Leg

All the features under this section work on individual leg. :For any queries reach out to us!

Simple Momentum

This feature enables you to take an entry if an index or option premium price moves by X amount after your entry condition is met.

The amount can be in percentage or point terms. You can enable the "Simple Momentum" feature, as shown in the image below.

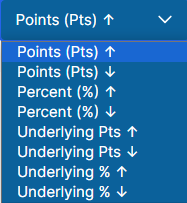

There are many features available under Simple momentum, you can use it to try different variations of momentum as shown in the image below.

Points (Pts) ↑

This option enables you to take an entry only if option premium price moves up by X points after the entry conditions.

Example: Assume you created a strategy

Index : Nifty

Entry : 09:20

Strike : ATM CE

Positon : Buy

Momentum Points Up : 15

- Assume at 9:20 Nifty ATM CE strike is 18500 and ATM strike premium is 200 Entry Price = 200 + 15 (Momentum Up) = 215

- So according to our momentum condition it will take entry in the 18500 CE strike only if the 18500 CE strike moves to 215. If this price doesn't come it will not take any entry.

Points (Pts) ↓

This option enables you to take entry only if option premium prices move down by X points after the entry conditions.

Example: Assume you created a strategy

Index : Nifty

Entry : 09:20

Strike : ATM CE

Positon : Sell

Momentum Points Up : 15

-

Now assume that at 09:20 ATM CE strike = 200

Your actual stop loss = 175 (25 points)

TSL = 20%(entry price) - 10%(entry price)

TSL = 20%(200) - 10%(200)

TSL = 40-20

TSL = For 40 point move in our favor, Trail SL 20 pointIf ATM CE strike started moving in your favor:

It moved to 240 , SL will be moved to 195

It moved to 280, SL will be moved to 215

And so on, it keeps on moving till our TSL hits.

Percentage (%) ↑

This option enables you to take entry only if option premium price moves up by X percentage after the entry conditions.

Example: Assume you created a strategy

Index : Nifty

Entry : 09:20

Strike : ATM CE

Positon : Buy

Momentum % Up : 15

- Assume at 9:20 Nifty ATM CE strike is 18500 and ATM strike premium is 200 Momentum in Points = 15 % of 200 = 30 points Entry Price = 200 + 30 (Momentum Up) = 230

- So according to our momentum condition, it will take entry into the 18500 CE Buy Position only if the 18500 CE strike moves up to 230. If this price doesn't come, it will not take any entries.

Percentage (%) ↓

This option enables you to take entry only if option premium price moves down by X percentage after the entry conditions.

Example: Assume you created a strategy

Index : Nifty

Entry : 09:20

Strike : ATM CE

Positon : Sell

Momentum % Down : 15

- Assume at 9:20 Nifty ATM CE strike is 18500 and ATM strike premium is 200 Momentum Down in Points = 15 % of 200 = 30 points Entry Price = 200 - 30 (Momentum down) = 170

- So according to our momentum condition, it will take entry into the 18500 CE Sell Position only if the 18500 CE strike moves down to 170. If this price doesn't come it will not take any entries.

Underlying Pts ↑

This option enables you to take an entry only if the underlying price (Index Price) moves up by X points after the entry conditions.

Example :- Assume you created a strategy

Index :- Nifty

Entry :- 09:20

Strike :- ATM CE

Positon :- Buy

Momentum Underlying Points :- 15

-

Assume at 9:20 Nifty spot is at 18520 Entry Price = 18520 + 15 (Momentum up) = 18535

-

So according to our momentum condition, it will take entry only if nifty moves up to 18535 and it will select strike at the time of entry time i.e. 09:20 and entry will be taken when price reaches 18535. If this price doesn't come it will not take any entries.

Underlying Pts ↓

This option enables you to take entry only if the underlying price (Index Price) moves down by X points after the entry conditions.

Example :- Assume you created a strategy

Index :- Nifty

Entry :- 09:20

Strike :- ATM CE

Positon :- Sell

Momentum Underlying Points :- 15

-

Assume at 9:20 Nifty spot is at 18520 Entry Price = 18520 - 15 (Momentum down) = 18505

-

So according to our momentum condition, it will take entry only if the nifty moves down to 18505 and it will select strike at the time of entry time i.e. 09:20 and entry will be take when price reaches 18505, it will take entry. If this price doesn't come it will not take any entries.

