Iron Condor

The Iron Condor is an advanced, market-neutral options strategy that profits from low volatility. It involves four options: selling an out-of-the-money call and an out-of-the-money put while simultaneously buying a further out-of-the-money call and put to limit potential losses. The strategy earns maximum profit if the underlying asset remains between the two middle strike prices at expiration. However, if the price moves outside this range, losses are capped.

How It Works

-

Sell an Out-of-the-Money Call and Put:

Collect premiums, profiting if the price stays within a defined range. -

Buy Further Out-of-the-Money Call and Put:

Limit potential losses if the price breaks out significantly in either direction. -

Net Credit:

The strategy results in a net credit, which is the maximum profit if the underlying asset stays stable.

Iron Condor

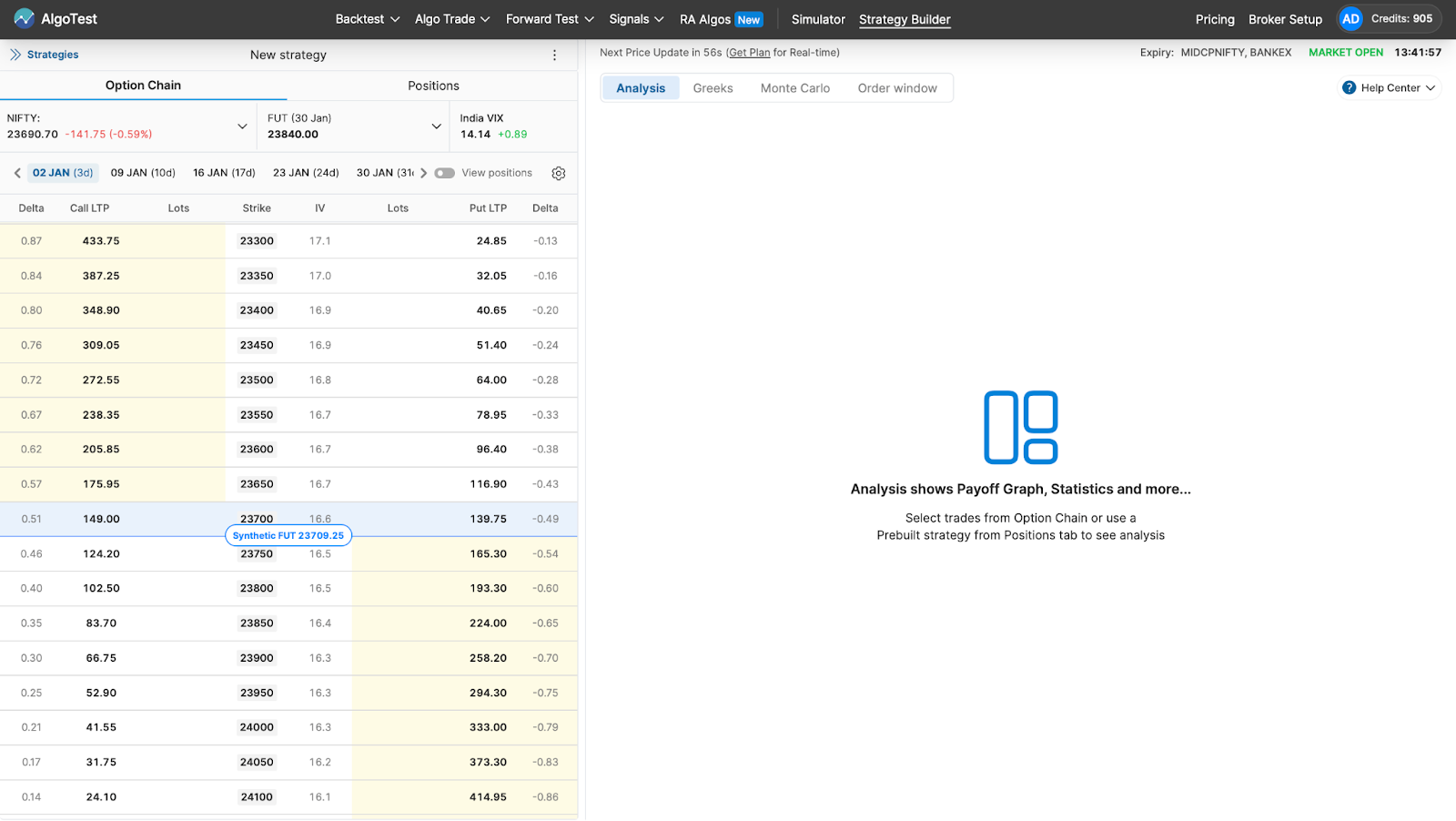

Go to AlgoTest’s Strategy Builder by clicking on this link. You will get an interface as shown in the image below.

