How to Backtest BTST Strategies

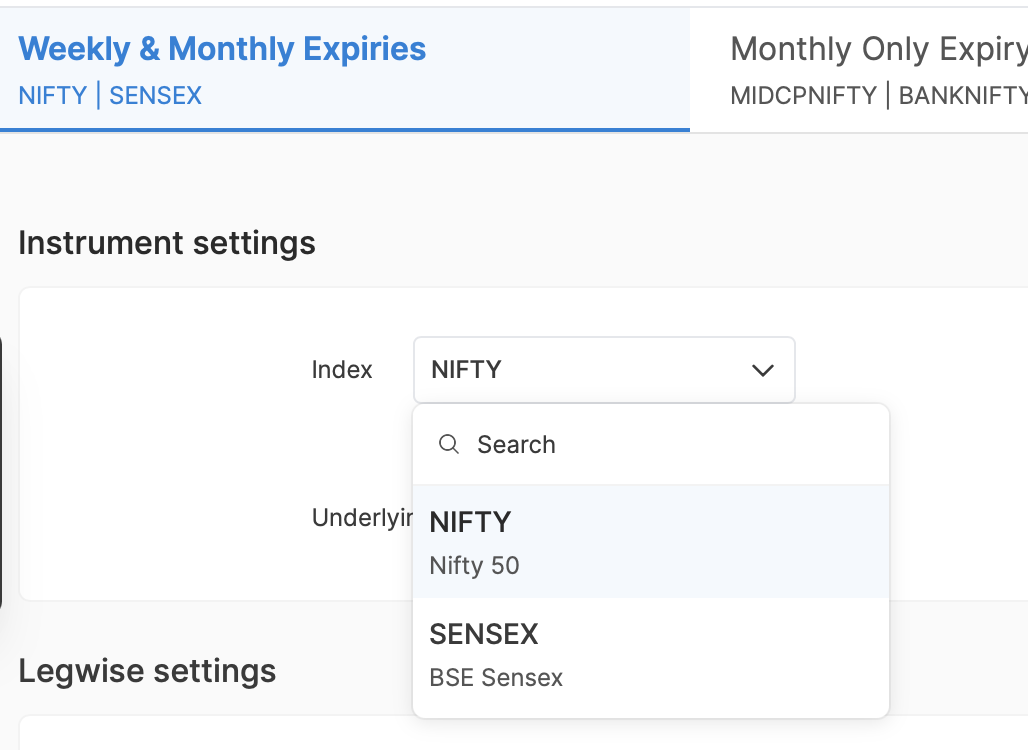

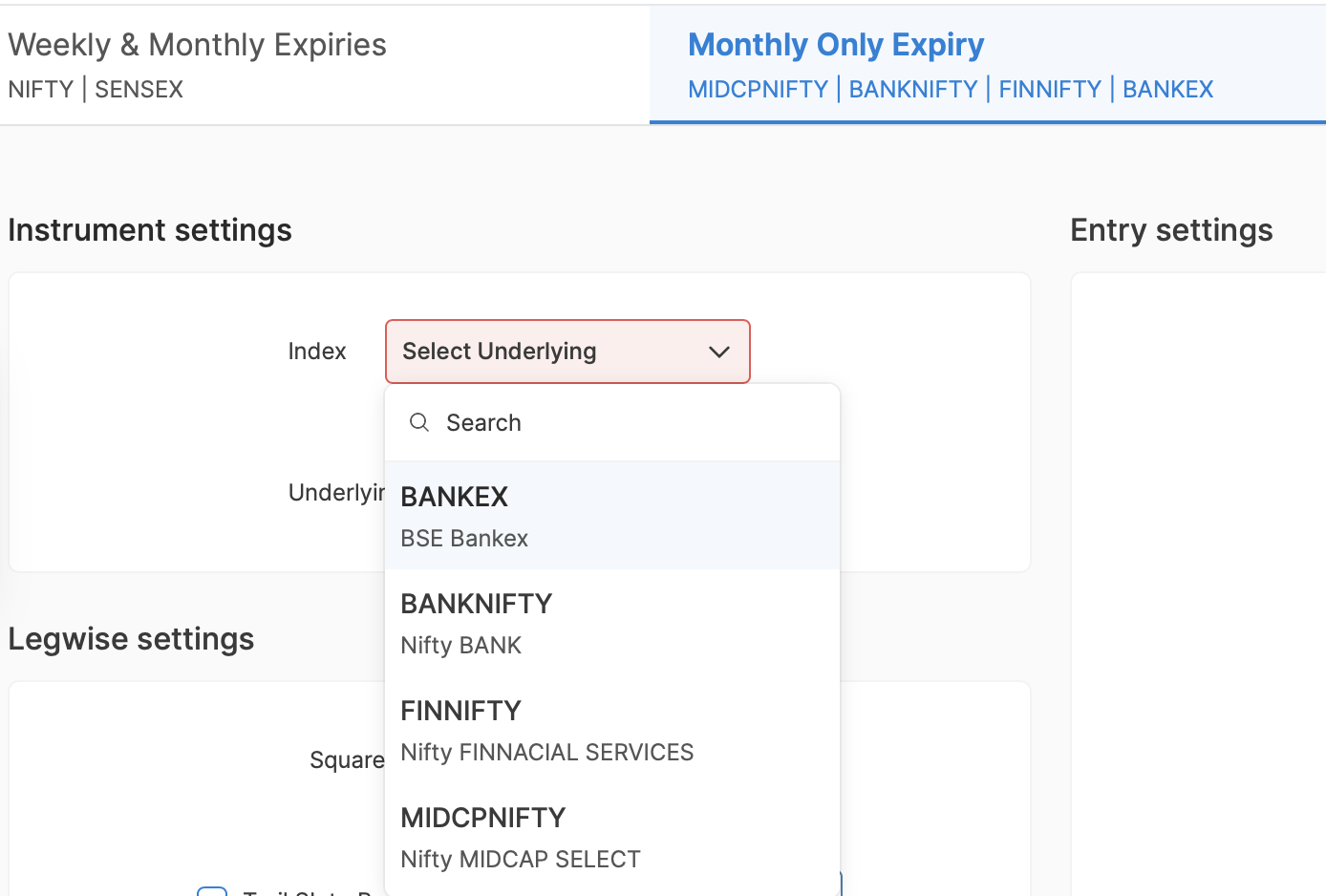

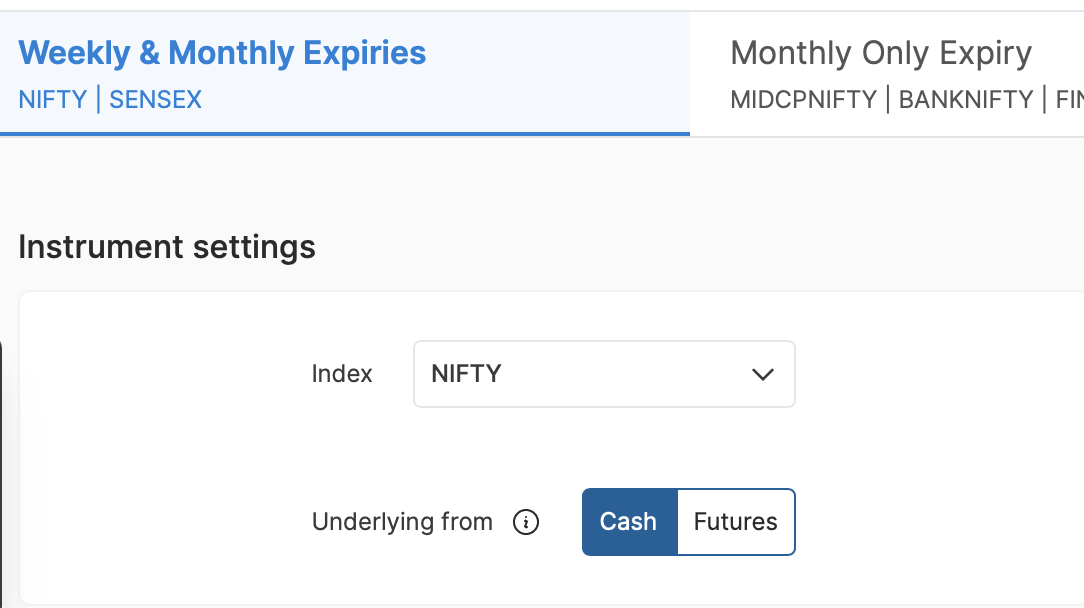

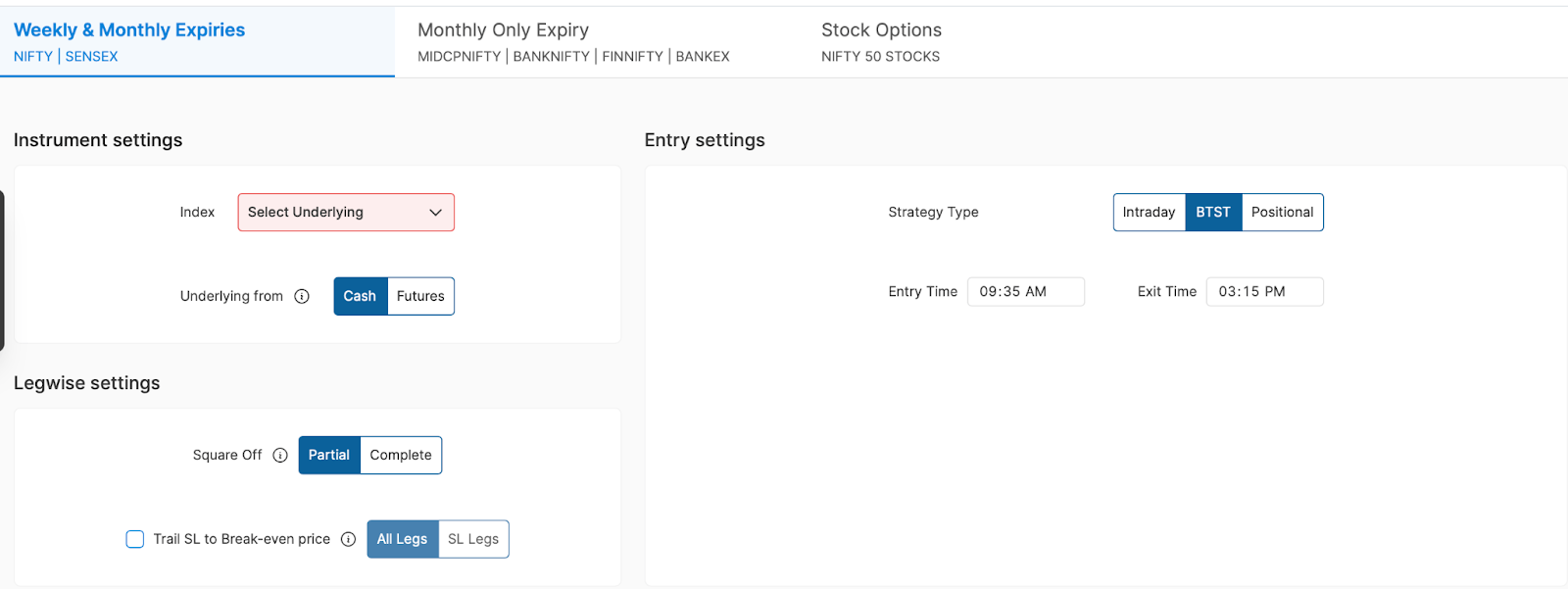

Indices are divided according to two expiry dates:

If you trade in indices with weekly and monthly expiry, these two indices are available.

Indices with Weekly and Monthly Expiry

If you trade in indices with monthly expiry, these four indices are available.

Indices with Monthly Expiry

When you trade in monthly expiry, you also get the option to get weekly expiries from the previous regime.

