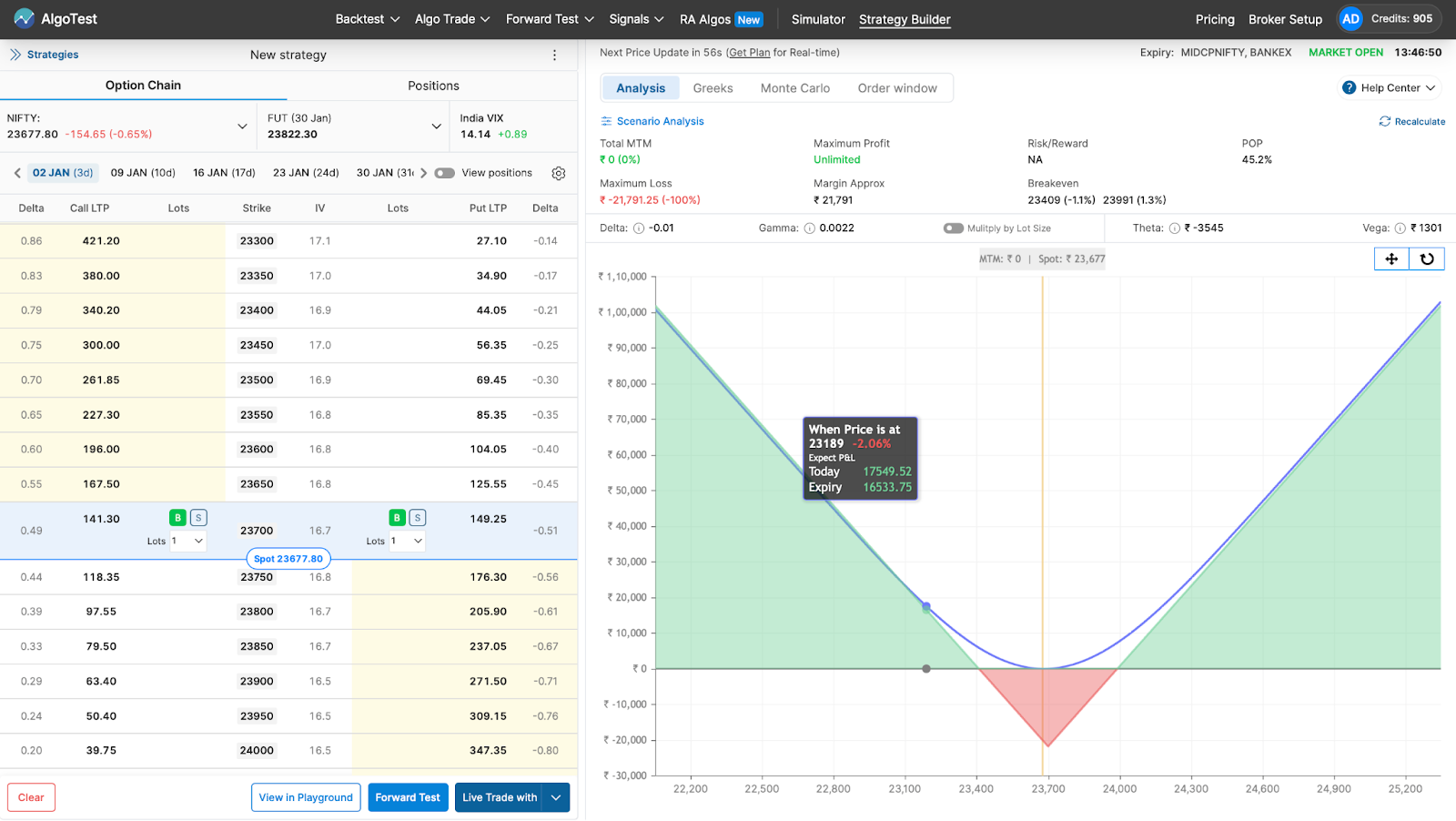

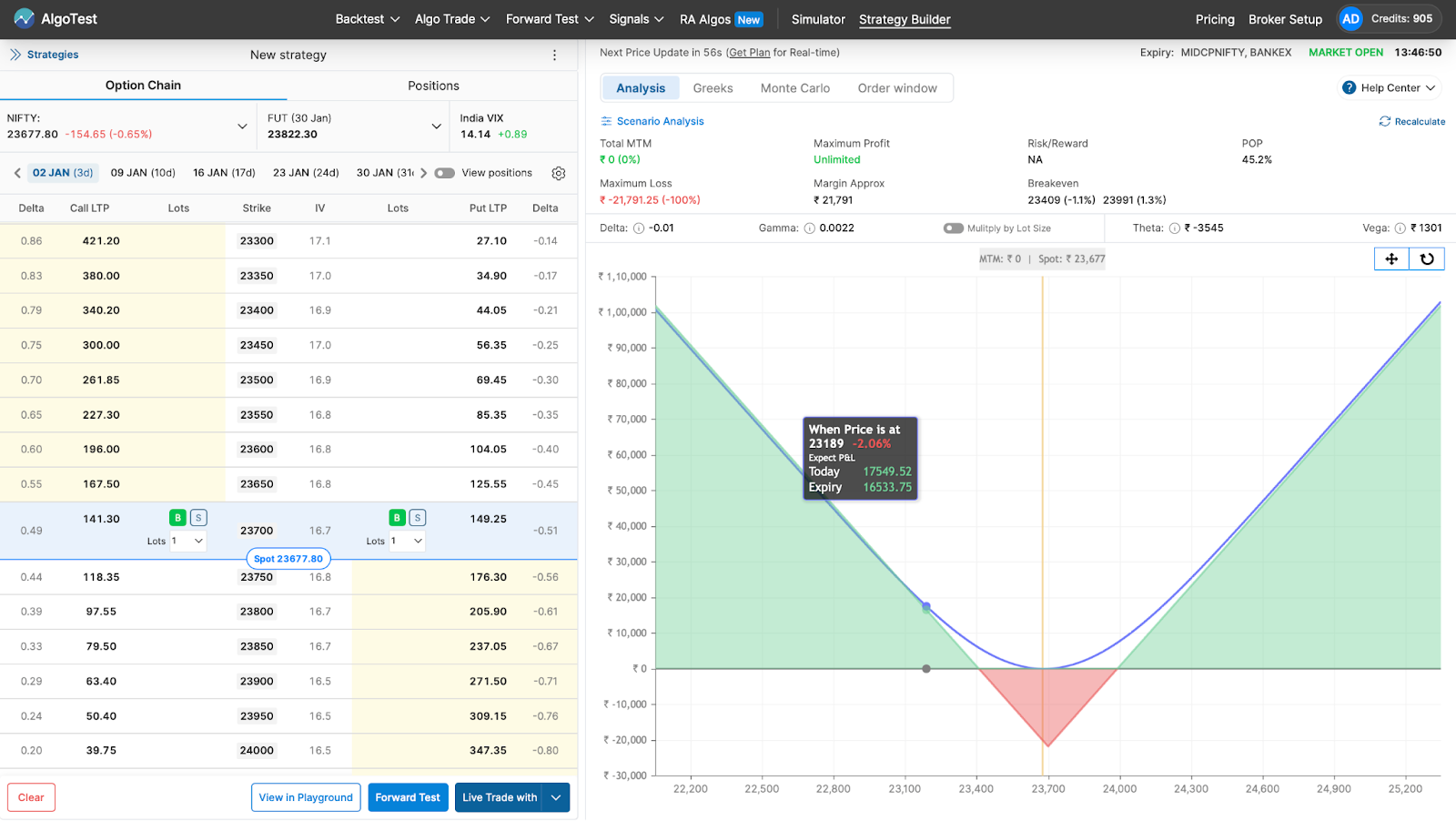

From the Option Chain, we just have to:

- Buy 1 lot of ATM call options

- Buy 1 lot of ATM put options

Click the Buy/Sell button as shown in the image below.

After that, you can deploy it on your broker in one click by clicking the Live Trade With button as shown in the image below. Alternatively, you can forward test (paper trade) it on AlgoTest if you don’t want to deploy it with real money.

Example

Assume a stock is trading at ₹100:

- Buy a Call Option with a ₹100 strike for ₹5.

- Buy a Put Option with a ₹100 strike for ₹5.

Total Cost:

- ₹5 (call) + ₹5 (put) = ₹10 premium paid.

Profit Scenarios:

- If the stock price moves above ₹110 or below ₹90, you start making a profit.

- If the price remains close to ₹100, your maximum loss is limited to ₹10 (the total premium paid).

When to Use It

-

Market Outlook:

- Ideal for scenarios where you expect high volatility but are unsure about the direction.

- Commonly used before earnings announcements or major economic releases.

-

High Volatility Conditions:

- Best employed when there is a strong expectation of movement but no directional bias.

Advantages and Disadvantages

Advantages

-

Unlimited Profit Potential:

- If the asset moves significantly in either direction, profits are unlimited.

-

Limited Risk:

- The maximum loss is capped at the total premium paid for the options.

Disadvantages

-

Break-Even Requires a Large Move:

- Significant price movement is needed to cover the total premium paid.

-

Time Decay (Theta):

- Works against you, as both options lose value over time if the asset price remains stagnant.

Practical Application for AlgoTest Users

AlgoTest users can:

- Automate the Long Straddle strategy for efficient execution.

- Backtest the strategy against historical data to identify optimal setups.

- Monitor implied volatility and dynamically adjust positions to capitalize on anticipated market movements.

AlgoTest’s platform provides tools to analyze and refine this strategy, helping traders optimize their risk-to-reward ratios.

Conclusion

The Long Straddle is a powerful strategy for betting on volatility without needing to predict the market’s direction. While the potential for unlimited gains is attractive, traders must be mindful of time decay and ensure they have a solid plan for managing risk.

By leveraging AlgoTest’s automation and analysis tools, traders can enhance the effectiveness of the Long Straddle, enabling precise execution and improved performance.