Underlying % ↑

This option enables you to take an entry only if the underlying price (Index Price) moves up by X percentage after the entry conditions.

Example :- Assume you created a strategy

Index :- Nifty

Entry :- 09:20

Strike :- ATM CE

Positon :- Buy

Momentum Underlying % Up :- 0.5

Assume at 9:20 Nifty spot is at 18000 Momentum Up in Points = 0.5 % of 18000 = 90 points Entry Price = 18000 + 90 (Momentum up) = 18090

So according to our momentum condition, it will take entry only if nifty moves up to 18090 and it will select strike at the time of entry time i.e. 09:20 and will take entry when price reaches 18090. If this price doesn't come it will not take any entries.

Underlying % ↓

This option enables you to take entry only if the underlying price (Index Price) moves down by X percentage after the entry conditions.

Example :- Assume you created a strategy

Index :- Nifty

Entry :- 09:20

Strike :- ATM CE

Positon :- Sell

Momentum Underlying % Down :- 0.5

Assume at 9:20 Nifty spot is at 18000 Momentum down in Points = 0.5 % of 18000 = 90 points Entry Price = 18000 - 90 (Momentum up) = 17910

So according to our momentum condition, it will take entry only if nifty moves down to 17910 andit will select strike at the time of entry time i.e. 09:20 and it will take entry when price reaches 17910. If this price doesn't come it will not take any entries.

Stop loss

Stop-Loss is a very important tool in backtesting because you can try different variations of it to see which works best.

This feature enables you to set stop-loss on individual legs with many different methods.

You can enable stop-loss feature as shown in the image below.

AlgoTest provides you many different options to define your stop loss. You can use them by selecting from dropdown under stoploss as shown in the image below.

Points

This option enables you to select your Stop-Loss on individual CE/PE legs in Points on option premium.

- Example - Assume you created a strategy

Entry :- 09:20

Strike :- ATM CE

Positon :- Buy

Stop-Loss :- 30 Points

Assume at 9:20 ATM strike premium is 200 Your SL will be at = 200 - 30 = 170

So your SL here is at 170 for ATM CE Leg, which took entry at 200.

Underlying Points

This option enables you to select your Stop-Loss index value. Assuming you are doing backtesting on Banknifty, then using this feature, you can set your SL on the Banknifty Index Value.

- Example - Assume you created a strategy

Entry :- 09:20

Strike :- ATM CE

Positon :- Buy

Stop-Loss :- 80 Points on Underlying

Assume at 09:20 ATM CE Strike Premium 200 At 09:20 Banknifty is at 43700 Your Stop-Loss in points = 80 points on underlying Your Stop-Loss will be at = 43700 - 80 = 43620

So Your Stop-Loss here is at 43620 for the ATM CE Leg which took entry at 200.

Percent %

This option enables you to select your Stop-Loss in Percentage on option premium.

- Example - Assume you created a strategy

Entry :- 09:20

Strike :- ATM

Positon :- Buy

Stop-Loss :- 40%

Assume at 9:20 ATM strike premium is 200 Your SL in points is = 40% of 200 = 80 points Your SL will be at = 200 - 80 = 120

So Your SL here is at 120 for the ATM CE Leg which got entry at 200.

Underlying %

This option enables you to select your Stop-Loss in percentage terms on the index value. Assuming you are doing backtesting on Banknifty, then using this feature, you can set your SL on Banknifty Index Value in percentage.

- Example - Assume you created a strategy

Entry :- 09:20

Strike :- ATM CE

Positon :- Buy

Stop-Loss :- 1% on Underlying

Assume 09:20 ATM Strike Premium 200 At 09:20 Banknifty is at 43700

Your Stop-Loss is = 1% of 43700 = 437 points Your Stop-Loss will be at = 43700 - 437 = 43263

So Your Stop-Loss here is at 43263 on the Index.

Target

Target is a very important tool in backtesting because you can try different variations of it to see which works best.

This feature enables you to set a target on individual legs with many options. You can enable target features in your strategy, as shown in the image below.