Weekly Expiries from Previous Regime

Toggle ON includes: Previous Regime Weekly Data & New Regime Monthly Data

Toggle OFF includes: Previous Regime Monthly Data & New Regime Monthly Data

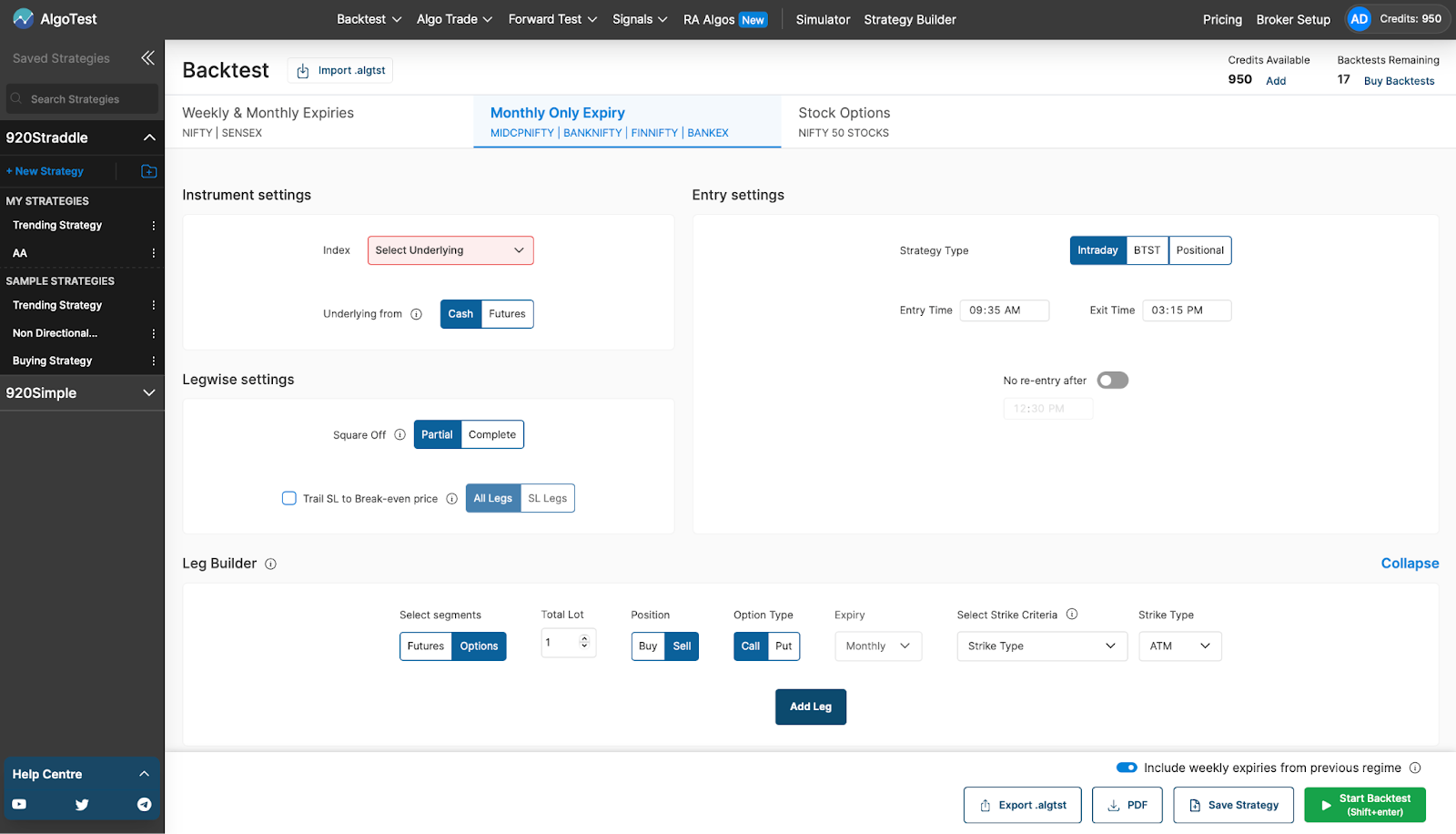

Once you have selected the index, you can choose which market you want to trade in. We have cash and a future market.

