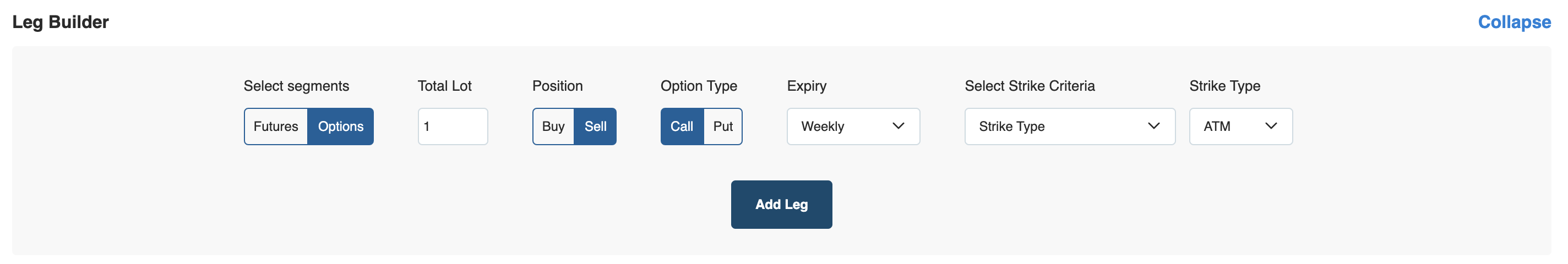

Leg Builder

This feature enables you to create a leg in your strategy.

For example - if you want to create an ATM Buy position of current week, next week, or monthly expiry with 1 Lot, you can do that using this feature.

:For any queries reach out to us!

Select Segments

This feature enables you to add a leg in either Futures or Options.

If you want to backtest your strategy on Futures select Futures as shown in the image below

If you want to backtest your strategy on Options select Options as shown in the image below

Total Lots

This feature enables you to enter desired quantity in terms of lots if you want to backtest each leg.

For example - If you want 10 lots then you can add 10 lots as shown in the image below.

Position

This feature enables you to select your position in a leg.

If you want to create Buy Options/Future position you can select Buy as shown in the image below.

If you want to create Sell Options/Future position you can select Sell as shown in the image below.

Option Type

This feature enables you to select CALL or PUT for your legs.

If you want to add a Call leg, you can select Call as shown in the image below

If you want to add a Put leg, you can select Put as shown in the image below

Expiry

This feature enables you to select the expiry of option contracts you want to backtest.

It provides you access to select different expiry contracts like weekly, next weekly, and monthly.

To select the current week's expiry select weekly from the dropdown menu under expiry as shown in the image below.

To select the next week's expiry, select next weekly from dropdown menu under expiry as shown in the image below.

To select the current month's expiry, select monthly from dropdown menu under expiry as shown in the image below.

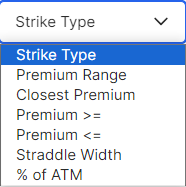

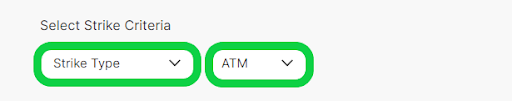

Strike Selection

This section is all about the features available to select your desired option strike.

It provides you with different methods to select your desired option strike. You can select any of the available features to select a strike from the drop down under Select Strike Criteria as shown in the image below.

Strike Type

This feature enables you to select option strike based on their type.

For example, you can select ATM, OTM, ITM, etc.

-

Example 1- Assume our entry time is 09:18 and we want to enter in the 2 strike away OTM CE option strike at 09:18, so we will select OTM2 in strike type. So if at 09:18 the underlying will be at 20000, then it will select the 20100 CE strike.

-

Example 2- Assume our entry time is 09:30 and we want to enter in the 2 strike away ITM CE option strike at 09:30, so we will select ITM2 in strike type. So if, at 09:30, the underlying will be at 20000, then it will select the 19900 CE strike.

