Stop-Loss Based on Range Breakout

Stop-Loss Based on Range Breakout

:For any queries reach out to us!

This feature enables you to set your stop-loss based on high-low range as defined by you in range breakout.

You can only use this feature only if you have enabled range breakout feature.

How to Use

To use this feature first enable the Stop-Loss feature.

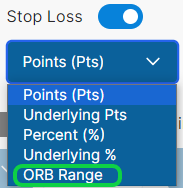

Now select ORB Range from the dropdown.

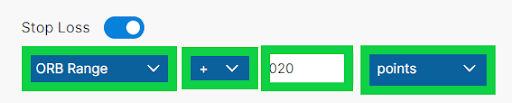

After selecting ORB Range, now you have 4 settings here as shown in the image below. You have 4 options to select from :

- ORB Range (High - Low Range, selected from drop-down)

- +/- (Add or Subtract from ORB Range)

- A number (The amount you want to add or subtract)

- Points/ % of Range (Given amount in points or percentage of Range terms)

ORB Range SL in Points

This option enables you to set your SL based on ORB Range in points.

It will work only if the Range Breakout feature is enabled for entry.

Example :- Assume you created a strategy

Underlying :- Nifty

Entry :- 09:20

Strike :- ATM CE

Positon :- Buy

Range Breakout Entry :- High of 09:16 to 09:30 on Underlying i.e. Nifty here

SL ORB Range :- ORB Range + 20 Points as shown4 in the image below

Now Assume entry ORB Range 09:16 to 09:30 High is 18760 and Low is 18710. So Range is = High - Low = 18760 - 18710 = 50 Points.

According to your SL conditions

SL = ORB Range + 20 Points

SL = 50 + 20

SL = 70 Points

Now assume your ORB high 18760 is broken and it took entry, So your SL for ATM CE Buy is 70 point on underlying is i.e. at 18760 - 70 = 18690.

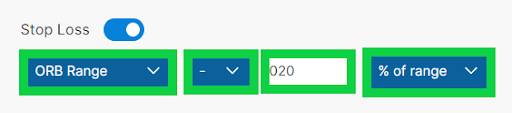

ORB Range SL in % of Range

This option enables you to set your SL based on ORB Range in terms of percentage. It will work only if the Range Breakout feature is enabled for entry.

Example :- Assume you created a strategy

Underlying :- Nifty

Entry :- 09:20

Strike :- ATM CE

Positon :- Buy

Range Breakout Entry :- High of 09:16 to 09:30 on Underlying i.e. Nifty here

SL ORB Range :- ORB Range - 20 Percentage of Range as shown in the image below

Now Assume entry ORB Range 09:16 to 09:30 High is 18760 and Low is 18710. So Range is = High - Low = 18760 - 18710 = 50 Points.

According to your SL conditions

SL = ORB Range - 20 % of Range

SL = 50 - (20 % of 50)

SL = 50 - 10

SL = 40 Points

Now assume your ORB high 18760 is broken and it took entry, So your SL for ATM CE Buy is 40 point on underlying is i.e. at 18760 - 40 = 18720