Toggle Settings

- Toggle ON: Previous Regime Weekly Data & New Regime Monthly Data

- Toggle OFF: Previous Regime Monthly Data & New Regime Monthly Data

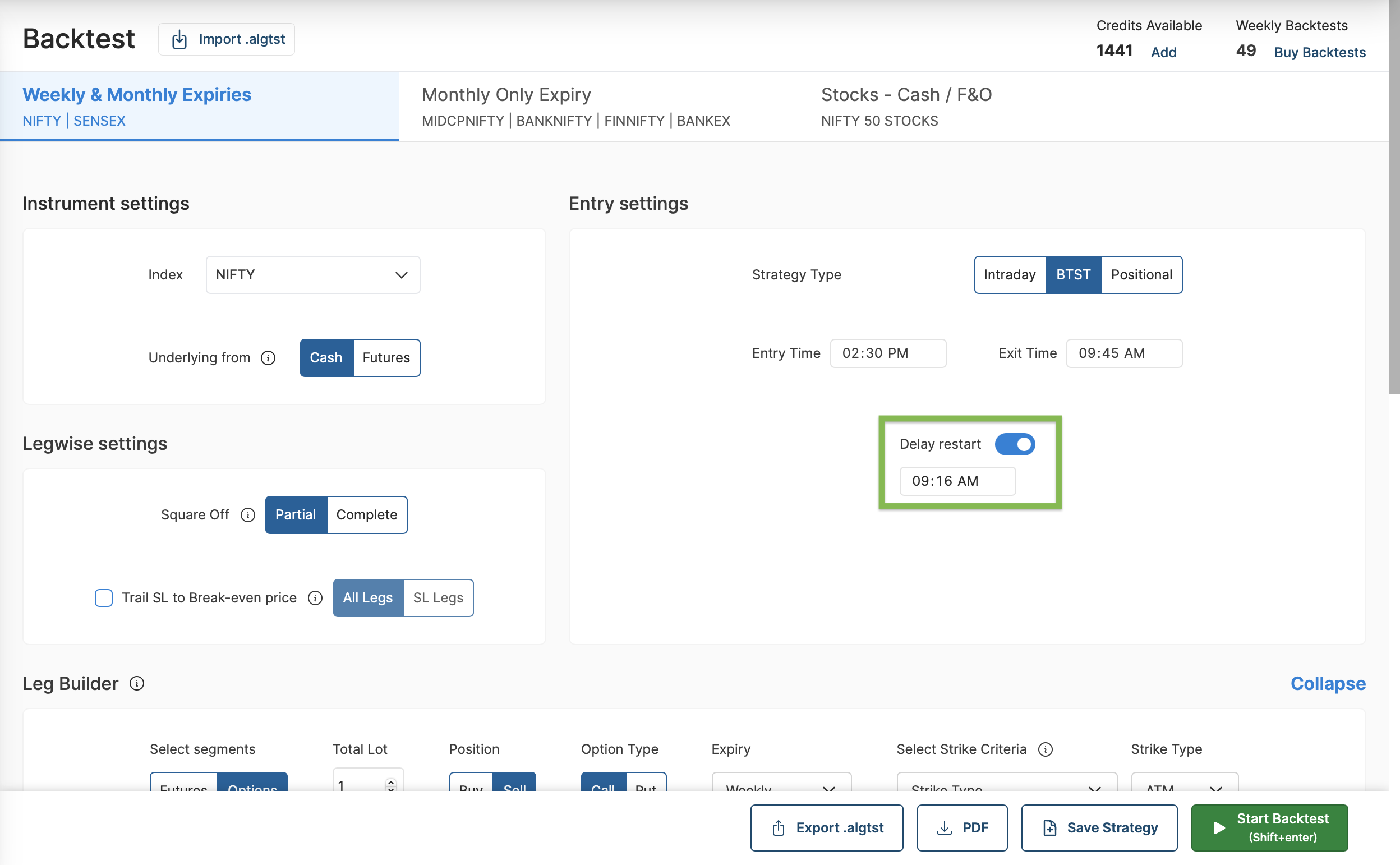

BTST and Positional Strategies

Market Selection

Choose your market: Cash or Future.