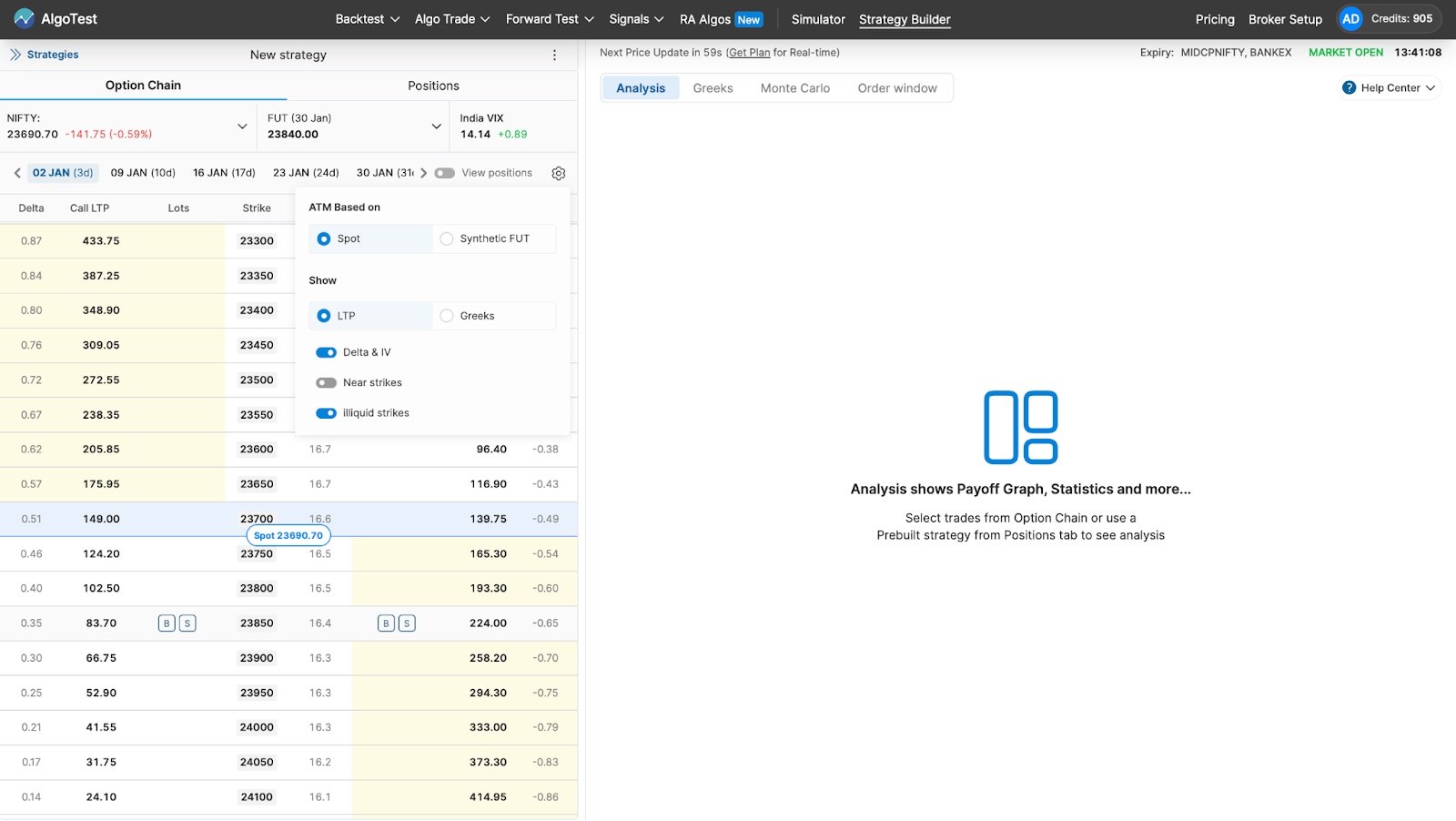

Go to Settings and select Spot to run the strategy.

