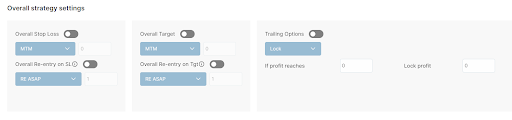

Overall Strategy Settings

Overall Strategy Settings

As the name suggests, all the feature available under Overall Strategy Settings are applied on your overall strategy.

:For any queries reach out to us!

Overall Stop Loss

This feature enables you to set overall stop loss on strategy.

For example let's assume you want to exit the strategy if your loss hits 'X' amount. The X amount can be in MTM or Percentage terms.

How to use

To use this feature first enable the overall stop-loss as shown in the image below.

Now you have 2 option in overall stop loss, you can select from dropdown as shown in the image below :

- MTM :- Using this feature you can set overall sl in MTM terms.

- Total Premium % :- Using this feature you can set overall sl in terms of percentage on total premium.

Overall SL in MTM

This option enables you to set overall stop loss in MTM terms.

For example let's assume you want to exit strategy if your loss reaches 2000, then you can use this feature.

Example :- Assume you created a strategy

Underlying :- Nifty

Entry :- 09:20

Exit :- 03:20

Strike :- ATM

Legs :- CE and PE

Positon :- Buy

Overall SL (MTM) :- 5000

The strategy will exit for the day if at any point of time between entry and exit time loss reaches 5000.

Overall SL in Percentage of Premium

This option enables you to set overall stop loss in terms of percentage on total premium value.

For example let's assume you want to exit strategy if your loss reaches 20% of the total combined premium, then you can use this option.

Example :- Assume you created a strategy

Underlying :- Nifty

Entry :- 09:20

Exit :- 03:20

Strike :- ATM

Legs :- CE and PE

Positon :- Buy

Overall SL (Percentage of Premium) :- 30%

Assume strategy took entry at 09:20 in ATM CE at 170 and ATM PE at 130

Combined premium = 170 + 130 = 300

Overall SL = 30% of 300 = 90 point

At any point of time between if you face 90 point loss in strategy, the strategy will be exited.

Overall Re-Entry on SL

This feature enables you to re-enter in a position after an overall Stop Loss is hit.

You can use this feature only if the 'overall stop loss' is enabled. You can do a maximum 5 re-entries.

How to Use

To use this feature first you need to enable Overall Re-entry on the SL feature as shown in the image below.

Now you have 4 options in Re-entry on overall SL, you can select any from dropdown as shown in the image below

- RE ASAP

- RE ASAP ↩

- RE MOMENTUM

- RE MOMENTUM ↩

Now enter the number of re-entries you want to do as shown in the image below. You can do max 5 re-entries on overall SL hit.

RE-ASAP on Overall SL

This feature enables you to re-enter immediately in a new strike at market price as selected by you in initial entry legs after your overall SL hit.

For example let's assume you have selected an ATM strike for entry. If your overall SL hits, it will look for a new ATM strike available in the market and enter immediately in the same positions with a new ATM strike.

Example :- Assume you created a strategy

Underlying :- Nifty

Entry :- 09:20

Exit :- 03:20

Strike :- ATM

Legs :- CE and PE

Positon :- Buy

Overall SL (MTM) :- 5000

RE-ASAP on Overall SL :- 1 (Max you can do 5 re-entries)

Imagine at 09:20 nifty spot was at 18515, so ATM is 18500. It took entry in nifty 18500 CE and PE. Now at 09:50 the loss reached 5000. So it exited due to overall SL.

Now according to our re-entry ASAP condition, it will look for a new ATM strike available at 09:50 and will enter immediately. Assume at 09:50 nifty was at 18446 so ATM is 18450. So it will select 18450 strike for re-entry in CE and PE Buy position.

RE-ASAP ↩ on Overall SL

This feature enables you to re-enter immediately in reverse position with a new strike available at market price when your overall SL hits.