Example: Trading in Nifty in the Cash Market.

BTST Strategy Settings:

- Entry Time: Time to enter the strategy

- Exit Time: Time to exit positions

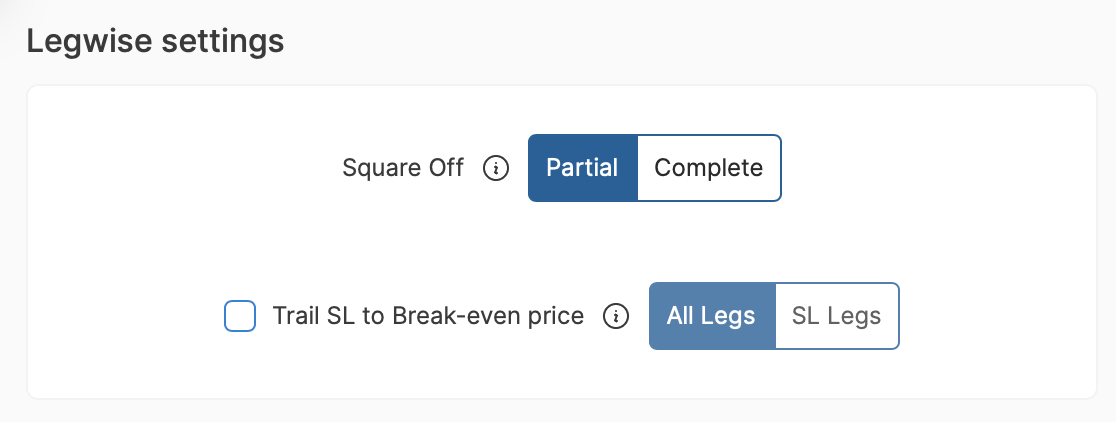