There is a gap of 50 between strikes here. So the strikes here are 19900, 19950, 20000, 20050, 20100, etc.

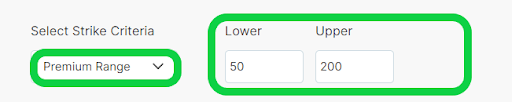

Premium Range

This feature enables you to select an option strike based on the option premium range.

It will select a strike whose premium is in the range defined by you. According to the below image, it will select a strike whose premium is between 50 and 200.

- Example :- Assume our entry time is 09:18 and we want to select a strike whose premium is between 40 and 80. So we will select Premium Range in Select Strike Criteria, with 40 in the lower and 80 in the upper. So it will enter a strike whose premium is between 40 and 80.

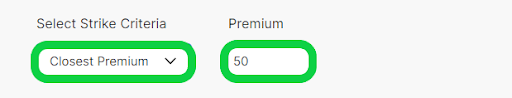

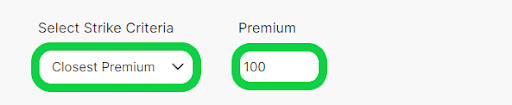

Closest Premium

This feature enables you to select a strike based on the nearest option premium value.

It will select an option strike whose premium is nearest to the premium value defined by you. Assuming you defined a value of 50, it will take entry in a strike whose premium is nearest to 50. If there are two strikes whose premiums are 49 and 52, it will select a strike whose premium is 49.

- Example :- Assume our entry time is 09:18 and we want to select a strike whose premium is closest to 100. So we will select the Closest Premium in the Select Strike Criteria and put 100 in the premium. So it will enter into a strike whose premium is closest to 100.

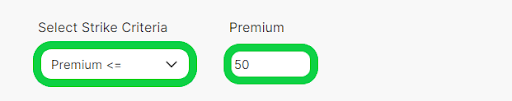

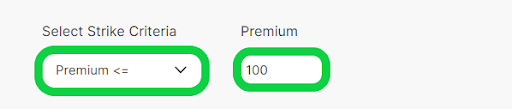

Premium >=

This feature enables you to select a strike based on an option premium value that is either more than or equal to a specific value.

It will select an option strike whose premium is either equal to or more than the premium value defined by you. Assuming you define a value of 50, it will take entry in a strike whose premium is either equal to 50 or more than 50. If there are two strikes whose premiums are 49 and 52, it will select the strike whose premium is 52.

- Example :- Assume our entry time is 09:18 and we want to select a strike whose premium is more than or equal to 100. So we will select Premium >= in Select Strike Criteria and put 100 in Premium. So it will enter at 09.18 in a strike whose premium is either 100 or more than 100.

Straddle Width

This is an advanced way to select a strike. It enables you to select a strike based on the straddle price (ATM CE + ATM PE).

In simple terms, what it is doing here is multiplying the ATM straddle price with a number defined by you and adding or subtracting (selected by you) it from the ATM strike at that time.

- Example 1 :-

Assume entry timing 09:18

Nifty ATM Strike is 20000

Nifty ATM Straddle Price 200 ( Straddle = ATM CE + ATM PE)

If enter + and 0.5 as shown in the image below.Strike it selects is

Strike = ATM STRIKE + ( 0.5 _ ATM Straddle Price)

Strike = 20000 + (0.5 _ 200)

Strike = 20000 + (100)

Strike = 20100

- Example 2 :-

Assume our entry timing is 09:20

Nifty ATM Strike is 20000

Nifty ATM Straddle Price is 200 ( Straddle = ATM CE + ATM PE)

We enter - and 1 as shown in the image below.Strike it selects is

Strike = ATM STRIKE - ( 1 * ATM Straddle Price)

Strike = 20000 - (1 * 200)

Strike = 20000 - (200)