For example let's assume you have selected an ATM strike for entry. If your overall SL hits, it will look for a new ATM strike available in the market and enter immediately in a reverse position with the new ATM strike.

Example :- Assume you created a strategy

Underlying :- Nifty

Entry :- 09:20

Exit :- 03:20

Strike :- ATM

Legs :- CE and PE

Positon :- Buy

Overall SL (MTM) :- 5000

RE-ASAP on Overall SL :- 1 (Max you can do 5 re-entries)

Imagine at 09:20 nifty spot was at 18515, so ATM is 18500. It took entry in nifty 18500 CE and PE. Now at 09:50 the loss reached 5000. So it exited due to overall SL.

Now according to our re-entry ASAP Reverse condition, it will look for a new ATM strike available at 09:50 and will enter immediately in the reverse position. Assume at 09:50 nifty was at 18446 so ATM is 18450. So it will select 18450 strike for re-entry in CE and PE Sell Position instead of Buy position.

RE-MOMENTUM on Overall SL

This option enables you to re-enter in a new strike at market price as selected by you in the initial entry legs after your overall SL hits when the momentum condition holds true.

If you haven't enabled momentum in strategy, this option will work like RE-ASAP. For example you have selected an ATM strike for entry in CE and PE legs with 10% momentum each. If your overall SL hits, it will look for new ATM strikes available in the market and wait if any of your leg move 10% or not. It will enter only if your momentum condition holds true.

Example :- Assume you created a strategy

Underlying :- Nifty

Entry :- 09:20

Exit :- 03:20

Strike :- ATM

Legs :- CE and PE

Positon :- Buy

Momentum :- 10%

Overall SL (MTM) :- 5000

RE-Entry Momentum on Overall SL :- 1 (Max you can do 5 re-entries)

Imagine your strategy CE and PE legs took entry respectively at 09:26 and 09:28 after momentum condition holds true. At 09:55, your overall SL hits.

Now according to our Re-Entry Momentum condition, it will look for a new ATM strike available at 09:55. Assume at 09:55 nifty was at 18446 so ATM is 18450 and CE price is 200 and PE price is 150. Now it will wait for our 10% momentum condition to hold true in any of CE or PE legs and it will take entry.

So it will take entry in the 18450 CE Buy position when price reaches 200 + 20 = 220 and in the 18450 PE Buy position when price reaches 150 + 15 = 165.

RE-MOMENTUM ↩ on Overall SL

This option enables you to re-enter in the reverse position in a new strike at market price as selected by you in the initial entry legs after your overall SL hits when the momentum condition holds true.

If you haven't enabled momentum in strategy, this option will work like RE-ASAP-Reverse.

For example let's assume you have selected an ATM strike Buy position for entry in CE and PE legs with 10% momentum each. If your overall SL hits, it will look for new ATM strikes available in the market and wait if any of your leg move 10% or not. If it holds true it will enter in reverse position i.e. Sell position instead of Buy position.

Example :- Assume you created a strategy

Underlying :- Nifty

Entry :- 09:20

Exit :- 03:20

Strike :- ATM

Legs :- CE and PE

Positon :- Buy

Momentum :- 10%

Overall SL (MTM) :- 5000

RE-Entry Momentum Reverse on Overall SL :- 1 (Max you can do 5 re-entries)

Imagine your strategy CE and PE legs took entry respectively at 09:26 and 09:28 after momentum condition holds true. At 09:55, your overall SL hits.

Now according to our Re-Entry Momentum condition, it will look for a new ATM strike available at 09:55. Assume at 09:55 nifty was at 18446 so ATM is 18450 and CE price is 200 and PE price is 150. Now it will wait for our 10% momentum condition holds true in any of CE or PE legs and it will take entry in reverse position i.e. Sell instead of Buy.

So it will take entry in the 18450 CE Sell position when price reaches 200 + 20 = 220 and in the 18450 PE Sell position when price reaches 150 + 15 = 165.