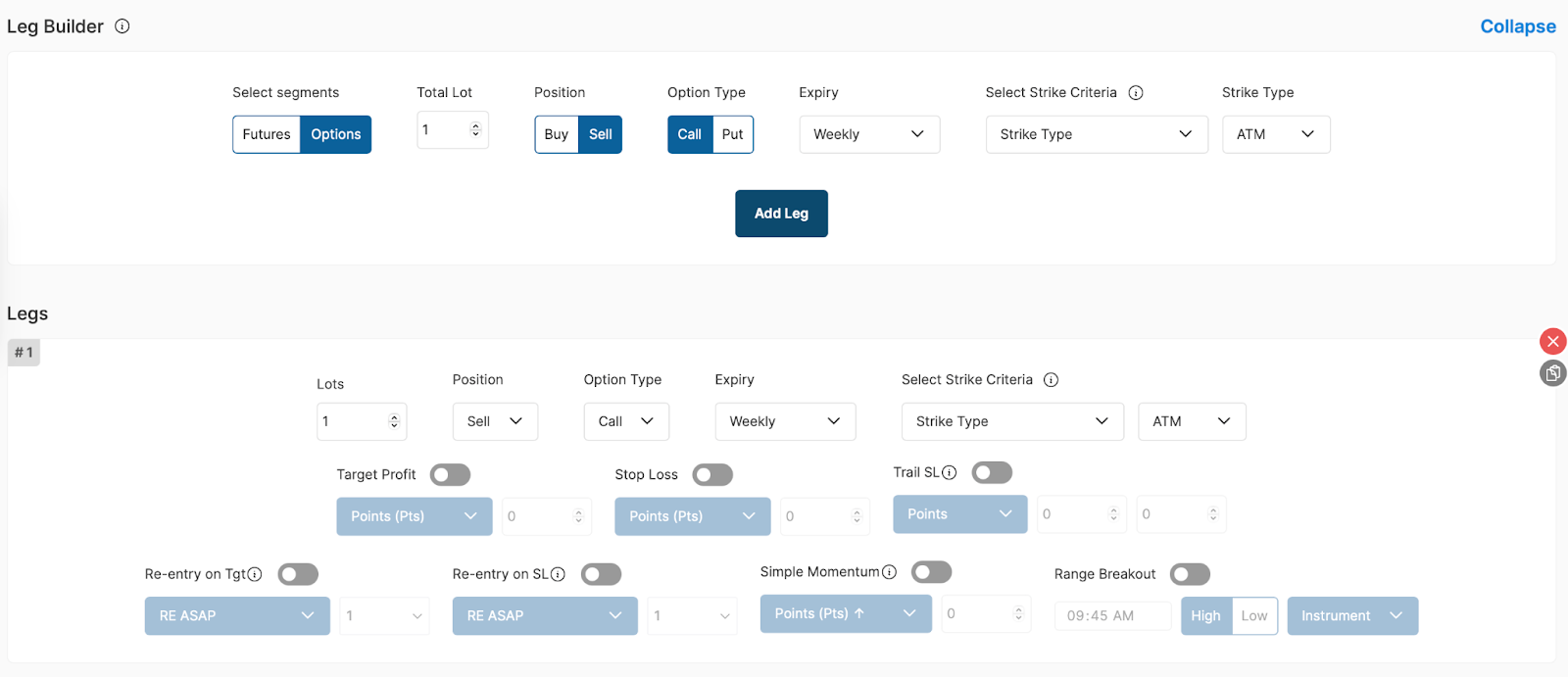

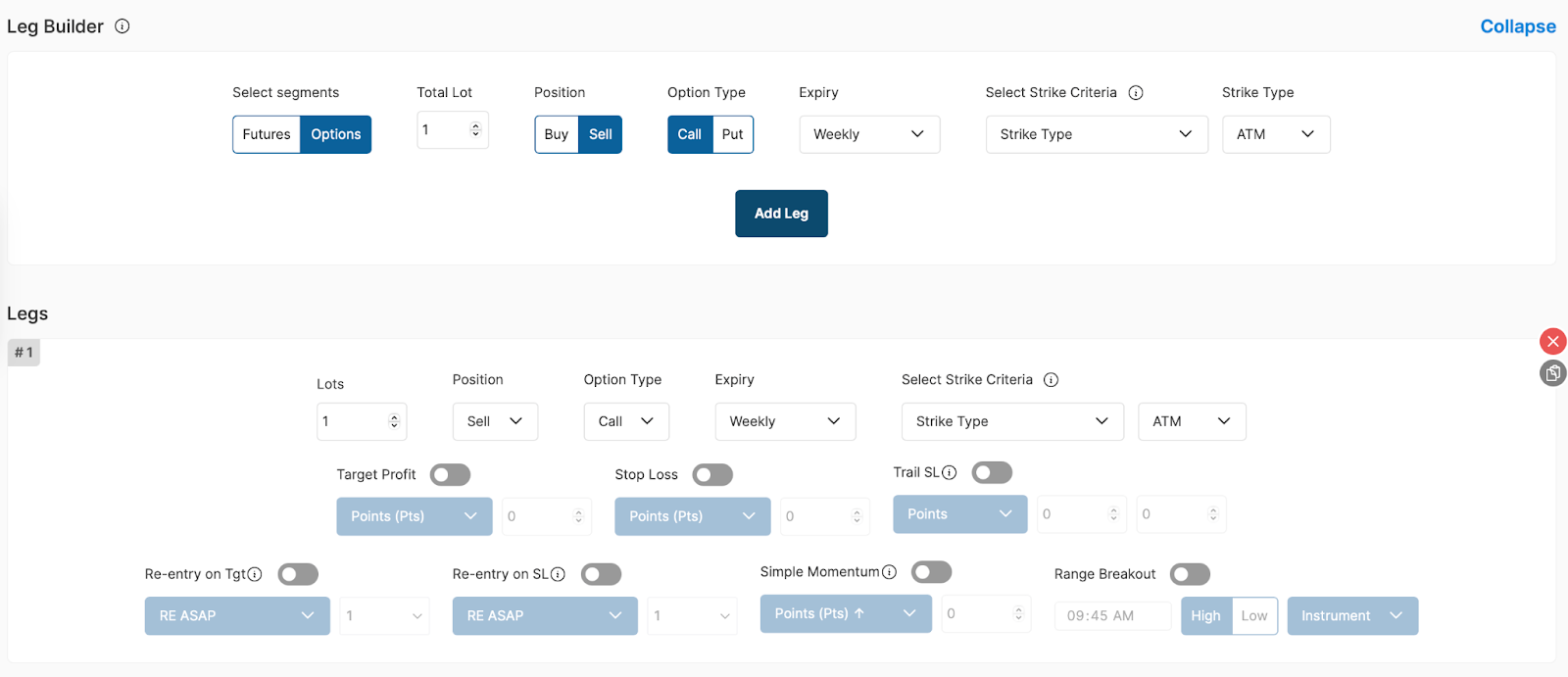

Legwise and Leg Builder Settings

Legwise Settings

You can square off positions partially or completely.

