Call Ratio Back Spread

The Call Ratio Back Spread is a bullish options strategy used when a trader expects a significant upward move in the underlying asset. It involves selling one in-the-money (ITM) or near-the-money (ATM) call option and buying two out-of-the-money (OTM) call options. This strategy offers unlimited profit potential if the asset price rises sharply, while losses remain limited if the price stays flat or decreases.

How It Works

-

Sell One Call Option:

- Collect premium by selling an in-the-money or at-the-money call option.

-

Buy Two Call Options:

- Use the collected premium to buy two out-of-the-money call options.

- This creates a net debit or, in some cases, a small net credit.

-

Profit Potential:

- The strategy benefits from a strong upward move in the underlying asset, as the value of the long calls increases significantly.

-

Loss Potential:

- Losses are capped if the asset price ends up near the strike price of the sold call.

- The maximum loss is limited to the net debit paid (if applicable).

Call Ratio Back Spread on AlgoTest

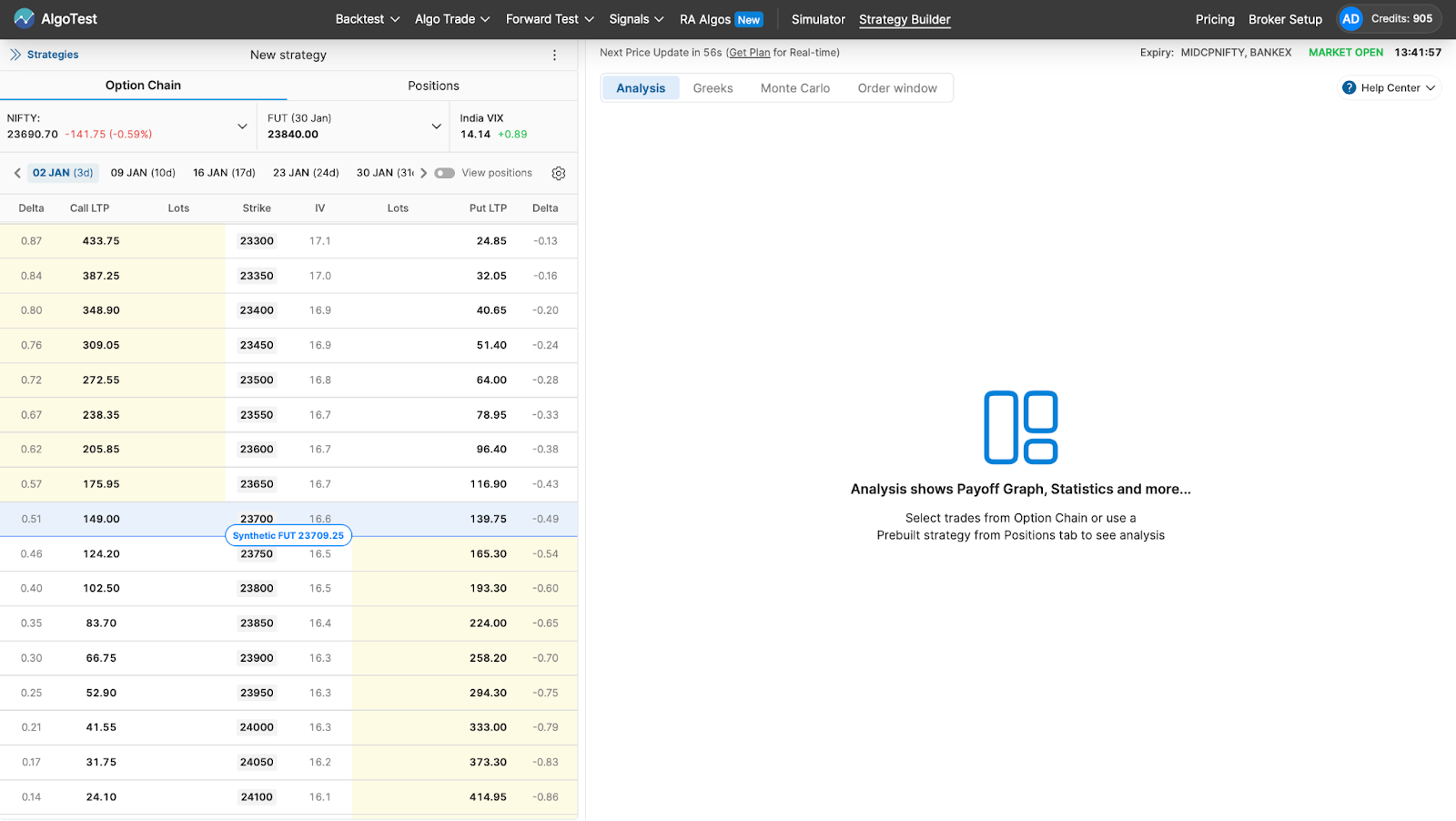

- Go to AlgoTest's Strategy Builder by clicking on this link. You will get an interface as shown in the image below.