Overall Target

This feature enables you to set an overall target on strategy.

For example you want to exit the strategy if your profit hits an X amount. The X amount can be in MTM or Percentage terms.

How to use

- To use this feature first enable the overall target as shown in the image below.

- Now you have 2 option in overall stop loss, you can select from dropdown as shown in the image below

- MTM :- Using this feature you can set an overall target in MTM terms.

- Total Premium % :- Using this feature you can set overall target in terms of percentage on total premium.

Overall Target in MTM

This option enables you to set an overall target in MTM terms.

For example let's assume you want to exit the strategy if your profit reaches 2000, then you can use this feature.

Example :- Assume you created a strategy

Underlying :- Nifty

Entry :- 09:20

Exit :- 03:20

Strike :- ATM

Legs :- CE and PE

Positon :- Buy

Overall Target (MTM) :- 5000

The strategy will exit for the day if at any point of time between entry and exit time your profit reaches 5000.

Overall Target in Percentage of Premium

This option enables you to set an overall target in terms of percentage on total premium value. For example you want to exit strategy if profit reaches 20% of total combined premium, then you can use this option.

Example :- Assume you created a strategy

Underlying :- Nifty

Entry :- 09:20

Exit :- 03:20

Strike :- ATM

Legs :- CE and PE

Positon :- Buy

Overall Target (Percentage of Premium) :- 30%

Assume strategy took entry at 09:20 in ATM CE at 170 and ATM PE at 130

Combined premium = 170 + 130 = 300

Overall Target = 30% of 300 = 90 point

At any point of time between 09:20 to 03:20 if you get 90 point profit in strategy, the strategy will be exited.

Overall Re-Entry on Target

This feature enables you to re-enter in a position after an overall target hit.

You can use this feature only if the overall target is enabled. You can do a maximum of 5 re-entries.

How to Use

To use this feature first you need to enable the Overall Re-entry on Target feature as shown in the image below.

Now you have 4 options in Re-entry on overall Target, you can select any from dropdown as shown in the image below

- RE ASAP

- RE ASAP ↩

- RE MOMENTUM

- RE MOMENTUM ↩

Now enter the number of re-entries you want to do as shown in the image below. You can do max 5 re-entries on overall Target hit.

RE-ASAP on Overall Target

This feature enables you to re-enter immediately in a new strike at market price as selected by you in the initial entry legs after your overall Target hits.

For example let's assume you have selected an ATM strike for entry. If your overall Target hit, it will look for new ATM strikes available in the market and enter immediately in the same positions with a new ATM strike.

Example :- Assume you created a strategy

Underlying :- Nifty

Entry :- 09:20

Exit :- 03:20

Strike :- ATM

Legs :- CE and PE

Positon :- Buy

Overall Target (MTM) :- 5000

RE-ASAP on Overall Target :- 1 (Max you can do 5 re-entries)

Imagine at 09:20 nifty spot was at 18515, so ATM is 18500. It took entry in nifty 18500 CE and PE. Now at 09:50 profit reached 5000. So it exited due to overall Target.

Now according to our re-entry ASAP condition, it will look for a new ATM strike available at 09:50 and will enter immediately. Assume at 09:50 nifty was at 18546 so ATM is 18550. So it will select an 18550 strike for re-entry in the CE and PE Buy position.

RE-ASAP ↩ on Overall Target

This feature enables you to re-enter immediately in reverse position with a new strike available at market price when your overall Target hits.

For example you have selected an ATM strike for entry. If your overall Target hit, it will look for a new ATM strike available in the market and enter immediately in reverse position with the new ATM strike.

Example :- Assume you created a strategy

Underlying :- Nifty

Entry :- 09:20

Exit :- 03:20

Strike :- ATM

Legs :- CE and PE

Positon :- Buy

Overall Target (MTM) :- 5000

RE-ASAP on Overall Target :- 1 (Max you can do 5 re-entries)

Imagine at 09:20 nifty spot was at 18515, so ATM is 18500. It took entry in nifty 18500 CE and PE. Now at 09:50 the profit reached 5000. So it exited due to overall Target.