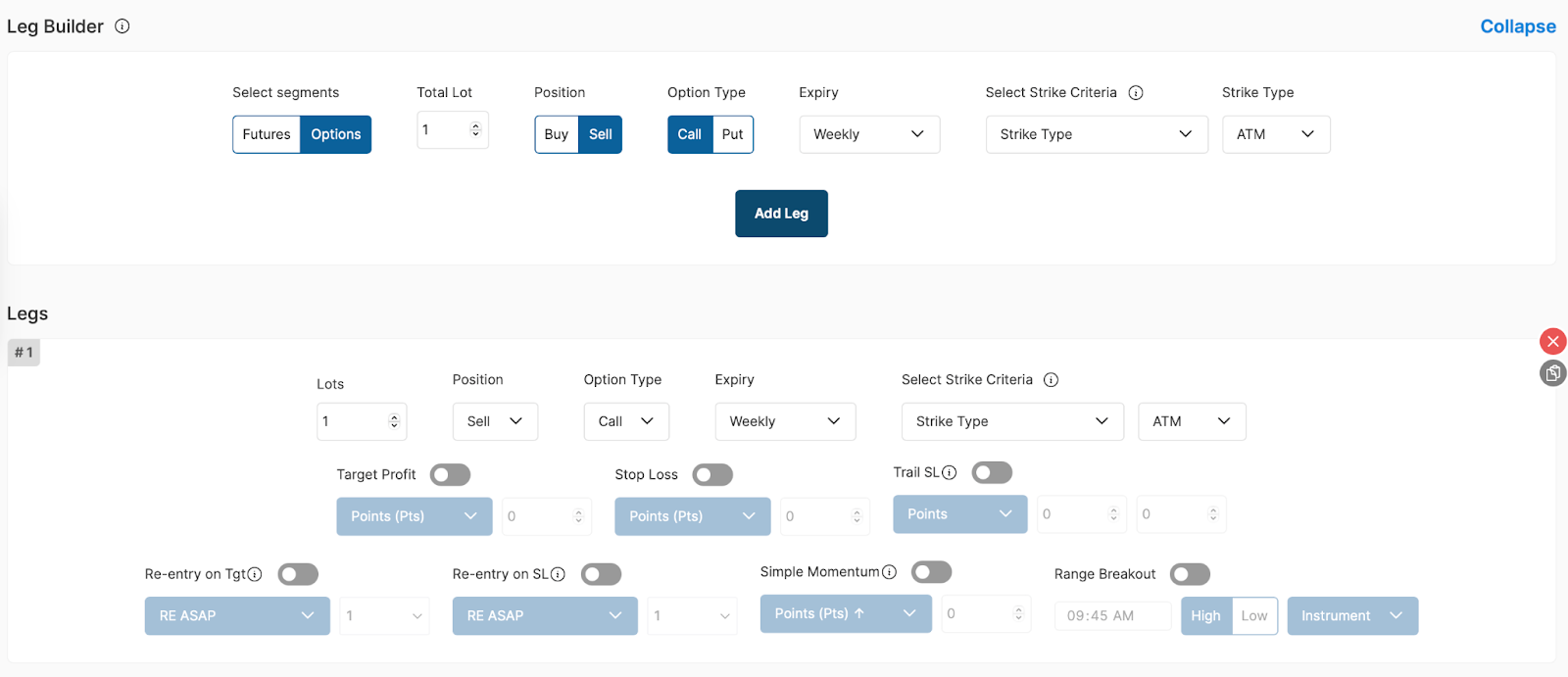

Leg Builder Configuration:

- Segment: Future or Options

- Lot: Number of Lots

- Position: Buy or Sell

- Option Type: Call or Put

- Expiry, Strike Criteria, Strike Type

Add a Leg

Click Add Leg and customize settings as per your strategy.

Strategy Customization Options:

- Target Profit

- Stop Loss (dropdown options)

- Trail SL

- Re-entry on Target

- Re-entry on SL

- Simple Momentum

- Range Breakout

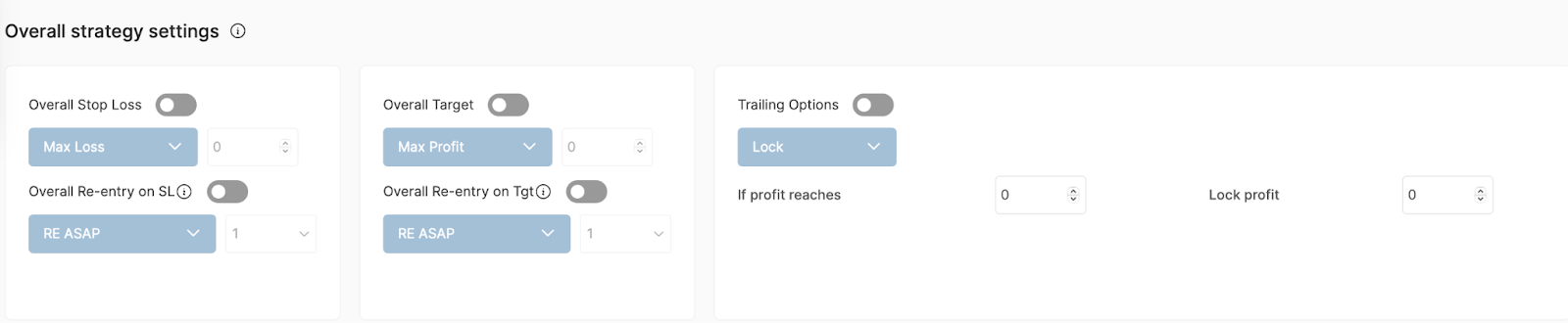

Overall Strategy Settings

These settings apply to all strategies.