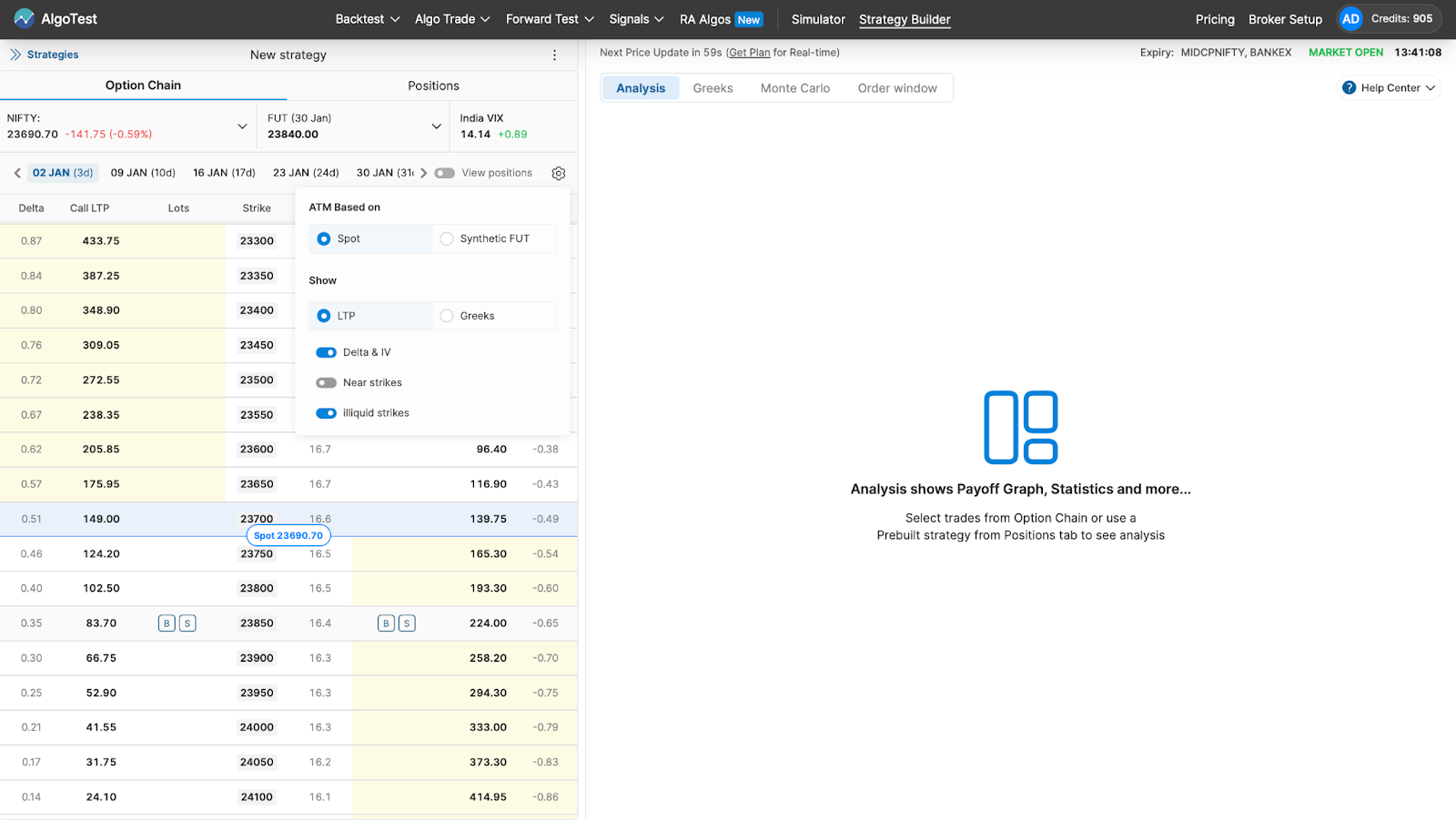

- Go to settings and select Spot to run the strategy.

