Bull Call Spread

The Bull Call Spread strategy is ideal for traders with a moderately bullish outlook on an asset. It involves buying a call option at a lower strike price while simultaneously selling another call option at a higher strike price, both expiring on the same date. The premium collected from selling the higher strike call reduces the cost of purchasing the lower strike call, creating a cost-effective strategy. While this approach caps the maximum profit at the higher strike, it also limits the maximum loss to the net premium paid, balancing risk and reward.

How It Works

- Buy Call Option: You buy a call option at a lower strike price, expecting the underlying asset to rise. This costs a premium.

- Sell Call Option: You sell a call option at a higher strike price. The premium received helps offset the initial cost.

- Net Premium Paid: The total cost of the strategy is the difference between the premium paid and the premium received.

Bull Call Spread on AlgoTest

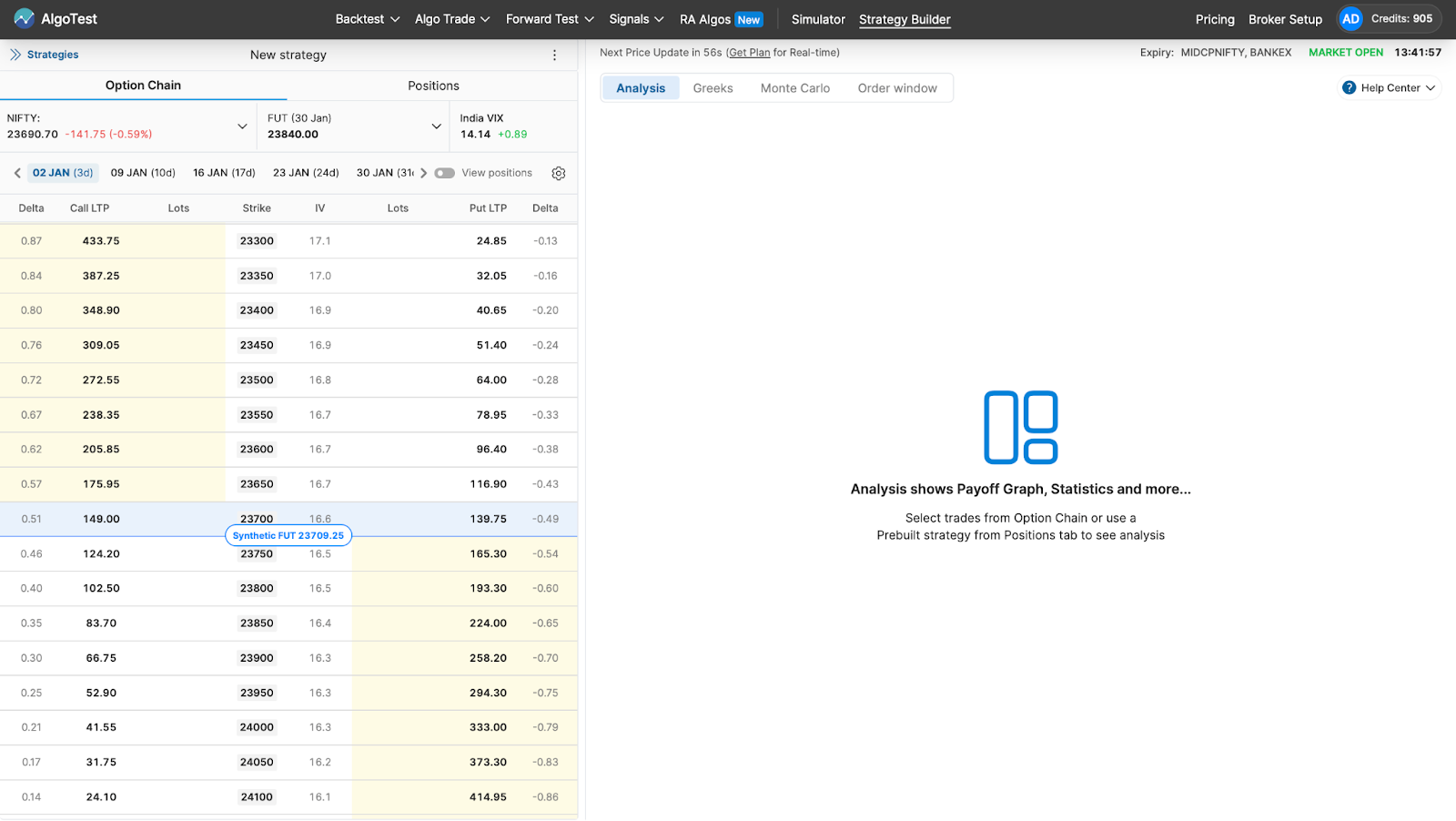

Go to AlgoTest’s Strategy Builder by clicking on this link. You will get an interface as shown in the image below.