You can enable this feature as shown in the image below

AlgoTest provides you many different options to define your Target. You can use them by selecting from dropdown under target as shown in the image below

Points

This option enables you to set Target for individual CE/PE legs in Points on option premium.

- Example - Assume you created a strategy

Entry :- 09:20

Strike :- ATM CE

Positon :- Buy

Target :- 25 Points

Assume at 9:20 ATM strike premium is 200 Your Target in points = 25 points Your Target will be at = 200 + 25 = 225

So Your Target here is at 225 for ATM CE Leg which has an entry price 200.

Underlying Points

This option enables you to select your target based on the Index Value in points.

Assuming you are doing backtesting on Banknifty, then using this feature, you can set your target on the Banknifty Index Value in points.

- Example - Assume you created a strategy

Entry :- 09:20

Strike :- ATM CE

Positon :- Buy

Target :- 50 Points on underlying

Assume at 09:20 ATM CE Strike Premium 200 At 09:20 Banknifty is at 43700

Your Target will be at = 43700 + 50 = 43750

So Your Target here is at 43750 on Banknifty for ATM CE Leg which took Entry at 200.

Percent %

This option enables you to select your Target in Percentage terms on option premium value.

- Example - Assume you created a strategy

Entry :- 09:20

Strike :- ATM CE

Positon :- Buy

Target :- 30%

Assume at 9:20 ATM strike premium is 200 Your Target in points is = 30% of 200 = 60 points Your Target will be at = 200 + 60 = 260

So Your Target here is at 260 for the ATM CE Leg which got Entry at 200.

Underlying %

This option enables you to select your target in percentage terms based on the index value.

Assuming you are doing backtesting on Banknifty, then using this feature, you can set your target on Banknifty Index Value in percentage.

- Example - Assume you created a strategy

Entry :- 09:20

Strike :- ATM CE

Positon :- Buy

Target Underlying :- 01%

Assume 09:20 ATM Strike Premium 200 At 09:20 Banknifty is at 43700

Your Target in points is = 1% of 43700 = 437 points on underlying Your Target will be at = 43700 + 437 = 44137

So Your Target here is at 44137 on the Index for ATM CE Leg which entered at 200.

Trail SL

This feature enables you to move your actual stop loss whenever the price moves in your favor.

So every time an instrument moves in your favor by X amount, it will move your Stop-Loss by Y amount. The amount can be in terms of points or percentages.

You can enable this feature as shown in the image below

AlgoTest provides you many different options to define your Target. You can use them by selecting from dropdown under target as shown in the image below

Points

This option enables you to move your actual stop-loss by Y Points if the instrument moves X points in your favor.

For example if you select points in Trail SL and put 10-5 as shown in the image below, it will move your stop-loss 5 points if the instrument moves 10 points in your favor.

- Example - Assume you created a strategy

Entry :- 09:20

Strike :- ATM CE

Positon :- Buy

Trail SL :- 20-10 points

Now assume at 09:20 ATM CE strike = 200

Your actual stop loss = 175 (25 points)

TSL = 20% of 200 will be 40 points and 10% of 200 will be 20 points

If ATM CE strike started moving in your favor

It moved to 240 , SL will be moved to 195

It moved to 280, SL will be moved to 215

And so on, it keeps on moving till our TSL hits.

Percentage

This option enables you to move your actual stop-loss by Y amount if the instrument moves X amount in percentage terms in your favor.

For example if you select the percentage option in Trail SL and put 10-5 as shown in the image below, it will move your stop-loss 5% if the instrument moves 10 % in your favor. Percentage is calculated on entry price and it is fixed. It don’t change according to the price change.

- Example - Assume you created a strategy

Entry :- 09:20

Strike :- ATM CE

Positon :- Buy

Stop Loss :- 25 Points

Trail SL :- 20-10 (Percentage)

Now assume at 09:20 ATM CE strike = 200

Your actual stop loss = 175 (25 points)

TSL = For 20 point move in our favor, Trail SL 20 point.

If ATM CE strike started moving in your favor

It moved to 220 , SL will be moved to 190

It moved to 240, SL will be moved to 200

And so on, it keeps on moving till our TSL hits.

Log onto AlgoTest to get started.