Backtest Comparison

Optimise your backtests quickly

Introducing the backtest comparison feature on AlgoTest.

Now you can compare your past backtests quickly and optimise your algo-trading strategies for the best outcomes.

The comparison backtest feature gives you the ability to make changes to multiple parameters on your algo-trading strategy's leg and then compare them to each other.

What you can do with backtest comparison

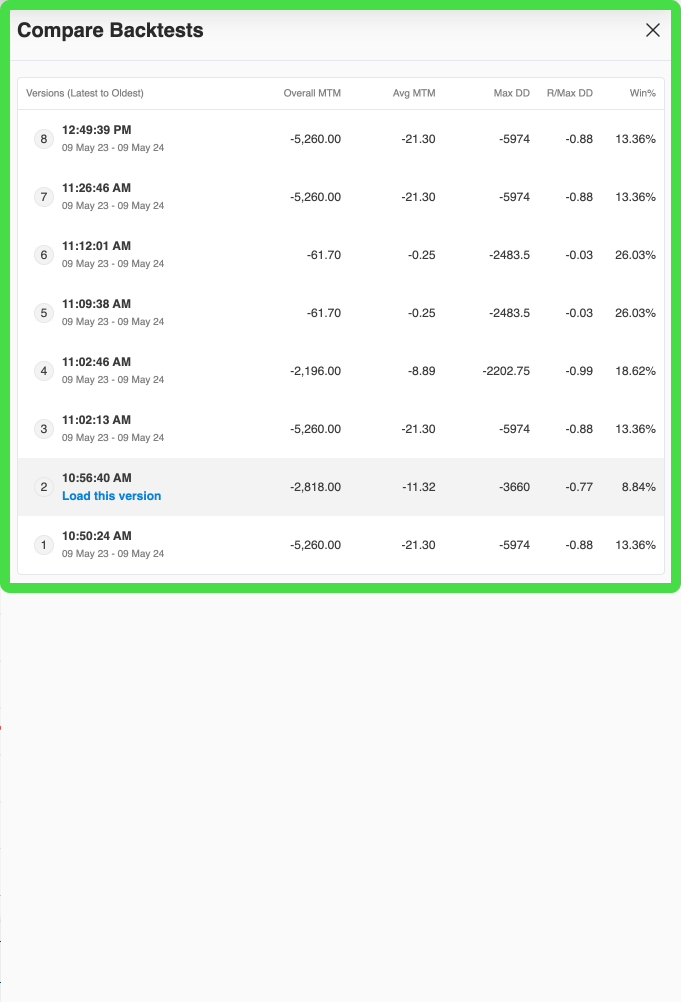

- Select Backtests: Choose up to 15 recent backtests you want to compare.

- Load Strategies: Load an old algo-trading strategy or start a new one to see how they perform.