Strike = 19800

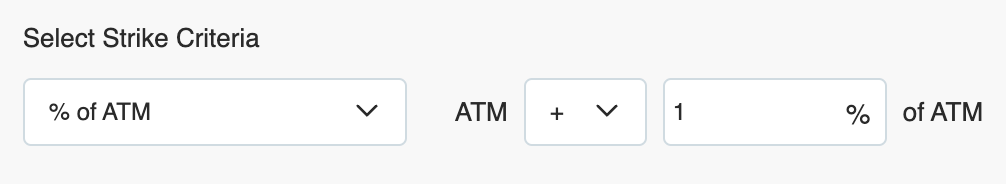

% of ATM

This feature enables you to select strikes based on the percentage of ATM Strike.

Assuming you want to select a strike that is 99% or 101% of the ATM Strike, you can do this using this feature.

We have 2 options here: “+ -” and “% of ATM." What it is doing here is subtracting or adding a % (which we define) from the ATM Strike. So if we want to select a strike that is 101% of the ATM, we just add(+) 1% to the ATM. If we want to select a strike that is 99% of the ATM, we just subtract (-) 1% from the ATM.

-

Example 1 :-

Assume entry timing 09:18

ATM Strike at 09:18 is 20000

We enter - and 1 as shown in the image below

Strike it selects is

Strike = ATM - 1% of ATM

Strike = 20000 - (1% of 20000)

Strike = 20000 - 200

Strike = 19800

-

Example 2 :-

Assume entry timing 09:18

ATM Strike at 09:18 is 20000

We enter + and 1 as shown in the image below

Strike it selects is

Strike = ATM + 1% of ATM

Strike = 20000 + (1% of 20000)

Strike = 20000 + 200

Strike = 20200

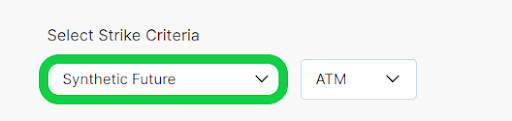

Synthetic Future

This feature enables you to select your strike based on Synthetic Future.

We can select any type of strike like ATM, OTM, ITM etc based on Synthetic future. Synthetic Future is calculated as below :

Synthetic Future = Spot ATM Strike - Spot ATM PE + Spot ATM CE

Example : Let's assume we want to select an ATM strike based on Synthetic Future. We will select Synthetic Future and ATM from the dropdown under Select Strike Criteria as shown below.

Let's assume we have the following values:

- Banknifty Spot = 45025

- Spot ATM Strike = 45000

- Spot ATM PE = 275

- Spot ATM CE = 550

Synthetic Future = 45025 - 275 + 550 = 45300

Synthetic Future ATM = 45300

So it will select the 45300 strike at our entry time.

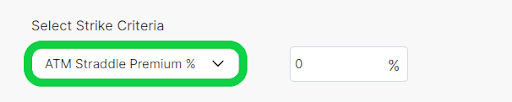

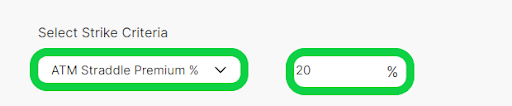

ATM Premium %

This feature enables you to select strikes based on the percentage of Premium of ATM Straddle.

For example ATM Straddle Premium (ATM CE + ATM PE) is 400 and you want to select an option whose premium is 30% of this ATM Straddle Premium then you can do so using this feature. It will select a strike whose premium is closest to 120 (30% of 400).

Example :

- Nifty Spot = 20210

- Spot ATM Strike = 20200

- Spot ATM PE = 120

- Spot ATM CE = 80

- Straddle Premium = 120 + 80 = 200

If we select ATM Straddle Premium % and enter 20% as shown in the image below.

The Strike it will select is

Strike Premium = 20 % of ATM Straddle Premium Strike Premium = 20% of 200 Strike Premium = 40

So it will select a strike whose premium is Closest to 40.