Bear Call Spread

The Bear Call Spread is a bearish options strategy used when a trader expects a moderate decline or limited upward movement in the underlying asset’s price. It involves selling a call option at a lower strike price and buying another call option at a higher strike price, both with the same expiration date. This setup generates a net credit, which is the maximum profit potential. The strategy limits both profit and loss, making it a relatively safe choice for bearish market conditions.

How It Works

-

Sell a Lower Strike Call:

- Generates a premium but exposes you to risk if the asset price rises above this strike.

-

Buy a Higher Strike Call:

- The premium paid for this option acts as insurance, capping potential losses.

-

Net Credit:

- The difference between the premium collected from selling the lower strike call and the premium paid for the higher strike call is your maximum profit.

Bear Call Spread

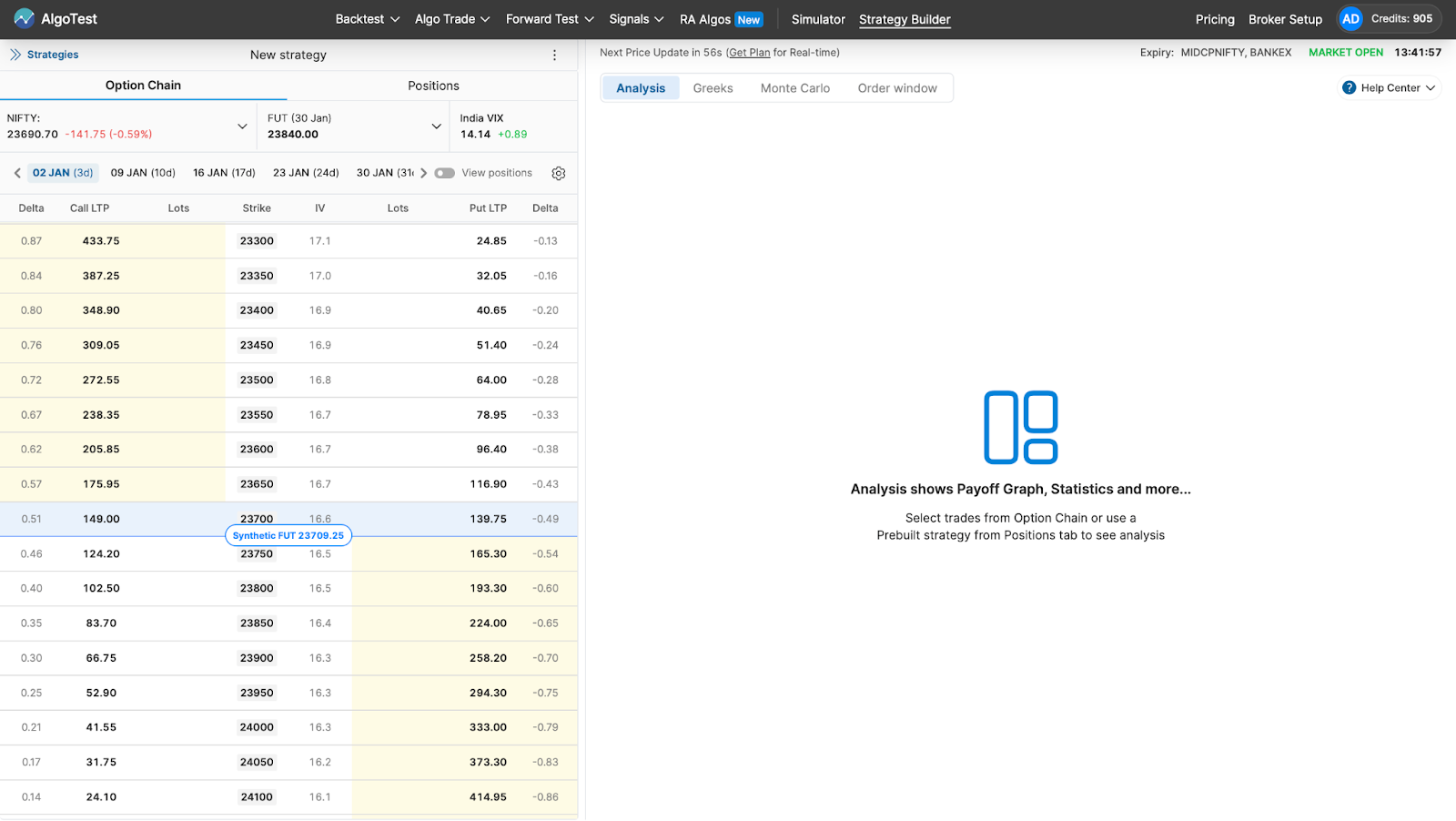

Go to AlgoTest’s Strategy Builder by clicking on this link. You will get an interface as shown in the image below.