Now according to our re-entry ASAP Reverse condition, it will look for a new ATM strike available at 09:50 and will enter immediately in reverse position. Assume at 09:50 nifty was at 18556 so ATM is 18550. So it will select 18550 strike for re-entry in CE and PE Sell Position instead of Buy position.

RE-MOMENTUM on Overall Target

This option enables you to re-enter in a new strike at market price as selected by you in the initial entry legs after your overall Target- hits, when momentum condition holds true.

If you haven't enabled momentum in strategy, this option will work like RE-ASAP.

For example let's assume you have selected an ATM strike for entry in CE and PE legs with 10% momentum each. If your overall Target hits, it will look for new ATM strikes available in the market and wait if any of your leg move 10% or not. It will enter only if your momentum condition holds true.

Example :- Assume you created a strategy

Underlying :- Nifty

Entry :- 09:20

Exit :- 03:20

Strike :- ATM

Legs :- CE and PE

Positon :- Buy

Momentum :- 10%

Overall Target (MTM) :- 5000

RE-Entry Momentum on Overall Target :- 1 (Max you can do 5 re-entries)

Imagine your strategy CE and PE legs took entry respectively at 09:26 and 09:28 after momentum condition holds true. At 09:55, your overall Target hits.

Now according to our Re-Entry Momentum condition, it will look for a new ATM strike available at 09:55. Assume at 09:55 nifty was at 18556 so ATM is 18550 and CE price is 200 and PE price is 150. Now it will wait for our 10% momentum condition to hold true in any of CE or PE legs and it will take entry.

So it will take entry in the 18550 CE Buy position when price reaches 200 + 20 = 220 and in the 18550 PE Buy position when price reaches 150 + 15 = 165.

RE-MOMENTUM ↩ on Overall Target

This option enables you to re-enter in the reverse position in a new strike at market price as selected by you in the initial entry legs after your overall Target hits, when momentum condition holds true.

If you haven't enabled momentum in strategy, this option will work like RE-ASAP-Reverse.

For example let's assume you have selected an ATM strike Buy position for entry in CE and PE legs with 10% momentum each. If your overall Target hits, it will look for new ATM strikes available in the market and wait if any of your legs move 10% or not. If it holds true it will enter in reverse position i.e. Sell position instead of Buy position.

Example :- Assume you created a strategy

Underlying :- Nifty

Entry :- 09:20

Exit :- 03:20

Strike :- ATM

Legs :- CE and PE

Positon :- Buy

Momentum :- 10%

Overall Target (MTM) :- 5000

RE-Entry Momentum Reverse on Overall Target :- 1 (Max you can do 5 re-entries)

Imagine your strategy CE and PE legs took entry respectively at 09:26 and 09:28 after momentum condition holds true. At 09:55, your overall Target hits.

Now according to our Re-Entry Momentum condition, it will look for a new ATM strike available at 09:55. Assume at 09:55 nifty was at 18546 so ATM is 18550 and CE price is 200 and PE price is 150. Now it will wait for our 10% momentum condition holds true in any of CE or PE legs and it will take entry in reverse position i.e. Sell instead of Buy.

So it will take entry in the 18550 CE Sell position when price reaches 200 + 20 = 220 and in the 18550 PE Sell position when price reaches 150 + 15 = 165.

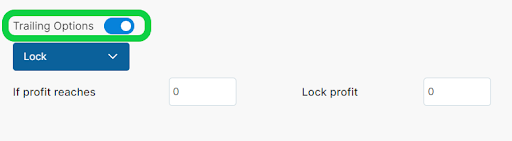

Trailing Options

This feature provides you different methods to trail your overall stop loss or overall profit.