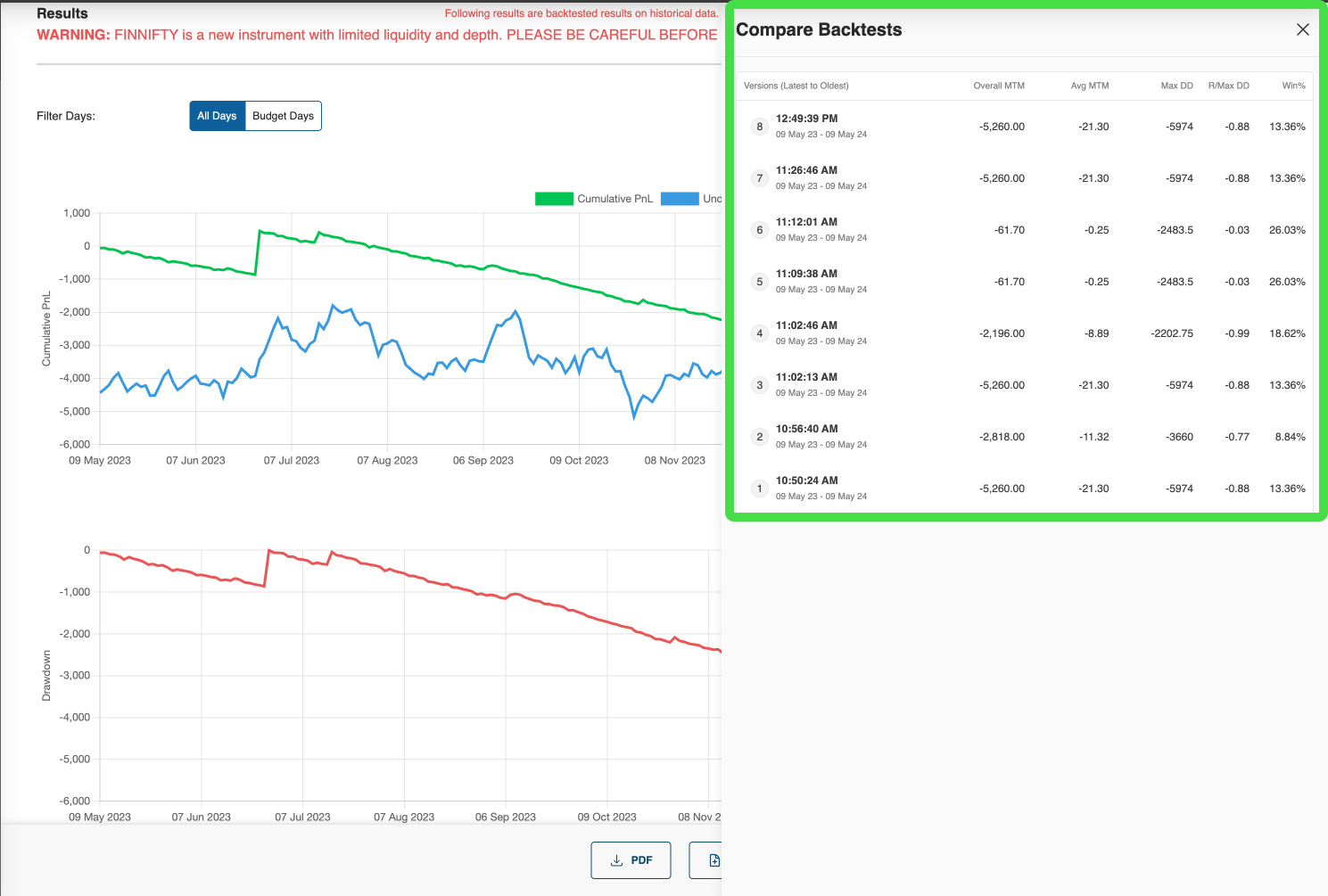

- View Metrics: Analyse detailed metrics such as Mark to Market (MTM), average MTM, maximum drawdown (Max DD), and win percentage.

- Compare Results: View multiple strategies side-by-side to identify which adjustments lead to the best performance.

- Track Changes: Use the change log to monitor your strategy's evolution and understand the impact of each tweak.

You can see your last 15 backtests in this feature.