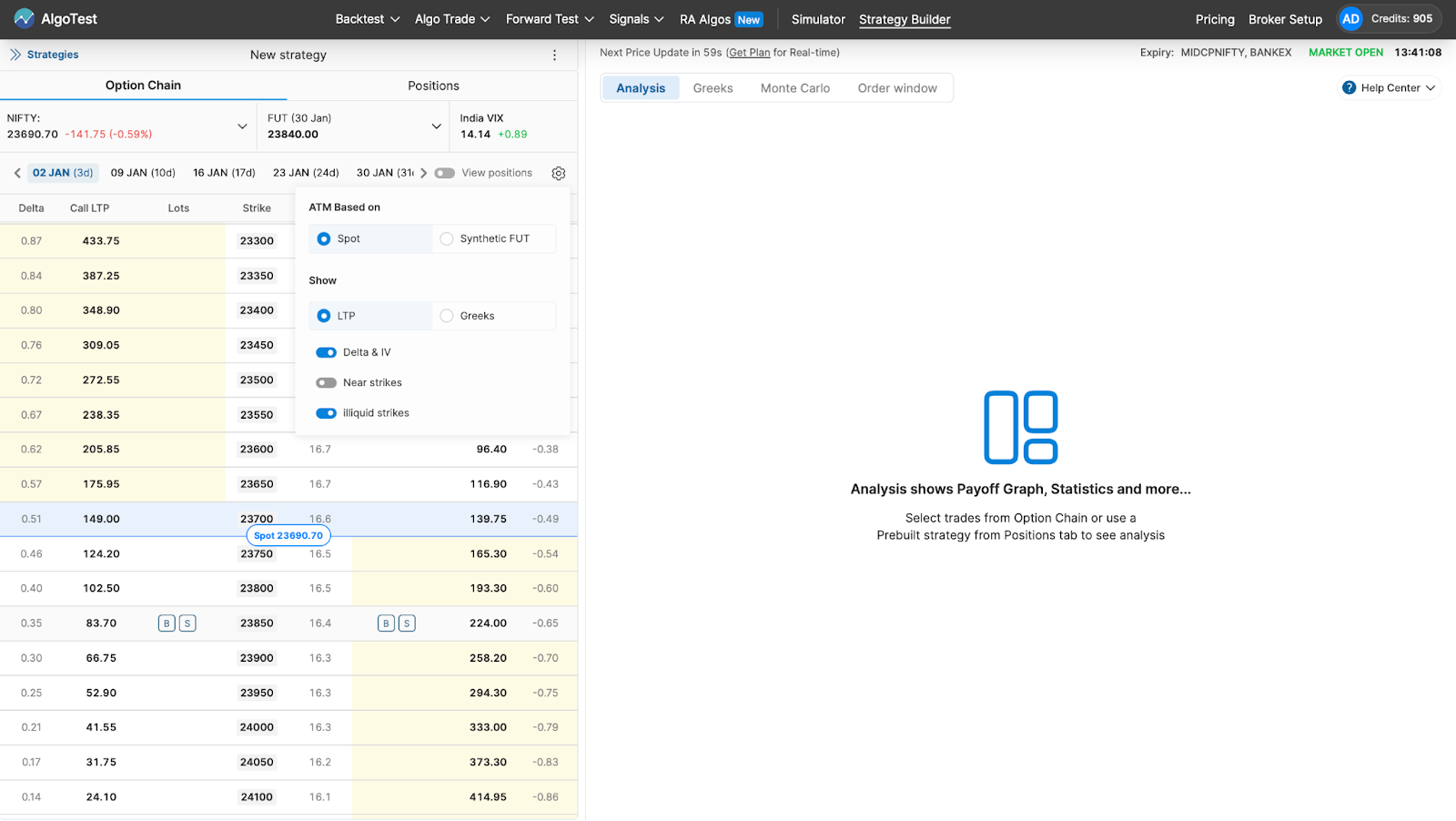

Go to Settings and select Spot to run the strategy.