For example let's assume you want to move your stop loss ₹ 500 for every ₹ 1000 overall profit or you want to lock a profit of ₹ 1000 if overall profit reaches ₹ 5000 or you want to lock ₹ 1000 profit when profit reaches ₹ 2000 and trail your locked profit ₹100 for every ₹100 in your favour.

How to use

First you need to enable Trailing Options as shown in the image below.

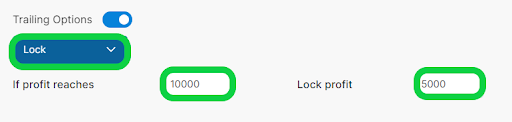

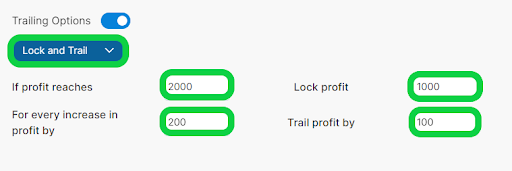

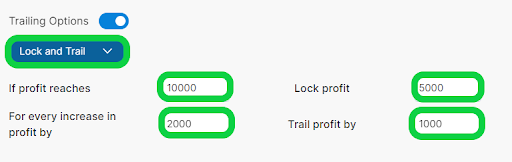

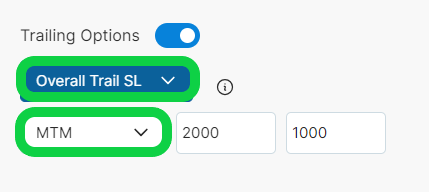

You can select any of the 3 options from drop down under Trailing Options as shown in the image below

- Lock

- Lock and Trail

- Overall Trail SL

After selecting your desired option, you can enter the amount you want to lock or trail as shown in the image below.

Lock and Lock and Trail Features

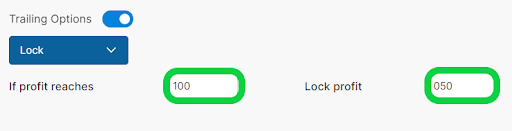

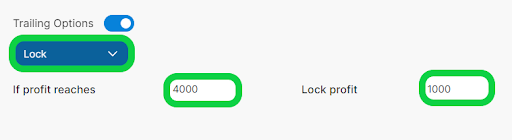

Lock

This option enables you to lock X amount of profit if your overall profit reaches a Y amount. You can enter the amount in MTM terms.

For example if you want to lock ₹ 1000 profit in case your overall profit reaches ₹ 4000, you can use this feature. So in case of reversal, the market reverses back in the opposite direction after hitting your ₹ 4000, it will exit if the profit comes below ₹ 1000.

It will work on overall strategy only.

Example :- Assume you created a strategy

Underlying :- Nifty

Entry :- 09:20

Exit :- 03:20

Strike :- ATM

Legs :- CE and PE

Positon :- Buy

Lock :- If profit reaches ₹ 10000, Lock Profit ₹ 5000

Imagine strategy took entry in Call and Put Buy position at 09:20 and at 10:45 profit reached ₹ 10000. So as soon as it crosses ₹ 10000, the system will lock ₹ 5000 profit.

So now assume after some time the market reverses and profit starts coming down. When it crosses below ₹ 5000, the system will exit at ₹ 5000 profit.

Lock and Trail

This option enables you to lock X amount of profit if your overall profit reaches a Y amount and then start trailing from lock profit. You can enter the amount in MTM terms.

For example let's assume you want to lock ₹ 1000 if profit reaches ₹ 2000 and after that for every ₹ 200 increase in profit trail lock profit ₹ 100, then you can use this feature. It will work on overall strategy only.

Example :- Assume you created a strategy

Underlying :- Nifty

Entry :- 09:20

Exit :- 03:20

Strike :- ATM

Legs :- CE and PE

Positon :- Buy

Lock and Trail :- If profit reaches ₹ 10000, Lock Profit ₹ 5000 and For every increase in profit by ₹ 2000 Trail profit by ₹ 1000

Imagine strategy took entry in Call and Put Buy position at 09:20 and at 10:45 profit reached ₹ 10000. So as soon as it crosses ₹ 10000, the system will lock ₹ 5000 profit.