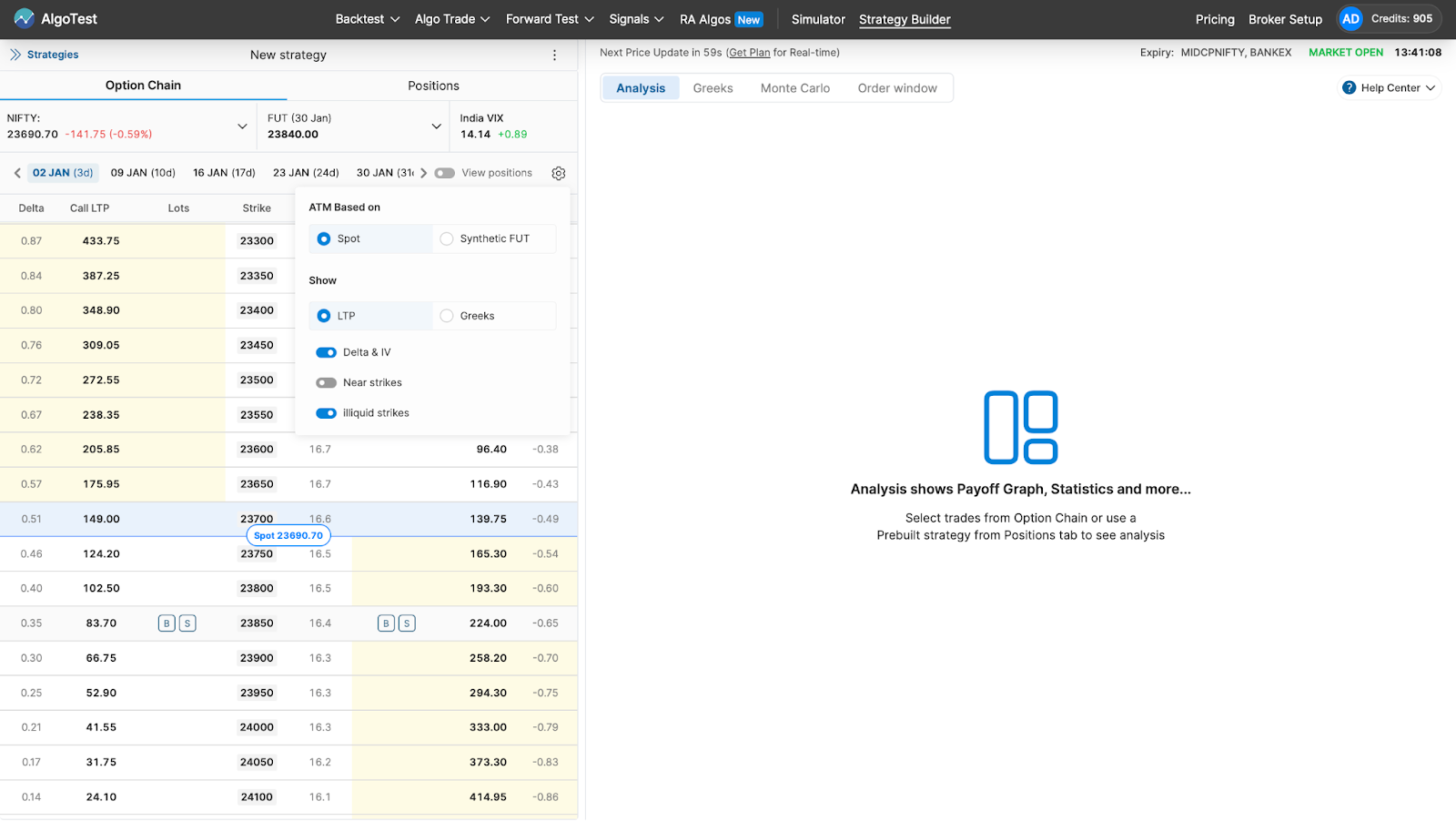

Go to Settings and select Spot to run the strategy.