Save the strategy and backtest it for your selected time period.

Important - Delay Restart

Turning on Delayed Restart exits your overnight BTST or positional positions at the 09:16 AM price (or any time you set) instead of 09:15 AM, giving you a result you could actually receive. Gap‑ups or gap‑downs at the open can push prices far away from the previous close.

The same feature is available in the live environment.

Click on the Delay Restart toggle to turn it on.

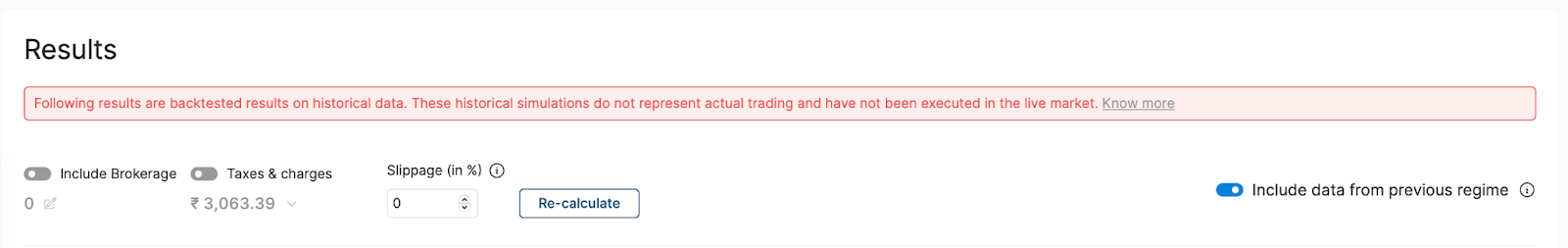

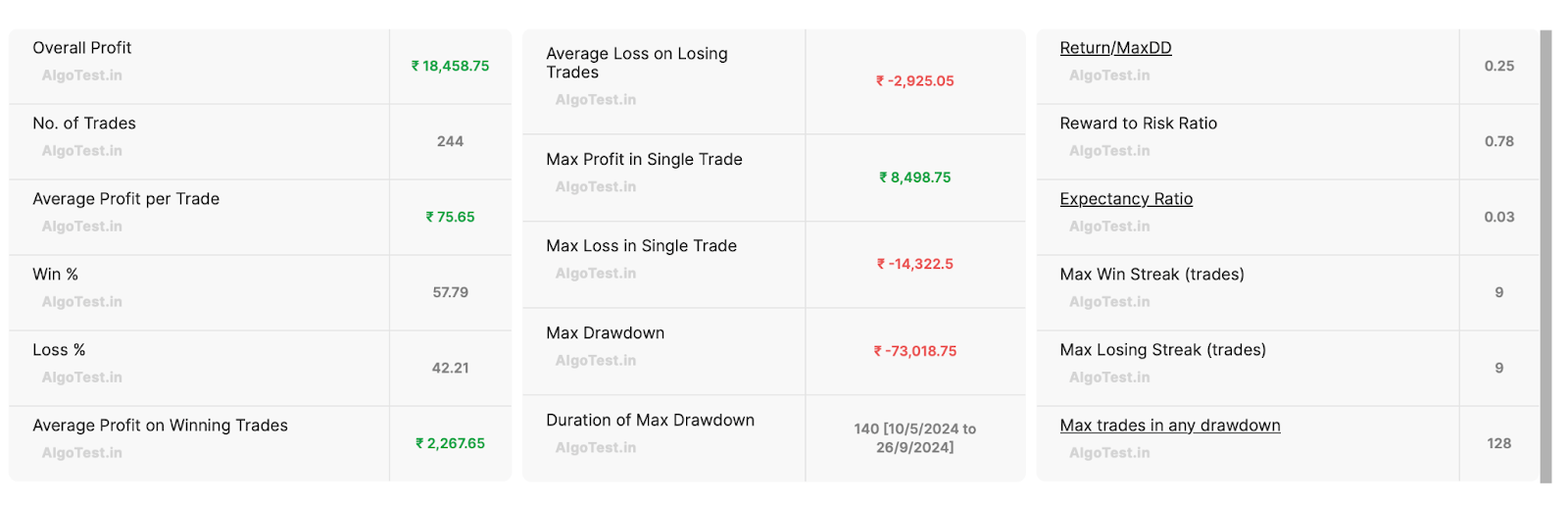

Backtest Results

View the results and stats of your strategy.

Use the toggle to exclude data before the implementation of SEBI changes.