Now according to our trail condition if profit reaches ₹ 12000, our lock profit i.e. ₹ 5000 will be trailed to ₹ 6000. Now again if profit reaches ₹ 14000, our lock profit i.e. ₹ 6000 will be trailed to ₹ 7000.

So now assume after some time the market reverses and profit starts coming down. When it crosses below our trailed sl i.e. ₹ 7000, the system will exit at ₹ 7000 profit.

Overall Trail SL

This feature enables you to trail your overall stop loss.

You can trail in MTM or Overall Premium % terms. This feature will work only if overall stop loss is enabled.

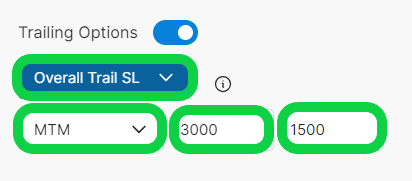

Overall Trail SL in MTM

This feature enables you to trail your overall stop-loss in mtm terms.

For example your strategy has an overall stop-loss of ₹ 5000 and you want to trail it ₹ 1000 for every ₹ 2000 profit, you can do this using this feature.

Example :- Assume you created a strategy

Underlying :- Nifty

Entry :- 09:20

Exit :- 03:20

Strike :- ATM

Legs :- CE and PE

Positon :- Buy

Overall SL :- 10000

Overall Trail SL (MTM) :- 3000 - 1500

Imagine strategy took entry in Call and Put Buy position at 09:20 and at 10:45 profit reached ₹ 3000.

So as soon as it crosses ₹ 3000, trail your overall sl i.e. 5000 to 3500.

Now if profit reaches ₹ 6000, our overall SL will be trailed from ₹ 3500 to ₹ 2000.

Now again if profit reaches ₹ 9000, our overall SL will be trailed from ₹2000 to ₹ 500.

It will keep on doing till our overall tsl hit.

So now assume after some time the market reverses and profit starts coming down. When it crosses a loss below 500, it will be exited.

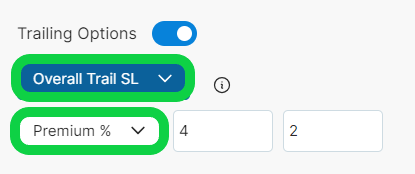

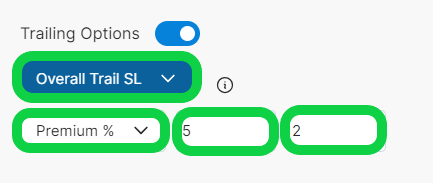

Overall Trail SL in Premium %

This feature enables you to trail your overall stop-loss in premium percentage terms.

For example your strategy has an overall stop-loss of 30% of premium and you want to trail it 2% on premium for every 4% profit on premium, you can do this using this feature.

**Example **:- Assume you created a strategy

Underlying :- Nifty

Entry :- 09:20

Exit :- 03:20

Strike :- ATM

Legs :- CE and PE

Positon :- Buy

Overall SL :- 30% of Premium

Overall Trail SL (Premium % ) :- 5 - 2

Assume strategy took entry at 09:20 in ATM CE at 170 and ATM PE at 130

Combined premium = 170 + 130 = 300

Overall SL = 30 % of 300 = 90 points

Overall Trail = 5% of 300 and 2% of 300 = 15 - 6 points

Now it will trail your overall sl 6 points for every 15 point overall profit.

Now imagine your profit in strategy reaches 15 points, your overall SL i.e. 90 points will be trailed to 84 points.

If profit reaches 30 points, your overall SL i.e. 84 will be trailed to 78 points.

If profit reaches 45 points, your overall SL i.e. 78 will be trailed to 72 points.

It will keep on trailing until your overall trailed SL hits.