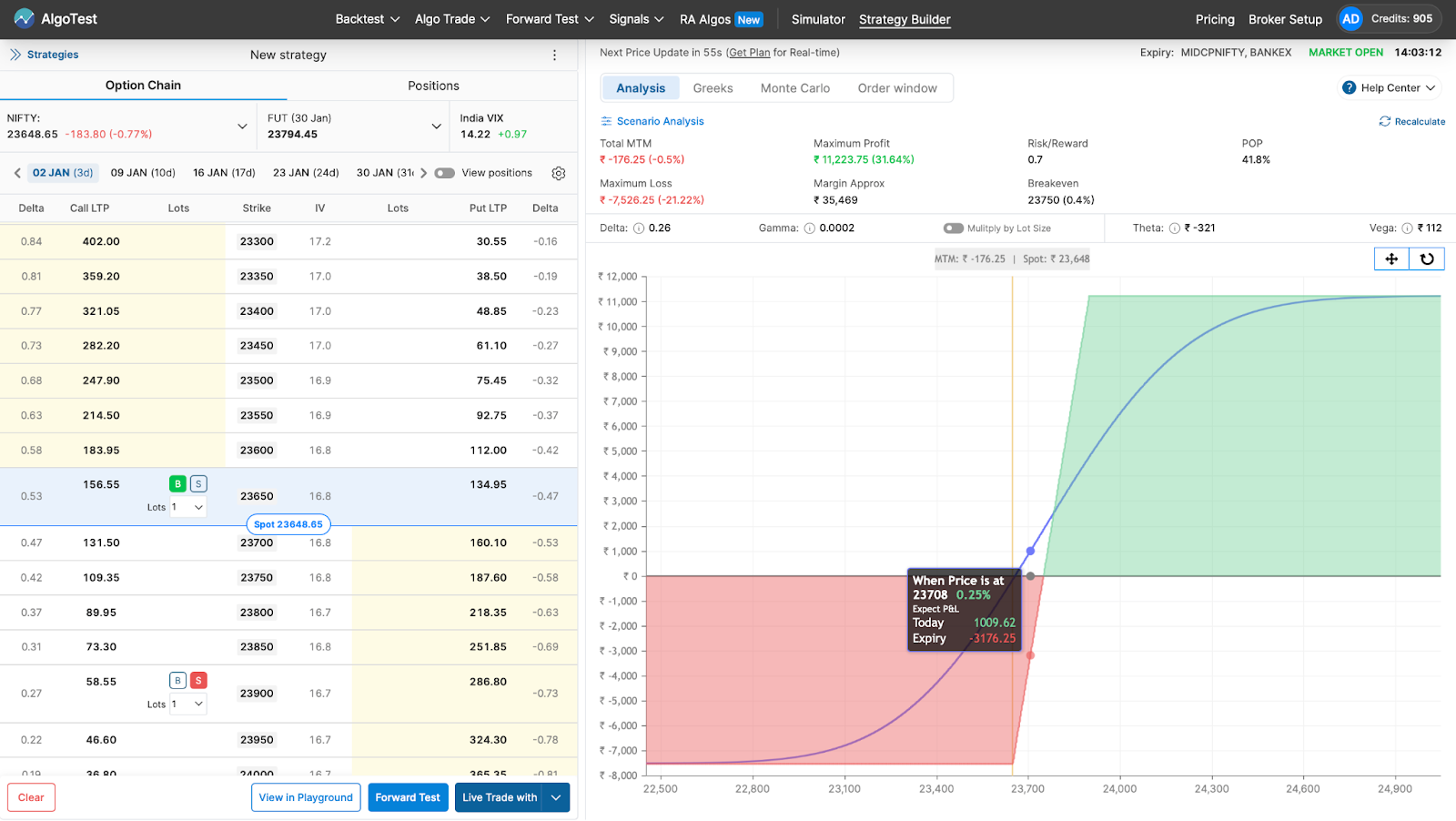

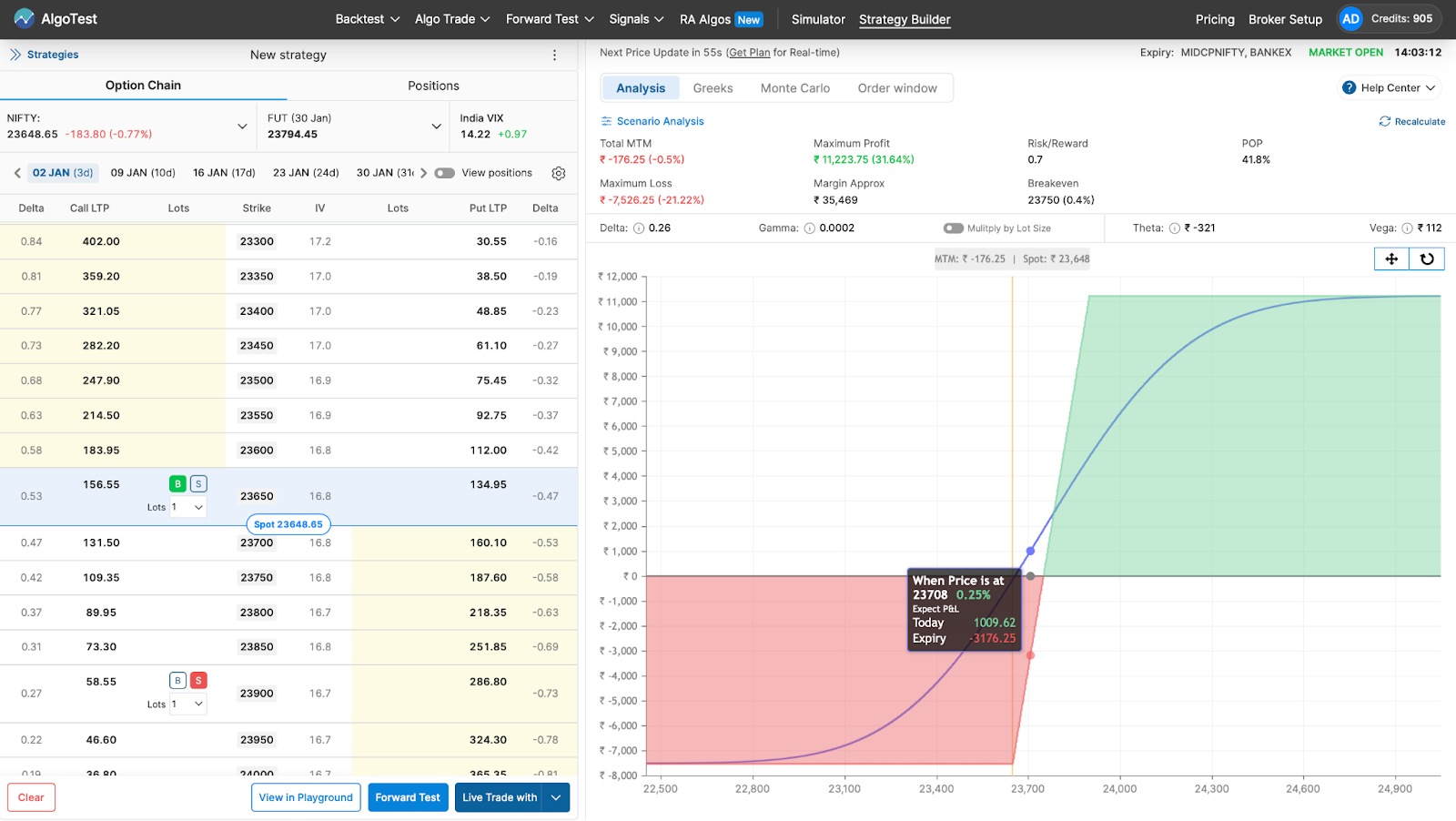

From the Option Chain, we just have to:

- Buy 1 ATM call option

- Sell 1 OTM call option

Click the Buy/Sell button as shown in the image below.

After that, you can deploy it on your broker in one click by clicking the Live Trade With button as shown in the image below. Alternatively, you can forward test (paper trade) it on AlgoTest if you don’t want to deploy it with real money.

Example

Suppose a stock is trading at ₹100. You believe the stock will rise but not significantly.

- You buy a call option at a ₹100 strike for a premium of ₹5.

- You sell a call option at a ₹110 strike for a premium of ₹2.

- The net premium paid is ₹3 (₹5 - ₹2).

Outcomes:

-

If the stock rises to ₹110 or higher:

- Your maximum profit is ₹7 (the difference between strike prices minus the net premium paid).

-

If the stock doesn’t rise above ₹100:

- Your maximum loss is the ₹3 premium paid.

When to Use

- Market Outlook: Use this strategy when you expect a moderate price increase.

- Risk Management: The strategy limits your downside risk to the net premium paid.

Advantages and Disadvantages

Advantages

- Reduces the cost of being bullish compared to buying a single call option.

- Relatively simple to execute.

Disadvantages

- Profit potential is capped at the higher strike price.

- If the underlying price doesn’t move as expected, you could lose the entire premium.

Practical Application with AlgoTest

AlgoTest traders can automate and backtest the Bull Call Spread strategy to evaluate performance under different market conditions. By simulating trades, you can:

- Better understand potential outcomes.

- Refine your trading approach.

This strategy is a great starting point for those looking to profit from a rising market with defined risks and is easily integrated into a broader options trading plan.