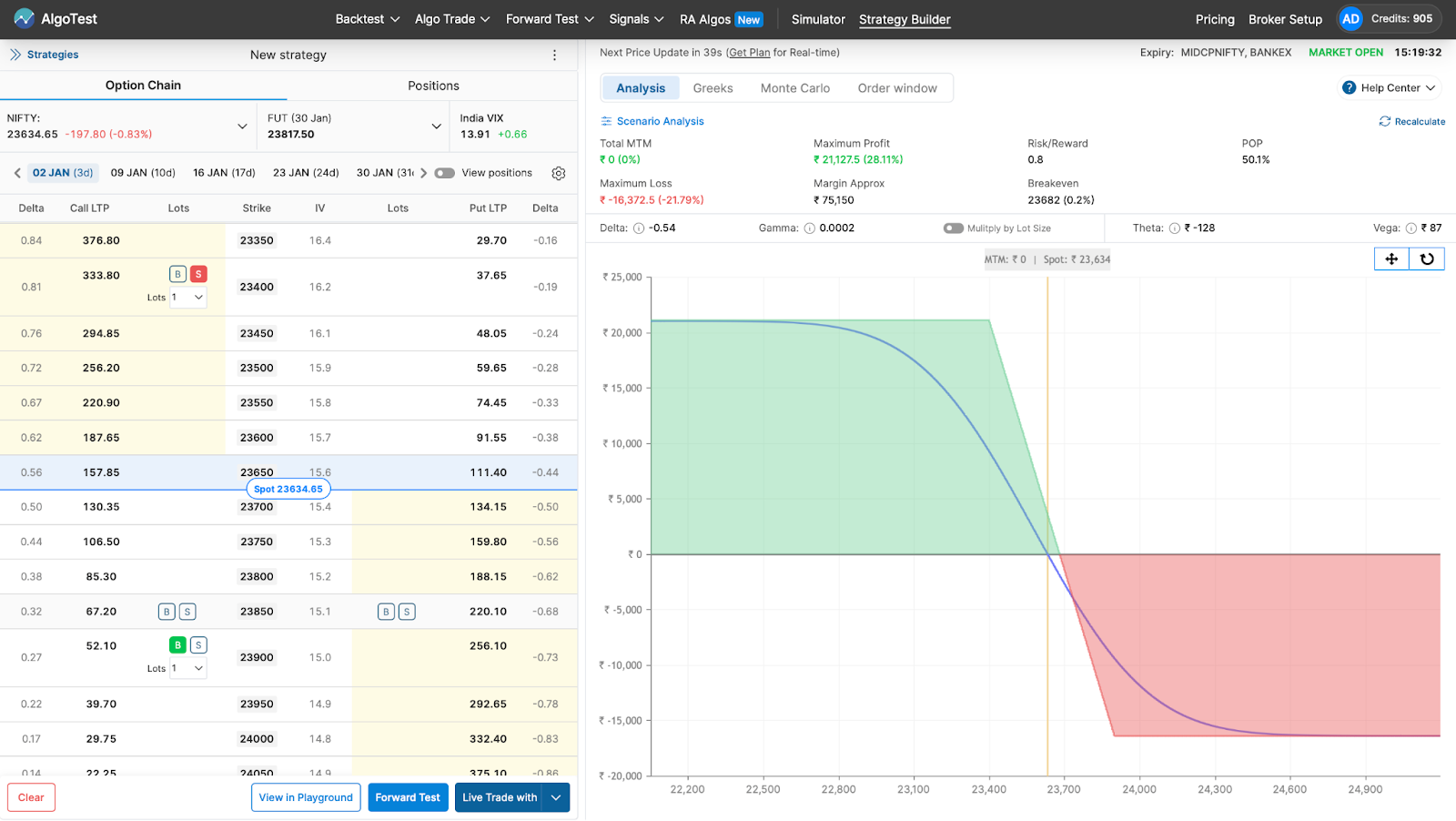

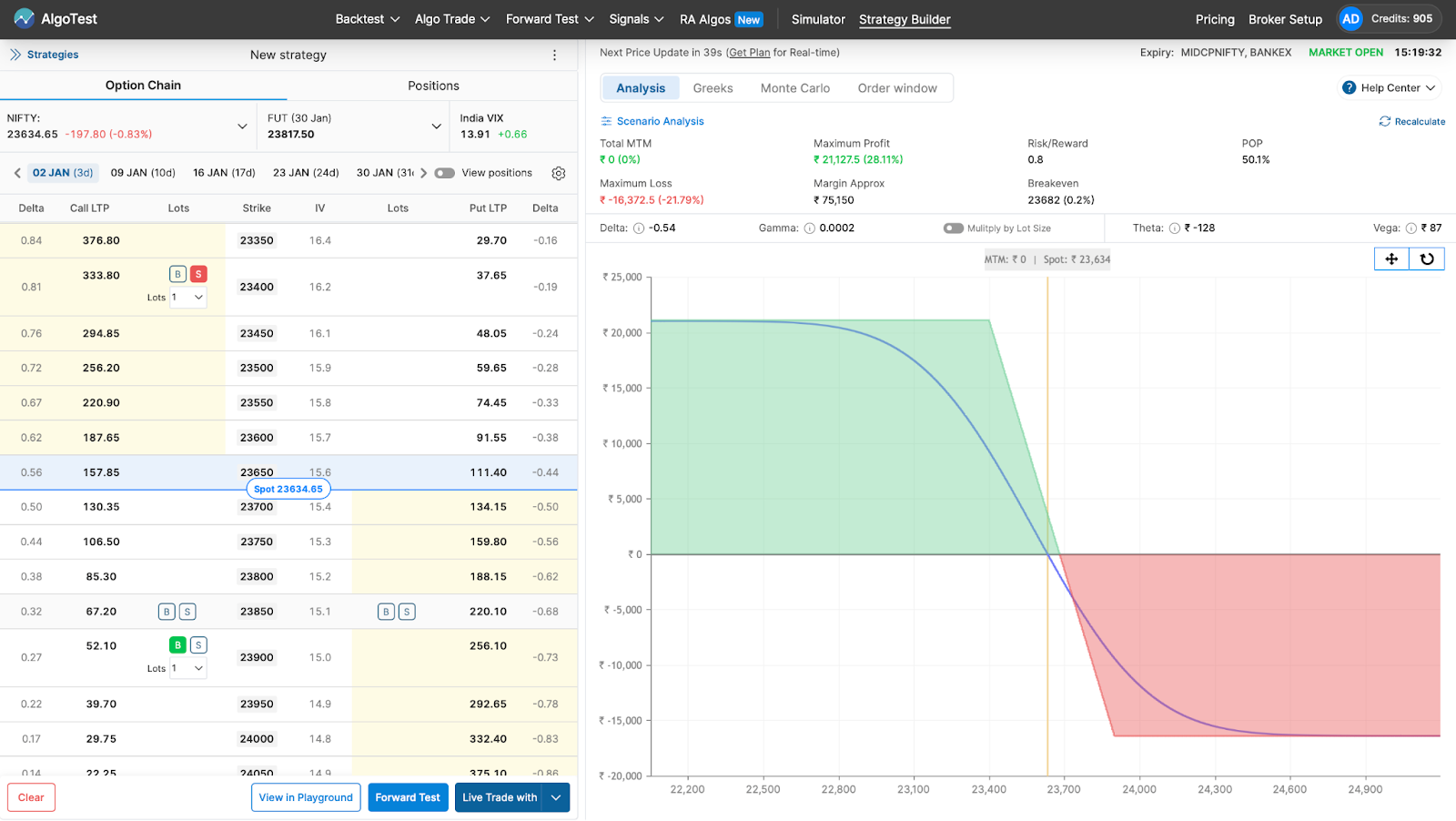

From the Option Chain, we just have to:

- Buy 1 OTM call option

- Sell 1 ITM call option

Click the Buy/Sell button as shown in the image below.

After that, you can deploy it on your broker in one click by clicking the Live Trade With button as shown in the image below. Alternatively, you can forward test (paper trade) it on AlgoTest if you don’t want to deploy it with real money.

Example

Assume a stock is trading at ₹100. You expect the price to remain below ₹105:

- Sell a ₹100 strike call option for ₹5.

- Buy a ₹110 strike call option for ₹2.

Net Credit:

- ₹5 (premium collected) - ₹2 (premium paid) = ₹3 net credit.

Outcomes:

-

If the stock stays below ₹100:

- Both options expire worthless.

- You keep the ₹3 net credit as your profit.

-

If the stock rises above ₹110:

- Your maximum loss is capped at ₹7 (difference between the strike prices ₹110 - ₹100 minus the net credit ₹3).

-

If the stock price closes between ₹100 and ₹110:

- Partial loss occurs depending on where the stock price lands.

When to Use It

- Market Outlook: Best suited for moderately bearish markets where you don’t expect significant price increases.

- Risk Management: Provides a defined risk-reward profile, making it a safer choice for bearish trading strategies.

Advantages and Disadvantages

Advantages:

- Generates income through the net credit received.

- Risk is capped, providing a known maximum loss.

Disadvantages:

- Limited profit potential, even if the market moves in your favor.

- The strategy can still incur losses if the asset price rises significantly.

Practical Application for AlgoTest Users

AlgoTest allows you to:

- Automate the Bear Call Spread strategy for efficient execution.

- Backtest the strategy to evaluate its performance under various historical scenarios.

- Refine your strike price selection and ensure your risk exposure is manageable.

- Monitor in real-time to make data-driven adjustments as market conditions change.

AlgoTest’s platform simplifies the execution and optimization of the Bear Call Spread, helping traders improve consistency and performance.

Conclusion

The Bear Call Spread is a conservative bearish strategy that offers a good balance between risk and reward. It’s particularly effective in markets where you expect limited upside movement. By leveraging AlgoTest’s automation and backtesting tools, traders can:

- Optimize the strategy,

- Ensure consistent execution,

- Maximize efficiency and profitability.

This makes the Bear Call Spread an excellent choice for bearish traders seeking controlled risk and reliable returns.