Entry & Exit Order Type

This feature on AlgoTest allows you to execute your entry orders via Market or Limit Order.

Market Order

It is a type of order that allows the order to be executed at the best available price in the market at that time. Market orders lead to high slippage as compared to limit orders. In this feature, no order is sent to your broker in advance. The system fires a market order as soon as your entry condition is met.

You can select market order by selecting from the drop-down on Entry Order Type as shown in the image below.

The order will not be placed on the broker's end. It will be on the AlgoTest end. As soon as the entry condition is met, Algo will send the order to the broker to execute it.

Limit Order

A limit order is a type of order that allows the order to be executed within a specified limit price only. They can help you to reduce slippage. In this feature, a Limit/SL-L order, with the defined trigger & limit price, will be sent to your broker and shall be placed in the order book of your broker either in advance or at the time of the condition being met.

You can select Limit Order from the drop-down on Entry Order Type as shown in the image below.

Trigger and Limit Buffer

A SL-L order needs to define its trigger and the limit price. Trigger price is the price at which your buy or sell order becomes active for execution. Once the price of the option hits the trigger price set by you, a limit order, with the price set by you, becomes active for execution on the exchange servers. You can enter the Trigger/Limit buffer in both points or percentages.

Let us understand this with a simple example

-

Nifty ATM Price at 09:20 is 100

-

Entry on Momentum Up = 10 Points

-

Entry Order Buy Price = 110

-

Buffer Typer = Points

-

Trigger buffer = 2 pts

-

Limit Buffer = 3 pts

In this case, a SL-L order will be placed in your broker's order book as follows: Trigger price = 110 - 2 = ₹ 108 & Limit Price = 110 + 3 = Rs 113. This means that as soon as the LTP breaches trigger a price of Rs 108 a Limit order of Rs 113 becomes active for execution on the exchange servers.

Entry Order

Entry Limit/SL-L orders (How they work)

Positions can be entered using Limit/SL-L orders. The order settings will be as follows:

Time-Based Entry: A Limit order based on the LTP along with the limit buffer is sent at the time of entry. The Limit Buffer is added in case of a Buy order while the Limit Buffer is subtracted in case of a Sell order.

Simple Momentum: Based on your condition a Limit or a SL-L order is sent in advance to your broker

Simple Momentum up (instrument) + BUY = SL-L order is placed in advance based on the Trigger and Limit buffer

Simple Momentum down (instrument) + SELL = SL-L order is placed in advance based on Trigger and Limit buffer

Simple Momentum up (instrument) + SELL = Limit order is placed in advance without any buffer

Simple Momentum Down (instrument) + BUY = Limit order is placed in advance without any buffer

All Simple Momentum strategies based on underlying points are entered via Limit order with a limit buffer as soon as the entry condition is met.

Re-Entry on Tgt/SL: All Re-entry orders are either placed in advance or a Limit order is sent at the time of the condition being met.

Re-Cost: Limit/SL-L order sent in advance to your broker.

Re-ASAP: A limit order with a limit buffer is sent as soon as the previous leg exits.

Re-Momentum on Instrument: Limit/SL-L order sent in advance to your broker based on the set momentum as soon as the previous leg exits.

Strategies that are based on the underlying are entered via a Limit order as soon as the Re-entry condition is met.

Range Breakout: All Range Breakout strategies that are based on the instrument have a Limit/SL-L order sent to your broker as soon as the range time ends. For strategies that are based on the underlying a Limit order is sent as soon as the break condition is met.

General Points:

- Make sure that your limit and trigger buffer does not lead to a NEGATIVE limit or Trigger price. In such a case the limit order will be rejected and we will enter the position via Market order.

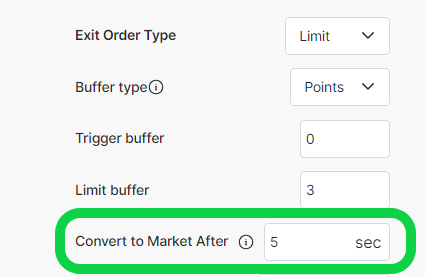

Convert to Market After

You can enter 0 to 20 seconds to convert to the market after time. This timer is used for converting to the market order when your Limit order skips or your Limit order is partially filled. It operates as follows:

-

Entry Limit Order Skipped:

-

Price at 09:20 is 100, Momentum Up = 10 Points

-

Buy Price = 110

-

Trigger buffer = 0 pts, Trigger Price = Rs 110

-

Limit Buffer = 3 pts, Limit Price = Rs 113

-

Convert to market = 5 secs

If the Limit order of Rs 113 skips, AlgoTest will modify the order incrementally by Rs 3 till the end of the Convert to market time. So the limit order will be modified from Rs 113 to Rs 116 to execute and if again skipped it will modify from Rs 116 to 119. It will keep on doing this for 5 seconds. If your order is not executed within 5 seconds, it will be converted to a market order.