How the Backtest Comparison Feature works

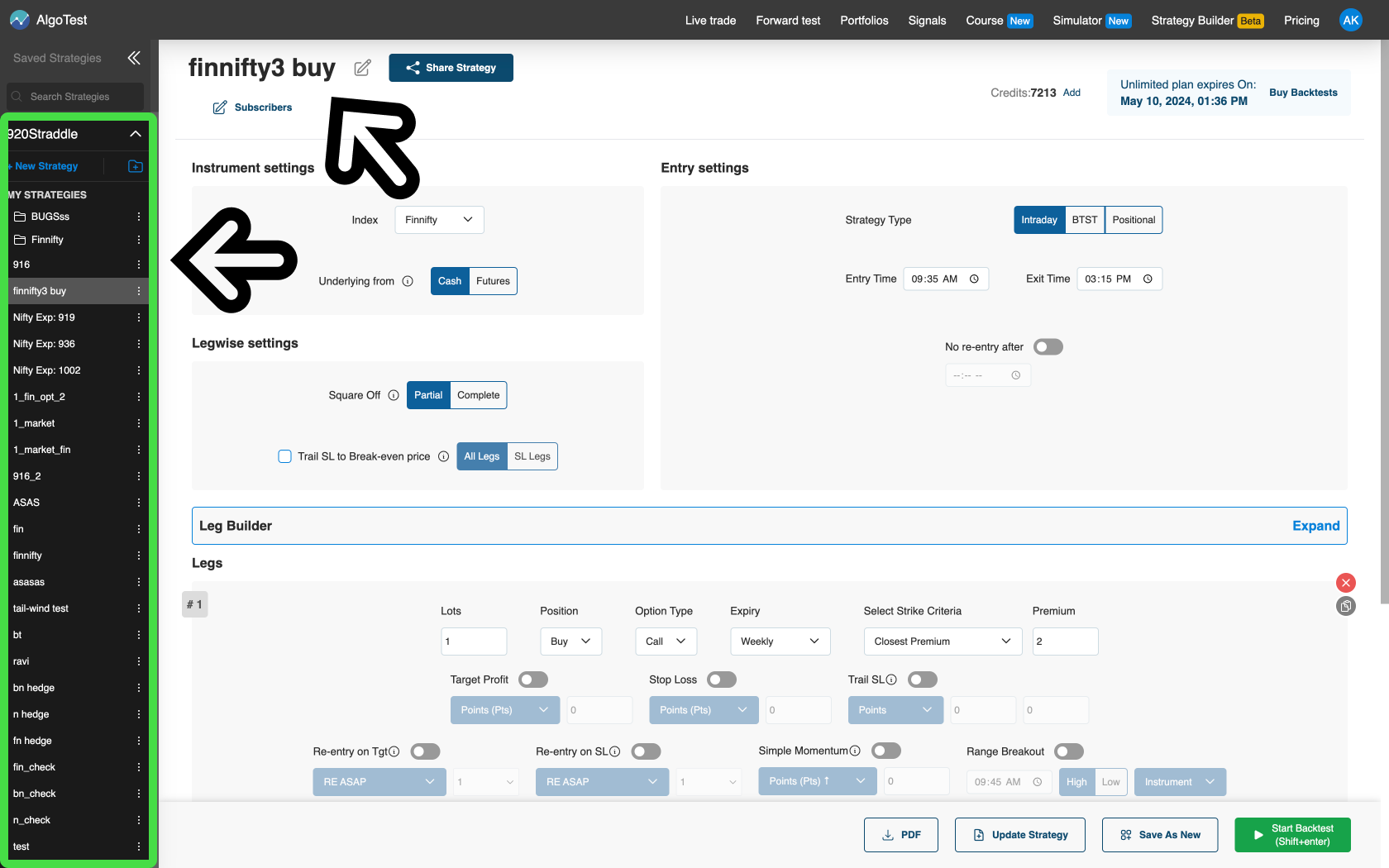

Start a backtest

You can start by opening up one of your old strategies from the left side of the console or you can start a brand new strategy.

Next, you can start a backtest.

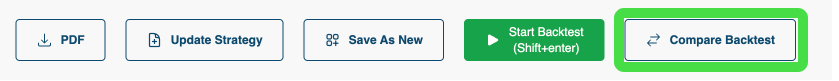

Click on Compare Backtest

After you finish one backtest the Comparison Backtest button will appear.

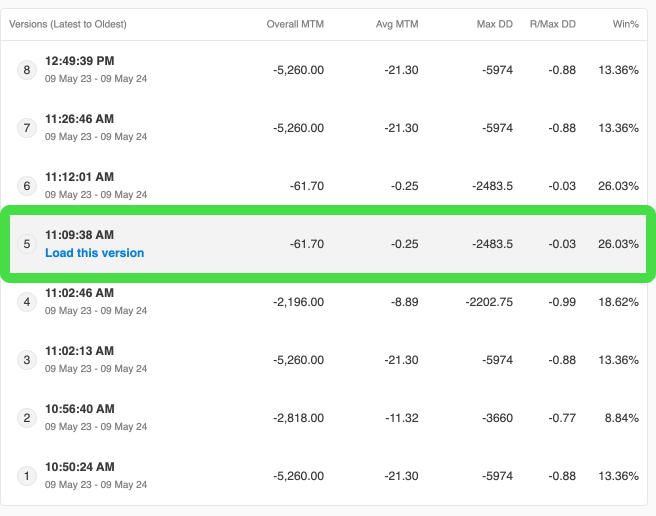

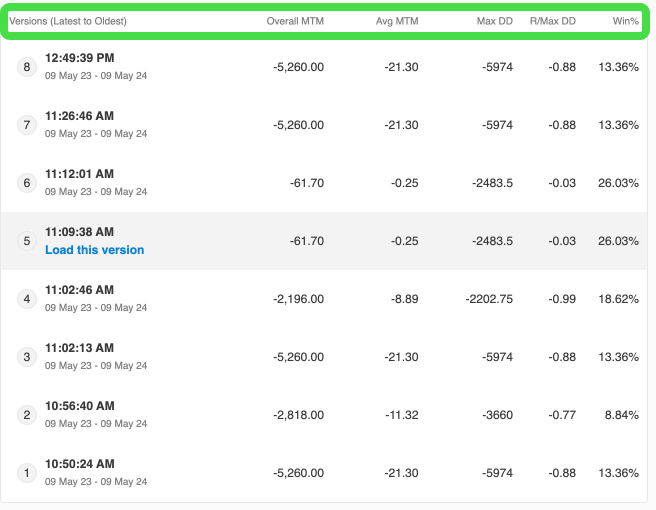

Clicking on "Compare Backtests" will show you 15 of the last backtests you have done on AlgoTest.

Only backtests that are less than 24 hours old will appear in this feature.

The backtests are organised from last to first. The timestamps indicate when the backtest was done.

Loading a previous backtest

You can load a previous backtest from the list by hovering over the backtest and then clicking on "Load this version".

Important Terms for Backtest Comparison

Version (Latest to Oldest)

Version refers to the version of the backtest.

This list is organised from latest backtest to first based on when the backtest was done.

Overall MTM

MTM or Mark to Market, is the overall profit or loss that your strategy (or strategies) make.

Avg MTM

Avg MTM, or Average MTM refers to the MTM (Mark to Market) per trade. This is different from overall MTM.

Max DD

A maximum drawdown (MDD) is the maximum observed loss from a peak to a trough of a portfolio, before a new peak is attained. Maximum drawdown is an indicator of downside risk over a specified time period.

R/Max DD

Return over maximum drawdown (RoMaD) is a risk-adjusted return metric used as an alternative to the Sharpe Ratio or Sortino Ratio. Return over maximum drawdown is used mainly when analyzing hedge funds.

Win%

Win % refers to the number of winning (money making) trades in your portfolio. It does not take into account how much was won or lost, but simply the number of trades that made money vs those that didn't.

Head over to AlgoTest to begin backtesting your algo-trading strategies!