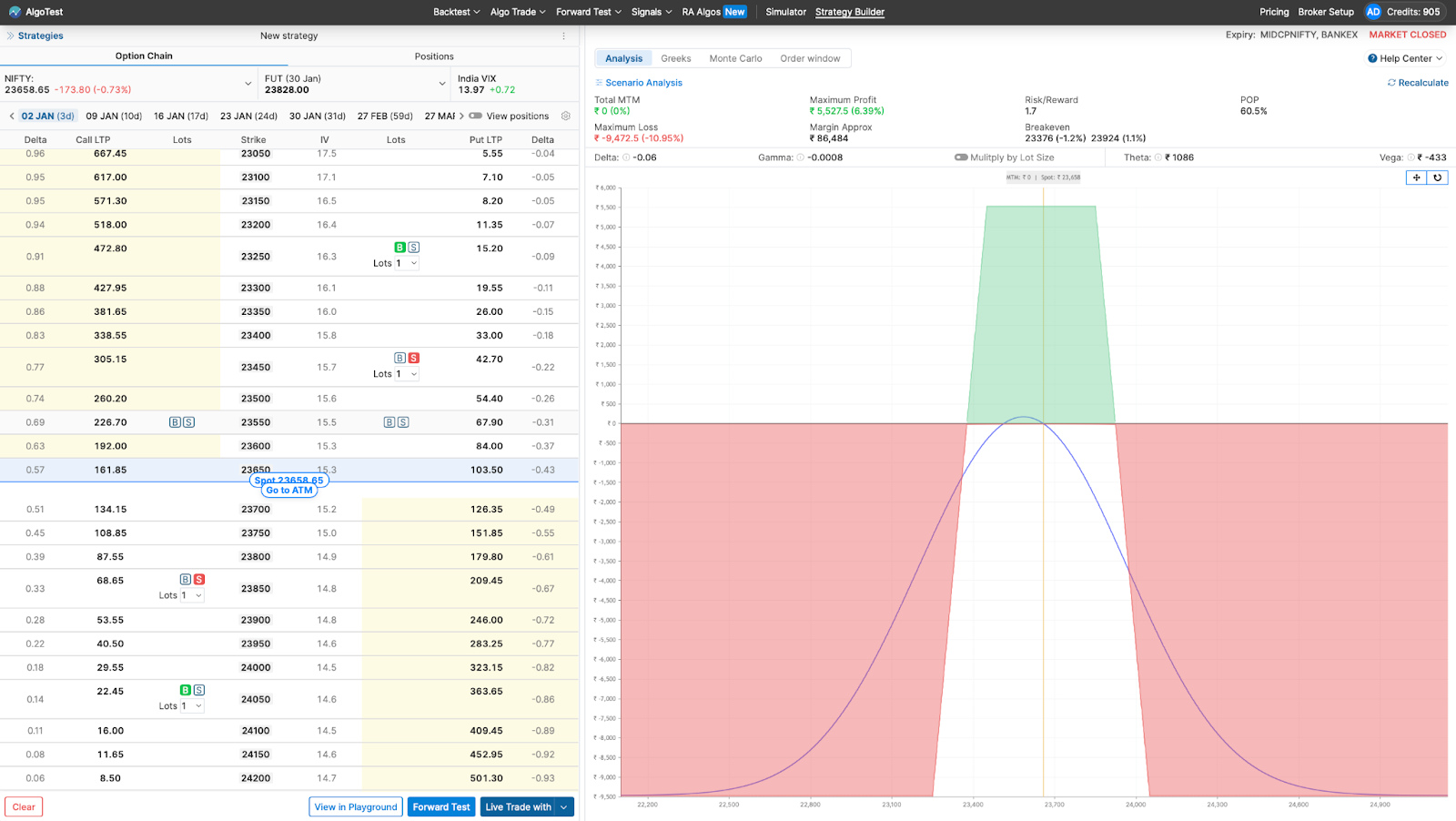

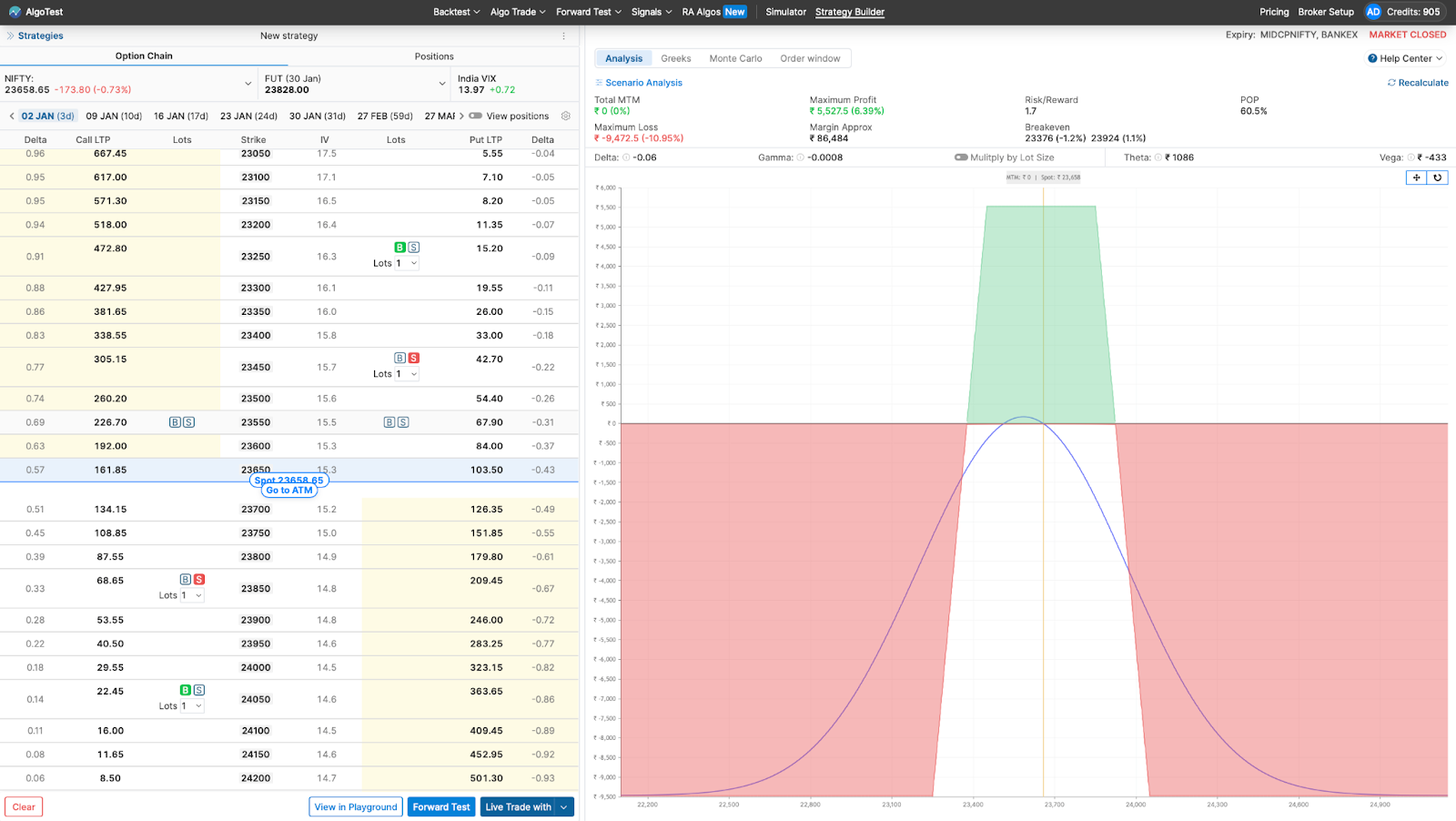

From the Option Chain, set up a short strangle by:

- Selling a slightly OTM Call and Put option

- Buying a further OTM Call

- Buying a further OTM Put

Click the Buy/Sell button as shown in the image below.

After that, you can deploy it on your broker in one click by clicking the Live Trade With button as shown in the image below. Alternatively, you can forward test (paper trade) it on AlgoTest if you don’t want to deploy it with real money.

Example

Assume a stock is trading at ₹100:

- You sell a ₹90 put for ₹2 and a ₹110 call for ₹2.

- You buy a ₹80 put for ₹1 and a ₹120 call for ₹1.

This results in a net credit of ₹2.

- If the stock stays between ₹90 and ₹110, you keep the ₹2 premium.

- If the price moves beyond ₹80 or ₹120, your maximum loss is capped at ₹8 (the difference between the strikes minus the credit received).

When to Use It

- Market Outlook: Best used in stable markets with low expected volatility.

- Low Volatility: Profits from minimal price movement over the strategy’s duration.

Advantages and Disadvantages

Advantages

- Generates income from premiums.

- Limited risk, making it safer than selling naked options.

Disadvantages

- Profits are capped, and the strategy underperforms in highly volatile markets.

- Requires careful monitoring as expiration approaches.

Practical Application for AlgoTest Users

AlgoTest makes it easy to automate the Iron Condor strategy and analyze market conditions for optimal execution.

- Backtesting Tools: Simulate historical performance to evaluate the strategy.

- Real-Time Monitoring: Adjust positions dynamically if volatility unexpectedly increases.

By automating and fine-tuning the Iron Condor, AlgoTest ensures your strategy remains efficient and well-managed.

Conclusion

The Iron Condor is a versatile strategy for generating income in low-volatility markets. By using AlgoTest, you can:

- Set up the strategy seamlessly.

- Automate execution and management.

- Refine your approach through backtesting and real-time adjustments.

This allows you to capitalize on stable market conditions while effectively managing risk.