Limit Order Partially Filled:

-

Price at 09:20 is 100, Momentum Down = 10 Points

-

Sell Price = 90

-

Trigger buffer = 0 pts, Trigger Price = Rs 90

-

Limit Buffer = 3 pts, Limit Price = Rs 87

-

Convert to market = 5 secs

If the Limit order of Rs 87 is partially filled (let's say 3 lots filled), AlgoTest will modify the order incrementally by Rs 3 till the end of the conversion to market time for the remaining quantity of 7 lots. So the limit order will be modified from Rs 87 to 84. And if this skip it again modify that from 84 to 81. It will keep on doing this for 5 seconds. If your order is not executed within 5 seconds, it will be converted to a market order. This allows the market to cool down during a spike and revert close to its original price.

Exit Order

Exit Limit/SL-L orders (How they work)

Positions can be exited using Limit/SL-L orders. The order settings will be as follows:

-

Stop Loss defined on Instrument: An SL-L order is sent in advance to your broker.

-

Target: If the leg does NOT have an SL defined on the instrument, then a Limit order without any buffer is sent to your broker in advance for the target profit price.

-

If the leg has an SL defined on the instrument and an SL-L order already is placed in advance, at the time the target condition is met this SL-L order is modified to a limit order with the Limit buffer.

-

Time-Based Exit: A Limit order based on the LTP along with the limit buffer is sent at the time of exit. The Limit Buffer is added in case of a Buy order while the Limit Buffer is subtracted in case of a Sell order. If a Limit/SL order is already placed for exit, then the existing order is modified with LTP and limit buffer.

-

Trail Stop Loss: Your placed SL-L order is modified periodically based on your strategies trail condition, and monitoring type.

Convert to Market After

You can enter 0 to 40 seconds to convert to the market after time. The system will chase the LTP till the convert to market after time, whereafter if not filled, the order will be converted to market.

This timer is used for converting to the market order when your Stop Loss Limit order skips or your Limit order is partially filled. It operates as follows:

Stop Loss Order Skipped:

-

A sell order with Entry = ₹80 and SL = ₹100

-

Trigger buffer = 0 pts, Trigger Price = ₹100

-

Limit Buffer = 3 pts, Limit Price = ₹103

-

Convert to market = 5 secs

If the Limit order of Rs 103 skips, AlgoTest will modify the order incrementally by Rs 3 till the end of the convert-to-market time. So the limit order will be modified from Rs 103 to Rs106 to execute and if again skipped it will modify from Rs 106 to 109. It will keep on doing this for 5 seconds. If your order is not executed within 5 seconds, it will be converted to a market order.

Limit Order Partially Filled:

-

A buy order with Entry Price = ₹80 and SL = ₹60

-

Qty = 10 lots

-

Trigger buffer = 0 pts, Trigger Price = ₹ 60

-

Limit Buffer = 3 pts, Limit Price = ₹57

-

Convert to market = 5 secs

If the Limit order of ₹57 is partially filled (let's say 3 lots filled), AlgoTest will modify the order incrementally by ₹3 till the end of the conversion to market time for the remaining quantity of 7 lots. So the limit order will be modified from ₹57 to 54. And if this skip it again modify that from ₹54 to 51. It will keep on doing this for 5 seconds. If your order is not executed in limit within 5 seconds, it will be converted to a market order. This allows the market to cool down during a spike and revert close to its original price.

Monitoring

This feature enables you to monitor your trailing stop-loss on continuous or delayed frequency. This applies only to trailing stop-loss.

Continuous Frequency

Under continuous monitoring, your trail SL shall be monitored continuously BUT shall be modified at the broker terminal at the defined trail Frequency.

-

Case 1: Eg. A strategy Buys a CE at Rs 100 @ 9: 20 AM with an SL of 20% (Rs 80), trail SL 1-1, monitoring = continuous & trail Frequency = 10 Secs. At time = 9:20:05 AM, the price goes up to Rs 110 and settles at Rs 108 at 9:20:10 AM. In this case, our SL-L order will be modified from Rs 80 to Rs 90 based on the high the CE made at 9:20:05.

-

Case 2: Continuing with our above example, at time = 9:20:05 AM, the price goes up to Rs 110 and falls drastically to Rs 90 at 9:20:07 AM and Rs 85 at 9:20:10 AM. In this case, since the Trail SL is being continuously monitored, at 9:20:07 AM when the LTP breaches Rs 90, your SL-L order deployed at Rs 80 will be converted into a market order to close your CE position. This action will be taken in the middle of the trial frequency.

Delayed Frequency

Under Delayed monitoring, your trail SL shall be monitored & modified at a Delay of the set trail frequency. Eg. A strategy Buys a CE at ₹ 100 @ 9: 20 AM with an SL of 20% (₹ 80 ), trail SL 1-1, monitoring = Delayed, & trail Frequency = 10 Secs. At time = 9:20:05 AM, the price goes up to Rs 110 and settles at ₹ 108 at 9:20:10 AM. Under Delayed monitoring, our SL-L order will be modified from ₹ 80 to ₹ 88 based on the current LTP at 9:20:10 AM.