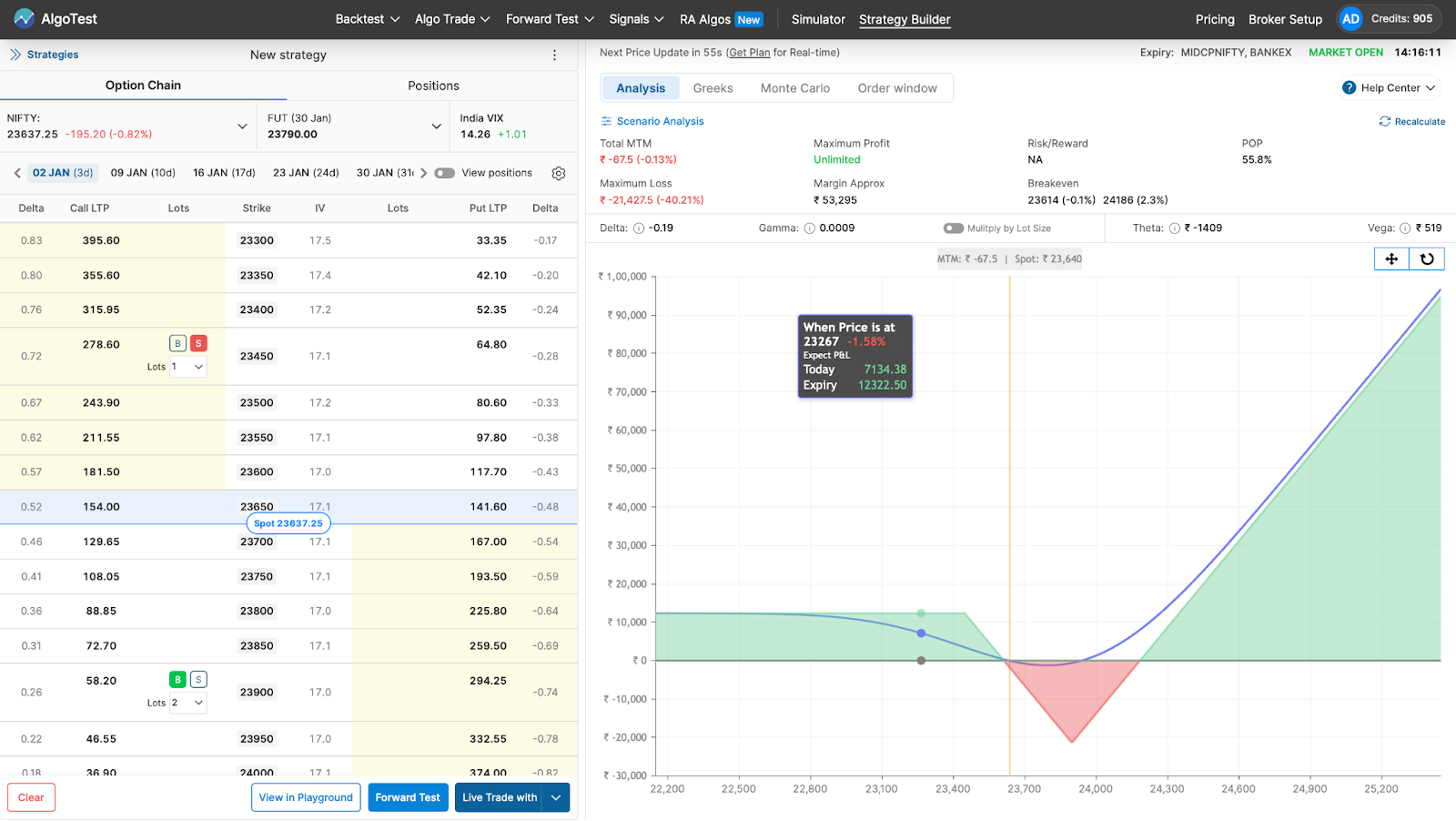

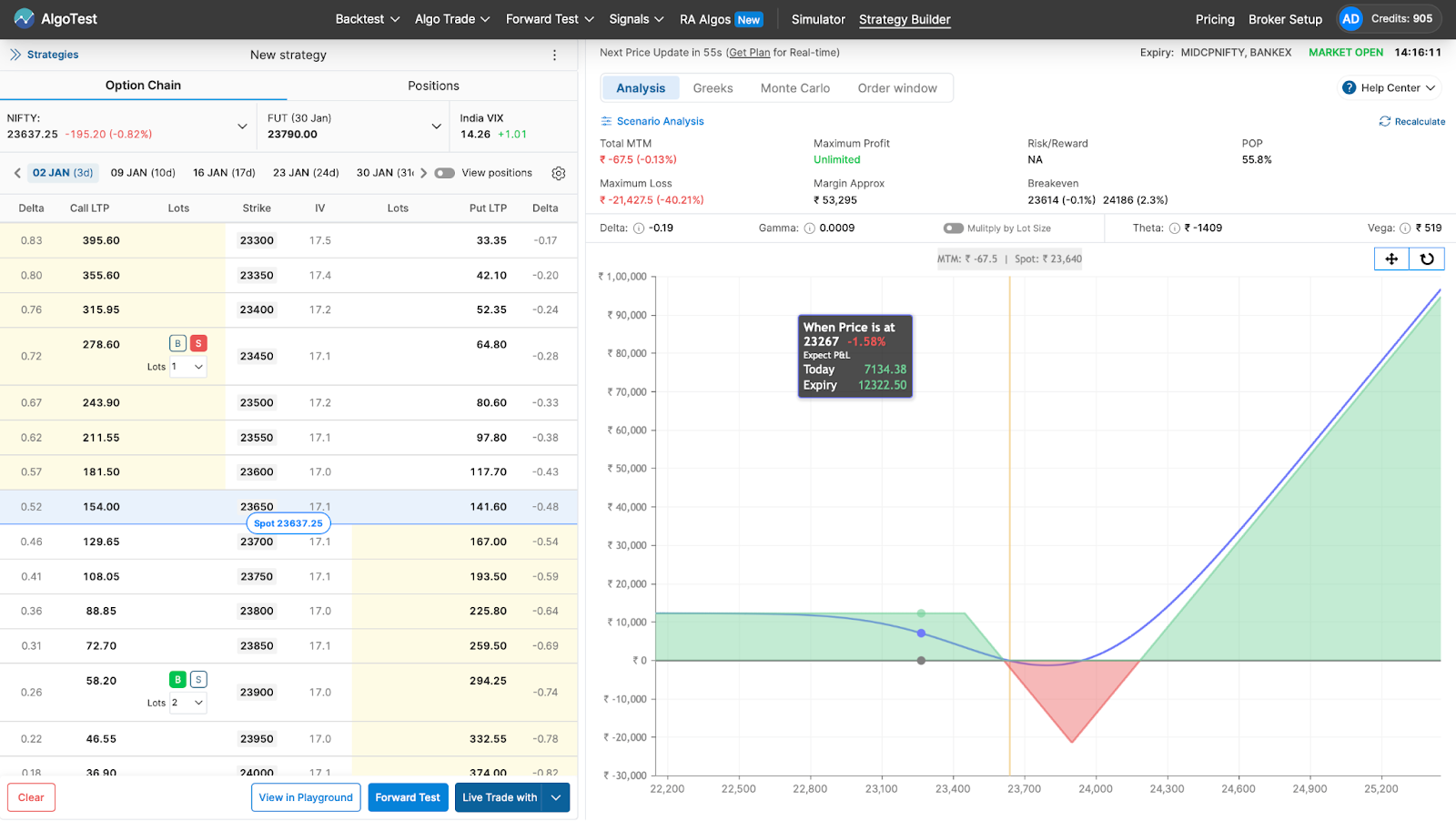

- From the option chain, we have to buy two OTM call options and sell one ITM Call option as shown in the image below by clicking the buy/sell button.

- After that, you can simply deploy it on your broker in one click by just clicking on the live trade with button as shown in the image below. Otherwise, you can also forward test (paper trade) it on AlgoTest if you don't want to deploy it with real money.

Example

Let’s say a stock is trading at ₹100:

- You sell a ₹100 call option for ₹5.

- You use the proceeds to buy two ₹110 call options for ₹2 each.

Net Cost:

- The net debit is ₹1 (₹5 - ₹4).

Outcomes:

-

If the stock price surges well above ₹110:

- The profits from the two long calls could be substantial, creating unlimited profit potential.

-

If the stock price remains around ₹100 or decreases:

- The maximum loss is ₹1, the net debit paid.

-

If the stock price hovers near ₹110:

- Gains may not materialize fully due to the strike price positioning.

When to Use It

- Market Outlook: Use this strategy when you anticipate a strong upward move in the asset price.

- Volatile Market Conditions: Works well when significant volatility is expected, such as before major announcements or economic events.

Advantages and Disadvantages

Advantages:

- Unlimited profit potential if the asset’s price rises significantly.

- Limited risk, making it a safer strategy for speculating on large price movements.

Disadvantages:

- Complex to execute compared to basic strategies.

- May result in a small net debit.

- Moderate price increases near the strike price of the sold call can lead to suboptimal outcomes.

Using AlgoTest for the Call Ratio Back Spread

AlgoTest simplifies the execution of this strategy with tools to:

- Automate the setup and trading of the Call Ratio Back Spread.

- Backtest the strategy using historical data to evaluate its performance under various market conditions.

- Set parameters to adjust strike prices, expiration dates, and evaluate your expected risk and reward before going live.

By understanding and practising the Call Ratio Back Spread, AlgoTest traders can capitalise on sharp market moves while keeping their downside risk manageable.